Given vast product lines and far-flung supply chains, retail and consumer goods companies face more daunting disclosure than most industries.

By Randall Sargent and Marc Rousset

Retailers and consumer goods manufacturers need to be proactive when it comes to the recently proposed greenhouse gas (GHG) emissions disclosure rule from the Securities and Exchange Commission.

While some may hope current court challenges will derail the proposal, the smartest thing the consumer sector can do is to recognize the significant investor support behind disclosure, which almost guarantees some iteration of the rule will be adopted. The best strategy is to get ahead of it.

And as it is with most management challenges, retailers and consumer goods manufacturers that move quickly will have first-mover advantage and the strongest shot at differentiating their customer value propositions and reimagining supply chains to cut emissions.

Compliance won’t be easy. With potentially tens of thousands of products in inventory, larger retailers and consumer goods companies would confront the task of measuring and evaluating emissions from each, if the regulation is adopted — starting with raw materials right through point of sale and beyond. That’s a more daunting challenge than most companies or industries face.

Adding to the complication, many large retailers and consumer goods manufacturers have voluntarily committed to reduce GHG emissions, with several pledging to achieve net zero emissions by a specific date. Those enterprises would have to disclose their success with emissions reductions each year in annual reports.

So where to start? Retailers and consumer goods manufacturers can hit the ground running by integrating global frameworks from the Task Force on Climate-Related Financial Disclosures (TCFD) and Greenhouse Gas Protocol into their climate-related oversight, management, and reporting. In particular, the GHG Protocol introduces a framework to measure GHG emissions from both operations and the value chain.

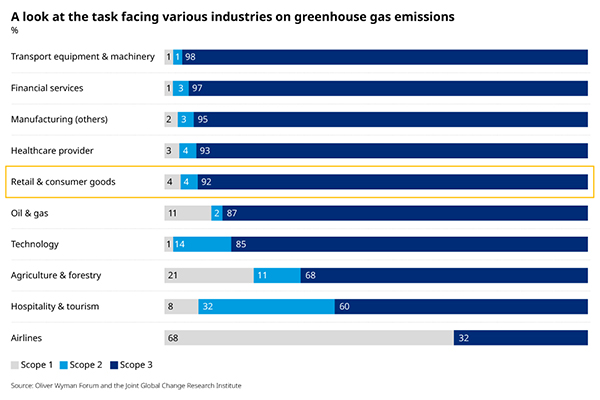

Based on an analysis by Oliver Wyman and the Joint Global Change Research Institute, 90% of emissions for the consumer sector are so-called Scope 3 emissions. These are among the hardest to track and control because they are usually being created by enterprises upstream and downstream from the company filing with the SEC.

Emissions are categorized based on the stage in a product’s life they are generated. For instance, for a manufacturer, Scope 1 are emissions from the production of a product. In the case of retailers, they’re from the operations of stores. Scope 2 are those from power consumed by a company’s operations.

Scope 3 emissions come from a company’s manufacturing supply chain, transportation of products, or use and disposal of products. For example, to gather Scope 3 emissions, food companies or grocery chains may need to tally emissions from vast networks of small farmers across the developing world. And putting processes in place to handle this is not something that can happen overnight. Yet, companies are expected to begin Scope 3 disclosures in 2024 filings.

But the disclosure data could prove useful to companies that want to make their supply chains more sustainable. Using the data, consumer sector companies may be able to restructure supply chains to reduce emissions risk. This might mean picking new suppliers or changing the mix of transportation modes. For instance, companies may decide to go with nearby suppliers to reduce emissions from transport or stock more sustainable products.

Considering factors like these could enhance reputation and brand from a corporate social responsibility (CSR) standpoint and companies should consider how they communicate their efforts to customers, employees, and investors. We believe retailers and consumer goods companies that move quickly have unique first-mover, customer engagement opportunities. For instance, could a new scale rating for ‘emission-friendly’ products based on Scope 3 emissions be developed? This is generally yet-to-be-claimed territory for the consumer sector, meaning the first retailers or consumer goods manufacturers to act will have an outsize influence on the customer expectation, outsize authority to define the standards, and reap outsize value on brand equity.

At present, retail and consumer goods companies are rightly distracted by the economy: They’re looking at supply chains, primarily trying to fend off inflation and eliminate the disruptions caused by COVID-19 and the invasion of Ukraine. But companies that factor in the long-term impact of sustainability are likely to create a more durable team of suppliers over the long-haul — less vulnerable to emissions and nature-related risks but also more diversified in terms of geography and delivery schedules and modes.

While combating inflation is top of mind, sustainability will be a more transformational trend and performance enhancer than higher prices. Despite the enormous complexities, Scope 3 disclosures present a unique opportunity for retailers and consumer goods manufacturers to differentiate their customer value proposition as a highly sustainable organization.

Randall Sargent is a principal in Oliver Wyman’s global retail and consumer goods practice. Based in Boston, Randall spent part of her career working in Singapore.

Marc Rousset is a partner in Oliver Wyman’s global retail and consumer goods practice. Based in Boston, Marc has had the advantage of working in Asia, Europe, and the US during his career.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.