China’s 2024 antimony export restrictions are shaking global markets, driving innovation and disruption in key industries.

By: Neeta Verma, Director, Accuris

In a move that has sent ripples through global markets, China announced in August 2024 its decision to impose export restrictions on antimony, a critical mineral that is essential in many industries. By tightening its grip on this vital resource, China aims to maintain strategic control over global supply chains, particularly in key sectors like electronics, renewable energy, and defense.

The restriction of antimony is expected to have major implications for U.S. manufacturers and their supply chains. The decision has already heightened tensions – particularly with Western countries who rely on the nations’ production of antimony. As access to antimony supply tightens, costs are also expected to rise.

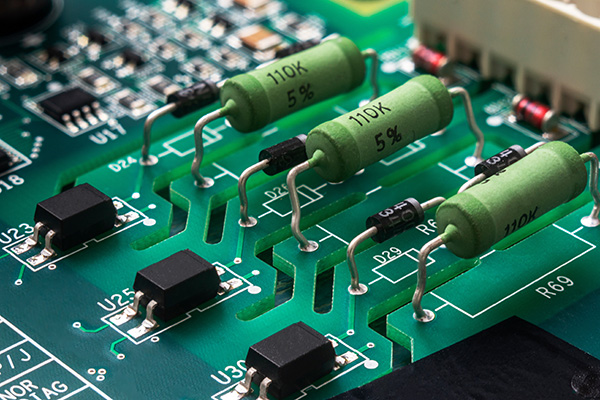

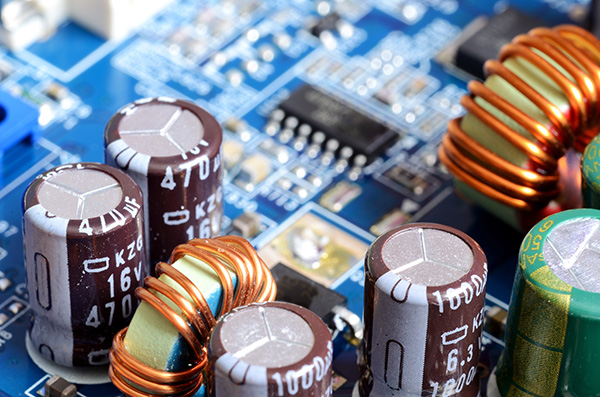

The world produces about 175,500 tons of antimony annually. Though it has many uses, antimony is often alloyed with lead to enhance hardness and strength, making it invaluable in the production of batteries, bullets, and cable sheathing. Additionally, antimony compounds serve as flame retardants in textiles and plastics and are used in the electronics industry for semiconductors, including infrared detectors.

While access to this material has depleted over the years, nations like China, who accounts for 48% of production have continued to establish a stronghold of the material. China’s new restrictions now require entities to obtain export licenses from its Commerce Ministry. This measure is designed to regulate the flow of antimony and related products, ensuring that they are not diverted for unauthorized purposes.

The restrictions are a direct response to rising geopolitical tensions and serve to protect China from potential retaliation. By tightening control over antimony exports, China aims to strengthen its strategic reserves and prioritize domestic consumption.

Particularly for nations heavily reliant on Chinese imports, including the U.S., antimony export restrictions have far-reaching consequences. Industries such as defense, electronics, automotive, aerospace, and safety equipment will face challenges in procuring this essential mineral as they try to find alternatives.

In the short term, companies may encounter production delays, elevated costs, and inventory shortages. Over the long term, these restrictions could drive a reconfiguration of supply chains, fostering increased diversification and the exploration of alternative materials. Furthermore, businesses may implement new risk management strategies and regulatory responses, ultimately transforming market dynamics and enhancing industry resilience.

As supply shortages become more prevalent, manufacturers may be forced to pay significantly higher prices for antimony, costs which could eventually be transferred to consumers. Although the market may adjust over time by seeking alternative materials or sources, the initial disruptions and the necessary investments in research and development are likely to lead to prolonged price increases. Additionally, these price hikes could exacerbate inflationary pressures across multiple sectors, impacting the broader economy. To mitigate these risks, it is imperative to diversify sources, invest in alternative materials, and bolster domestic production capabilities.

To counter the challenges posed by antimony export restrictions, U.S. manufacturers can implement several strategic measures:

There are several alternative materials that can replace antimony, each offering unique advantages depending on the application. For instance, tin and bismuth can be effectively used in ammunition, while zinc compounds and phosphates serve as substitutes in flame retardants. Tungsten alloys are suitable for armor-piercing projectiles, and nitrocellulose can be utilized in explosives. In lead-acid batteries, calcium-silver alloys can enhance performance, and in electronics, gallium and indium are viable substitutes for semiconductors.

These alternatives not only provide solutions but also create opportunities for innovation and improvement. The transition to alternative materials can drive advancements in research and development, leading to more efficient and sustainable manufacturing processes. In the long-term, diversifying material sources can enhance supply chain resilience by reducing dependency on a single supplier.

Artificial intelligence (AI) technology can significantly mitigate supply chain disruptions by predicting potential issues, optimizing inventory, assessing supplier risks, and expanding access to essential information. It also helps in scenario planning, allowing companies to prepare for various disruptions and assisting in the proactive discovery of alternative materials vital to production. By integrating AI tools, manufacturers can take steps to ensure a stable supply chain even amidst challenges like export restrictions.

While the shift to alternatives for antimony may require initial investments and adjustments, the long-term benefits include greater flexibility, improved performance, and potentially lower costs. Embracing these substitutes can help industries adapt to changing market conditions and regulatory landscapes, ultimately fostering a more robust and resilient industrial ecosystem.

About the Author:

Neeta Verma has more than 25 years of experience in the parts business, specializing in environmental compliance, hazardous materials parts management, and component engineering. As a Director at Accuris, Neeta leads a team across Gurgaon and Bangalore, India, managing an Environmental Compliance database of over 1.1 billion parts from leading manufacturers worldwide. This helps customers ensure BOM compliance with global environmental laws by identifying hazardous materials (HAZMAT), assessing supply chain risks, and achieving compliance with regulations such as REACH, RoHS, Conflict Minerals, and California’s Proposition 65. Neeta holds an MBA in Environmental Management, a Bachelor’s in Computer Applications, and a Diploma in Electronics & Communication Engineering

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.