Within a complex and labor-squeezed infrastructure landscape, automation and modular construction could improve project outcomes.

by Justin Dahl, Partner, McKinsey & Company

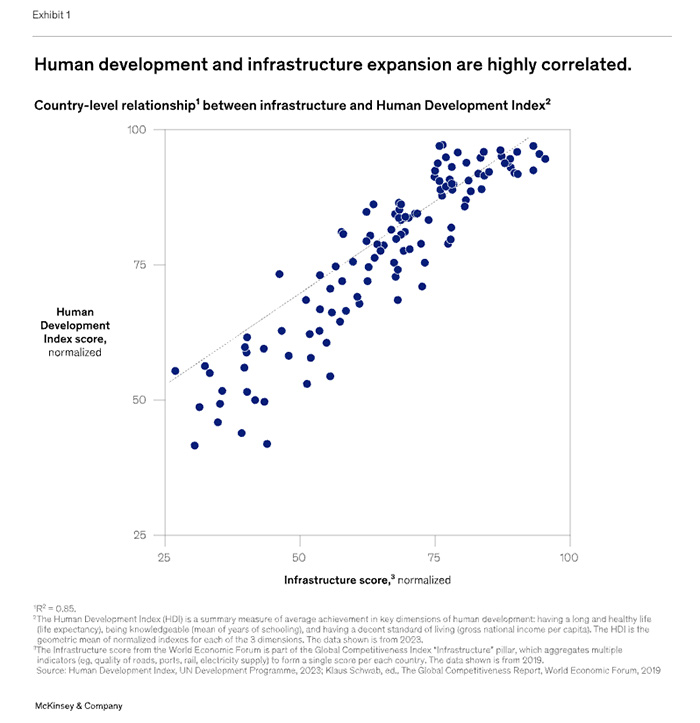

A confluence of global forces, compounded by skilled labor shortages, is changing how infrastructure is planned, financed, and executed. At the same time, outdated assets, rapid urbanization, geopolitical shifts, and technological advancements are exposing the limitations of traditional approaches to infrastructure development. The result is an accelerating need for investment, bringing both challenges and opportunities.

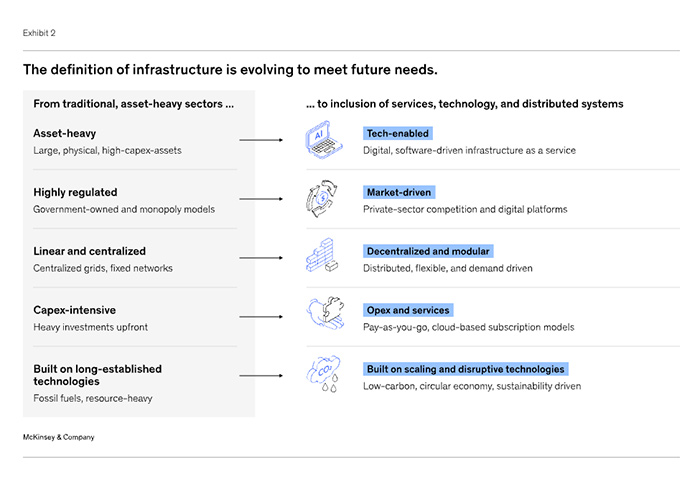

The established notion of “infrastructure” itself is changing, too—no longer just referring to assets such as roads and power grids but widening to include things such as data centers and fiber-optic networks, as well as their related specialized services.

Within this more interconnected infrastructure ecosystem, key verticals are increasingly intersecting. Infrastructure supporting the deployment of artificial intelligence can intersect with infrastructure required to enable energy security, for example. These intersections have the potential to create exciting opportunities for innovation and related investment.

