What used to be the exception is today’s new normal: uncertainty and complexity challenge procurement like never before. Can AI be the answer?

By Samir Khushalani and Dan Albrecht

Trade protectionism and economic nationalism are accelerating. Tariffs are replacing trade agreements. The trade-weighted average tariff rate in the US rose from under 2 percent in 2024 to 17 percent as of October of 2025, forcing companies to re-examine their supply bases and reconfigure long‑established trade corridors. At the same time, inflation remains stubbornly high, equipment and material shortages persist, and supply disruptions feel routine rather than exceptional.

As if that weren’t enough, procurement is being asked to do more with less. In a recent McKinsey survey, 55 percent of procurement leaders reported flat or shrinking budgets—even as 100 percent saw their savings targets increase. Spend managed per full-time position is now roughly 50 percent higher than it was five years ago. To exacerbate matters, the function struggles to attract top talent, in part because it is too often perceived as a tactical back‑office cost-cutter rather than a strategic business partner.

We believe a fundamental reimagining of the industry is required. Artificial intelligence is emerging as a critical tool to help meet these challenges. The question is no longer whether AI will transform the function. It is how fast organizations will move, and who will lead.

Many procurement organizations have already begun experimenting with AI. In our survey of more than 300 global procurement leaders, 40 percent said they are actively piloting generative AI. Some are already seeing tangible results. One pharmaceutical company, for example, used an AI‑based invoice‑to‑contract reconciliation tool to uncover more than $10 million in value leakage.

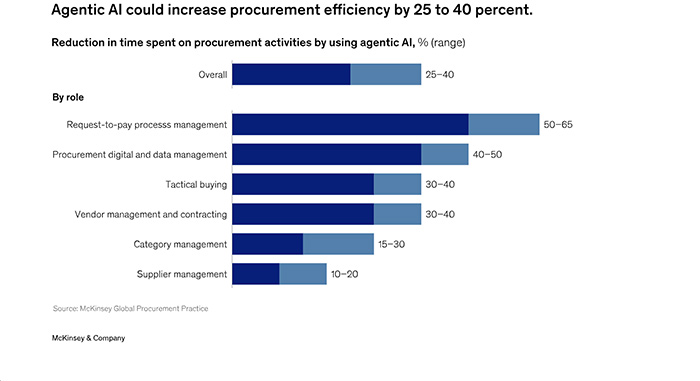

But this is just the starting point. McKinsey estimates that AI copilots, chatbots and task-level tools can improve procurement productivity by 25 to 40 percent (Figure 1). The next frontier is agents autonomously executing not just tasks but end-to-end workflows that have been specifically designed for machine-led execution. This will scale into agentic factories, where teams of AI agents collaborate with each other and with enterprise systems using emerging protocols, with humans serving as the final line of accountability. This would unlock an exponential leap in performance and productivity.

In this world, procurement will transition to an enterprise ‘nerve center’: smaller and flatter, yet far more influential. AI‑native workflows across source‑to‑pay will increasingly execute autonomously, pushing the marginal cost of the function toward the cost of compute. Human effort will shift decisively, from executing transactions to orchestrating business outcomes that truly matter. That shift will also change how performance is measured. Process‑centric metrics will give way to outcome‑oriented ones. Instead of tracking the cycle time to create purchase orders, leaders will ask: What percentage of POs are created autonomously—and with an error rate below one percent?

As AI becomes embedded in day‑to‑day work, procurement roles will evolve rapidly. With agentic systems taking on much of the heavy lifting—analyzing data, generating insights, and executing routine processes—humans will focus on activities that require a high degree of emotional intelligence and judgment.

This means that some roles will be replaced or repurposed. Buyers and accounts payable specialists will oversee AI outputs for accuracy or act as escalation points. Category managers will spend more time deeply understanding business needs and strengthening relationships with internal and external stakeholders. Skills such as intellectual curiosity, listening, influencing, and technical fluency will become indispensable. Notably, 43 percent of CPOs in a recent McKinsey survey identified strategic thinking as the most critical future competency for category managers.

At the same time, entirely new roles will emerge. Procurement AI strategists will set priorities for AI deployment and drive its adoption within the human workforce. AI risk and ethics specialists will be responsible for the transparent, responsible, and ethical use of AI ensuring, for example, no inadvertent bias creeps into supplier selection. AI orchestrators will manage the growing constellation of agents, maintaining registries and preventing uncontrolled AI sprawl.

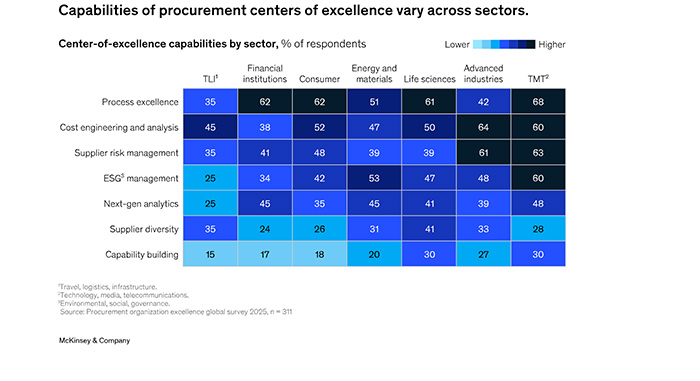

These new roles and capabilities will often be anchored in a revitalized procurement center of excellence (COE). Many organizations’ existing COEs will serve as a strong foundation on which to build new, AI-friendly skills, capabilities, and tools. But most organizations aren’t yet set up for success there. Our research shows that only a small minority of organizations—roughly one in ten—offer the full range of services required to unlock their COE’s potential. Those that do see outsized returns. One specialty chemicals company, for example, used its COE to build best‑in‑class should‑cost models grounded in materials, labor, and market data—delivering 13 percent savings on raw materials.

The COEs of the future will have a broader remit and higher profile than those today. The AI-optimized COE will provide deep expertise in AI-augmented cost engineering, next‑generation analytics, process excellence, supplier risk management, capability building, and supplier diversity, while remaining tightly integrated with day‑to‑day procurement execution.

Procurement now stands at a rare inflection point. While many organizations recognize the promise of AI, adoption is lagging badly. AI uptake in marketing and sales is roughly six times higher than in procurement—meaning suppliers are moving faster than buyers to gain competitive advantage.

The implication is clear. The cost of waiting is rising, and the window to lead is narrowing. The procurement leaders of tomorrow will be the first movers of today, while those who wait will find the gap increasingly hard to close.

About the Authors:

Samir Khushalani is a partner in McKinsey & Company’s Houston office. He helps companies transform their procurement function to improve productivity and unlock new sources of economic value through innovative operating models, digital enablement, and advanced analytics.

Dan Albrecht is an expert based in Chicago. Within McKinsey’s procurement practice, he works with companies across sectors to transform their procurement function with a focus on source-to-pay implementations.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.