The COVID-19 pandemic looks set to accelerate changes in the construction industry most notably in rapid adoption of digital capabilities.

Accounting for an estimated 13 percent of the world’s GDP, the construction industry—including real estate, infrastructure, and industrial structures—forms the world’s largest business ecosystem. Even before the onset of COVID-19, the sector was experiencing an unprecedented rate of disruption, sparking a long-expected overhaul that could transform the industry’s economics and business practices.

The crisis looks set to dramatically accelerate changes already underway, most notably in rapid adoption of digital capabilities. Some companies we have observed are compressing their 5-year digital transformation roadmaps, developed pre-COVID-19, into six months or less.

They have good reason. For the myriad of on–site contractors and sub-contractors that currently deliver projects, physical distancing and new health and safety requirements will require digitally supported detailed planning and lean on–site execution.

However, a digital transformation alone may not be enough. We have seen many industries—including shipbuilding, commercial aircraft manufacturing, agriculture, and automotive manufacturing—transform through waves of industrialization, consolidation (and often globalization), digitization, and, more recently, decarbonization.

Construction has lagged behind these peers, and now finds itself in a perfect storm with all of these forces impacting the industry at once. The result is a set of nine shifts in the industry, that will be underpinned by a new digital framework.

Our research suggests that the industry will look radically different five to ten years from now. We confirmed the trends and scenarios that surfaced in a recent survey of 400 global industry leaders, where more than 75 percent of respondents agreed that the nine shifts we lay out are likely to occur, and more than 60 percent believe they are likely to occur at scale in the next five years. The shifts ahead include productization and specialization, increased value-chain control, and greater customer centricity and branding. Consolidation and internationalization will create the scale needed to allow higher levels of investment in digitalization, R&D and equipment, sustainability, and human capital.

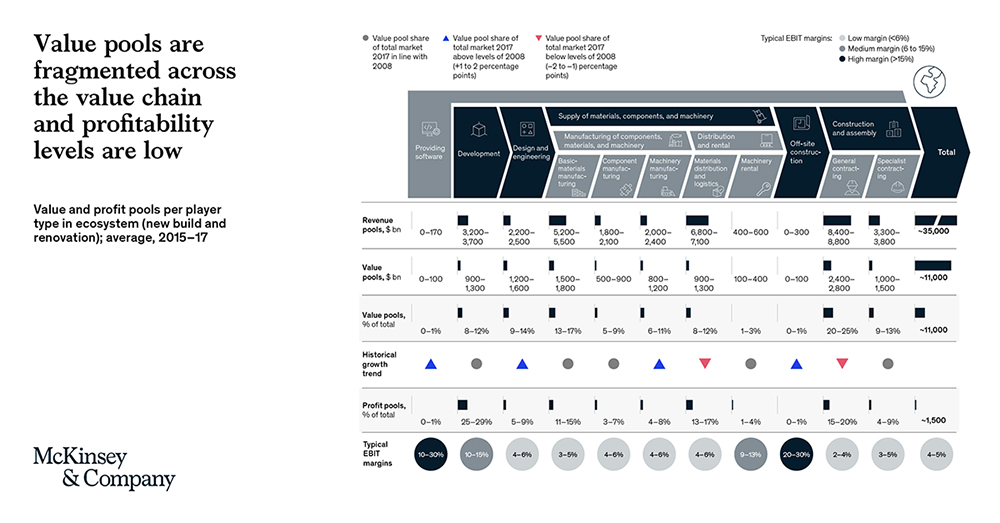

A new $265 billion annual profit pool awaits those that act quickly. A value chain delivering approximately $11 trillion of global value added and $1.5 trillion of global profit pools looks set for overhaul. In a scenario based on analysis and expert interviews by asset class, strongly affected segments could have a staggering 40 to 45 percent of incumbent value added at risk—value that could shift to new activities such as off–site manufacturing, to customer surplus, or to new sources of profit.

More than half of executives we surveyed have already raised their investment in new capabilities since the pandemic broke out. Every player needs to move—swiftly and boldly—or risk being left behind.

Digitization will be one of the key drivers of transformation across the entire value chain. Early in the value chain, developers can apply advanced analytics to understand customer needs and project values, and use artificial intelligence to optimize building shape and space use. Specifiers can choose from specialized product libraries—or build their own—to standardize projects and lock-in detailed specifications.

The designers and engineers producing these product libraries may see commoditization and specialization in parts of their sector. They can expect digitization to accelerate their work with automated parametric-design tools and software platforms directly translating those designs into factory-ready blueprints for component and module producers. A move towards modular construction has been gathering pace in recent years in parts of North America and Europe, and is expected to quicken , driving repeat-use of designs and reducing volumes of work. Some firms will choose to become “R&D arms” of property developers, or modular producers that design and optimize standard products rather than developing new projects from scratch.

Locking in specification decisions early in the process, combined with a modular building approach, will change the dynamics for procurement, distribution, and (sub)-contracting. Distributors will likely see an erosion in their traditional business of keeping stock for a long tail of small specialized trades firms, as early specification setting (combined with volume procurement by developers or contractors with direct delivery to sites) gains in importance. To survive and thrive, distributors have an opportunity to become advanced logistics hubs for the future construction ecosystem, using advanced analytics to optimize inventory and manage delivery to site: just-in-time, to the right floor, and packaged in sequence of assembly.

Should digital value chains and plans make projects smoother and less risky, general contractors also face commoditization of their traditional roles as project and risk managers. They can digitize their operating models, for instance, by using digital tools and advanced analytics to implement cost estimation and risk management models, or apply IoT on–site to track and optimize utilization and productivity of machinery and staff, thus supporting lean execution.

Digitization will also likely be applied to completed projects in the form of smart buildings and infrastructure. Structures equipped with IoT sensors can provide continuous feedback on factors such as usage and energy performance, feeding information back to investors, designers, and engineers to support continuous industry learning.

Industrialization, consolidation, digitalization, and decarbonization have been key drivers of change in all industries. All of these drivers are hitting construction simultaneously. Companies that familiarize themselves with the next normal and move quickly will be best positioned both to create value and to maintain their competitive edge. It is a daunting task and will require bold and agile moves to maneuver—but the size of the prize is enormous.

Jan Mischke

Jan Mischke is a Partner at McKinsey Global Institute (MGI), McKinsey’s business and economics research arm, based in Zurich. He is the lead author on McKinsey’s recent report, released this month: The Next Normal in Construction: How disruption is reshaping the world’s largest ecosystem.

Jan joined MGI in 2010 to lead its work on competitiveness and growth in Europe, and on infrastructure, construction and housing on a global basis. Jan is a prolific writer and frequent speaker on those topics. Prior to joining MGI, Jan worked for 10 years as a consultant with McKinsey. He served clients in 12 countries in a broad range of industries. Jan holds a Ph.D. from the Swiss Federal Institute of Technology (ETH) Zurich, after studies at RWTH Aachen and Imperial College London.

https://www.mckinsey.com/industries/capital-projects-and-infrastructure/our-insights

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.