Deloitte examines five important trends to consider in the year ahead amidst industry concerns related to inflation and economic uncertainty.

By Paul Wellener, US Industrial Products & Construction Leader, Deloitte

While the Manufacturing industry has demonstrated significant growth in 2022, building on the momentum it gained emerging from the pandemic with overall demand and production capacity hitting recent highs, there are indications that the near-term outlook may not be as bright due to volatile inflation and economic uncertainty.

Deloitte’s 2023 Manufacturing Outlook explores five key insights for leaders to consider as they craft a strategic approach to this disruption and uncertainty:

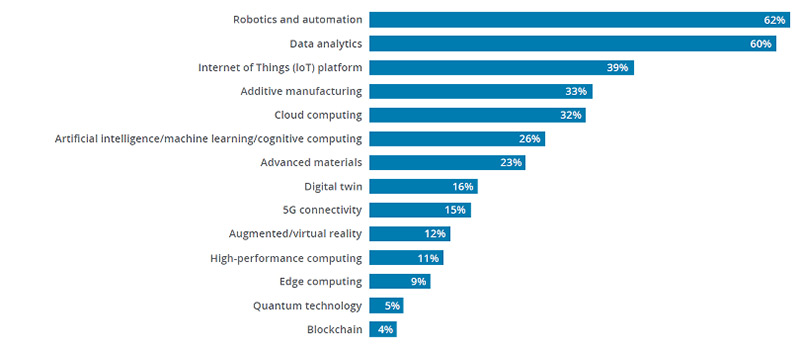

The past few years have witnessed increased digital investment by manufacturers along with the accelerated adoption of emerging technologies (Figure 1).

Deloitte analysis shows that companies with higher digital maturity have shown greater resilience as they were able to pivot faster than manufacturers with limited digital capabilities, especially during the pandemic. Higher digital implementation also allows companies to adapt to supply chain challenges through increased supply chain visibility.

Continued investments in advanced manufacturing technologies can help develop this required agility by:

Manufacturers are responding to substantial workforce churn, due to the shift to a hybrid work culture, the prevailing workforce shortage and supply chain limitations.

1 in 3 executives surveyed note that employee retention, is a strategic priority for 2023. 75% of respondents noted that retaining existing talent was their biggest challenge for managing the production workforce.

Pay increases, upskilling and reskilling, implementing diversity, equity and inclusion strategies, and enabling flexible work arrangements are key talent retention strategies to address the tight labor market and workforce churn amid shifting talent models for manufacturers in 2023.

Deloitte’s recent supply chain research highlights that 80% of surveyed manufacturing executives have experienced a “heavy” to “very heavy” impact of disruption on their supply chains over the past 12 to 18 months. In addition to this, our outlook survey highlights that 72% of surveyed executives believe the persistent shortage of critical materials and the ongoing supply chain disruptions present the biggest uncertainty for the industry in the coming year.

The question arises – how can manufacturers mitigate these supply chain risks?

Manufacturers can navigate disruption by building a relationship with suppliers as partners, and also evaluating the cost of multiple suppliers. In addition, companies are enhancing supply assurance by boosting local production capacity in the US and turning to digital capabilities to increase supply network visibility.

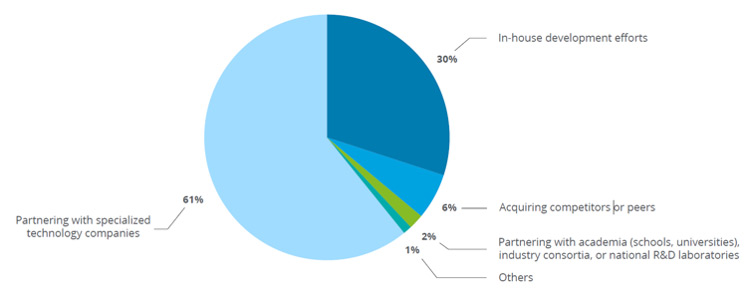

More than 60% of executives surveyed are partnering with specialized technology companies to further their smart manufacturing initiatives in the coming years. With the adoption of these foundational technologies, leading manufacturing companies are also likely to partner across their value chain, and enhance connectivity through the cloud, edge computing, and 5G.

Once they establish the digital core, manufacturers are investing in disruptive technologies such as augmented reality (AR), artificial intelligence (AI), Internet of Things (IoT), additive manufacturing, blockchain, and advanced analytics. Our survey highlights that one in five manufacturers is already experimenting with underlying solutions or actively developing a metaverse platform for their products and services. As manufacturers advance to the metaverse, cybersecurity will be table stakes. Organizations must stay ahead of cyberthreats, and most are investing in their cyber infrastructure.

The fast-evolving environmental, social, and governance (ESG) landscape may require close monitoring in 2023 for manufacturers.

Manufacturers are progressing toward their ESG commitments by making operational changes across their value chains by efficiently managing waste, increasing supplier diversity, elevating smart buildings, electrifying fleets and more. Focusing on the social aspect can create engagement among the younger workforce, which can provide manufacturers with another potential avenue for attracting new workers.

Headwinds of supply challenges, labor shortages and an uncertain economic environment will persist into 2023. Amid these uncertainties, innovations and approaches pioneered in 2022 are expected to gain momentum in 2023, enhancing tried-and-true business practices in the pursuit of growth and productivity.

About the Author

Paul Wellener is a Vice Chair, Deloitte LLP, and the leader of the US Industrial Products & Construction practice with Deloitte Consulting LLP. He has more than three decades of experience in the industrial products and automotive sectors and has focused on helping organizations address major transformations. Paul drives key sector industry initiatives to help companies adapt to an environment of rapid change and uncertainty—globalization, exponential technologies, the skills gap, and the evolution of Industry 4.0. Based in Cleveland, Paul also serves as the managing principal of Northeast Ohio.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.