In fact, the size of the required global investment in infrastructure over the next 15 years is potentially enormous. Recent McKinsey analysis estimates that cumulative investments of roughly $106 trillion may needed globally by 2040.1 And previous research has shown how choosing the right combination of projects and eliminating wasteful ones could save (or redeploy) billions of dollars a year in unnecessary spending globally.2

The current skilled labor shortage is a major challenge to unlocking opportunities in this “new” infrastructure environment. More than half of construction firms in the United States report project delays due to worker shortages; in the United Kingdom it is projected that more than 250,000 additional construction workers could be needed in the next five years;3 and a survey in France highlights labor shortages as a leading limiting factor to infrastructure development.4

This challenge is aggravated by long training pipelines, limited interest in joining the construction industry among younger workers, and sharp regional imbalances in labor availability, despite significant wage increases offered in the United States.5 Churn only compounds the impact, with annual hiring for many roles far exceeding net job growth. Firms are feeling these impacts through increased recruitment and training costs.

Within this context, automation and modular construction methods have the potential to offset labor shortages by improving productivity and speeding project delivery—as seen with the combined use of tele-operated heavy machinery and prefabricated components, for example.

Naturally, careful analysis is needed to determine the best construction method for each project, but automation and modular construction, especially in large-scale projects, can drive real productivity gains. Such gains can offset labor shortages, improve construction sequencing, reduce on-site labor needs and site disruptions, and accelerate project delivery—basically optimizing the broader end-to-end execution process.

The new infrastructure landscape taking shape makes investment strategies more complex, but adopting a mindset shift about which projects to fund and how to construct, and taking decisive action now, could open an investment window of opportunity for governments, investors, and industry operators.

Unlocking value and savings from a modular construction approach can be complicated and there is no guarantee of success. McKinsey analysis shows that project impact can vary from 10 percent savings to 5 percent higher costs. That said, the approach can sharply reduce the potential for significant cost overruns. The impact ultimately depends on where modules are built, the site’s location, and the technology used to build modules.

Given the unique nature of infrastructure projects, there is no one-size-fits-all solution. Building everything on-site might well be cost-effective under certain circumstances—or vice versa.

To illustrate: McKinsey has conducted data-driven cost analyses of multiple new manufacturing facilities in the United States to determine the trade-offs between a modular approach compared to a stick-built one. We found that cost savings depended largely on factors such as where the yard is located, the on-site conditions, and the technology used.

The analysis made clear that, to unlock the benefits of modularization, project teams need to look beyond the construction costs alone. Aspects such as lifecycle impact and supply chain risks alongside total project and labor costs need to be considered too.

Our experience has also shown that off-site labor is typically cheaper, even if it involves more work hours overall. While offshore labor is often more inefficient, it tends to cost significantly less, making modularization attractive in places where local construction labor costs are high. If properly designed and quality controlled, modularization can also improve schedule outcomes.

To glean these benefits, committing to modularization from the planning phase is paramount. Deciding on modularization too late in the process or skipping proper reviews can lead to costly fixes and slow progress, eroding potential savings. Quality assurance, quality control measures, and disciplined execution are all critical during the design phase.

Seizing opportunities from the rising infrastructure wave requires finding an answer to the current labor shortage. Under the right conditions, modular construction could prove a value-adding component of infrastructure projects.

About the Author:

Justin Dahl is a McKinsey partner based in Houston, Texas, and a leader within the firm’s capital excellence and capital analytics work. He works to expand project benchmarking and engineering, procurement, and construction (EPC) market intelligence capabilities in process industry and manufacturing projects globally.

1 “The infrastructure moment,” McKinsey, September 9, 2025.

2 “Infrastructure productivity: How to save $1 trillion a year,” McKinsey, January 1, 2013.

3 “Long on ambition, short on people: how the skills gap could scupper UK’s bid to decarbonize buildings,” Reuters, November 28, 2024.

4 “Factors limiting building activity in France from 2005 to 2024, by type of constraint,” Statista, January 29, 2025.

5 “Tradespeople wanted: The need for critical trade skills in the US,” McKinsey, April 9, 2024.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.