Manufacturers who treat contracts as operational assets rather than legal documents unlock hidden value and mitigate costly supply chain risks.

When you think about contracts in your manufacturing operation, what immediately comes to mind? Legal documents? Fine print? Necessary bureaucracy?

If that’s your perspective, you’re leaving money on the table—potentially millions.

I’ve spent years working with manufacturing companies, and I’ve seen firsthand the dramatic shift in how forward-thinking operations approach contract management. The reality is stark: contracts aren’t legal documents; they’re business processes at the heart of every manufacturing operation.

For manufacturers, the stakes of poor contract management are particularly high. According to recent research, manufacturing companies lose an average of 8.6% of contract value due to inefficient management—that’s nearly a dime of every dollar vanishing through avoidable leakage.

This challenge is amplified in manufacturing where supply chain complexity, regulatory requirements, and price volatility create a perfect storm of contract management challenges. More than 63% of manufacturers report that scattered contracts create significant operational problems, leading to missed obligations, unexpected costs, and compliance risks.

Why does this matter? Because in the manufacturing world, contracts govern everything that keeps your operation running—from raw material supply agreements to equipment maintenance schedules, distribution partnerships to customer commitments. When these contracts aren’t managed strategically, the results are predictable: production delays, compliance penalties, and profit erosion.

What’s fascinating is how rapidly contract management is shifting away from legal departments—particularly in manufacturing. Over the last decade, I’ve watched this evolution accelerate dramatically.

When we started Concord ten years ago, contracts were all about legal—it was exclusively legal teams managing contracts. But today, we see a complete transformation where most contracts are actually managed by CFOs or COOs, with legal becoming less and less involved in the day-to-day process.

This shift makes perfect sense. Most manufacturing contracts (more than 90% in my experience) are never negotiated—they’re standardized templates that simply need efficient handling, not legal scrutiny for every transaction. Legal teams are simply too resource-constrained to handle the volume, and frankly, their specialized expertise is better deployed elsewhere.

What we’re seeing instead is operations and finance taking ownership—treating contracts as operational assets that drive business outcomes rather than legal risks to be managed. Recent surveys confirm this trend, with approximately 65-70% of our manufacturing customers operating without dedicated legal teams, instead outsourcing specialized legal work only when necessary.

If you’re in manufacturing, you’re no stranger to automation. You’ve likely invested heavily in streamlining production processes through technology—but what about your contract processes?

The manufacturing sector is now embracing AI-powered contract management at a striking pace. A 2024 survey found that AI is expected to cut manual labor in the contract review process by half this year. For manufacturers dealing with hundreds or thousands of contracts, that’s transformative.

This isn’t theoretical. AI tools can now automatically extract critical data from manufacturing contracts (equipment specifications, delivery dates, price adjustment clauses, compliance requirements) in seconds rather than hours. In manufacturing, where timing is everything, AI can complete contract reviews in 26 seconds compared to the 92 minutes it takes humans.

Beyond speed, AI brings unprecedented accuracy. In head-to-head comparisons, AI outperformed trained lawyers by 10% in contract review accuracy. For manufacturers, where a single missed commitment can cascade into production delays, this precision is invaluable.

The manufacturing sector specifically is adopting these technologies faster than most industries, with 75% of organizations expected to implement AI-driven automation for business-critical operations by 2025. This reflects a growing understanding that contract management isn’t peripheral—it’s essential infrastructure.

Let’s get concrete about the ROI. What does improved contract management actually deliver for manufacturers?

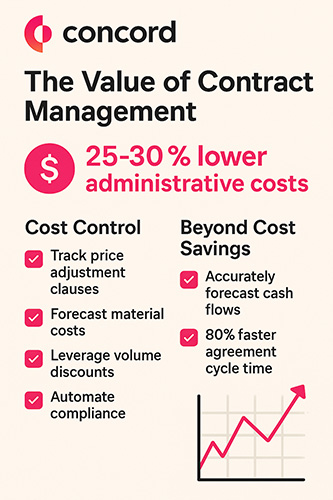

First, there’s cost control. Manufacturing companies implementing contract management software report slashing administrative costs by 25-30%. But the real value comes from operationalizing contract data for strategic advantage.

Consider procurement. Raw materials for manufacturing aren’t always available at fixed prices, making supply chain cost management a constant challenge. Modern contract lifecycle management software allows manufacturers to:

Beyond cost savings, there’s revenue protection. Manufacturing companies using advanced contract analytics can accurately forecast cash flows based on actual contractual commitments rather than historical patterns. This ensures more accurate financial planning and resource allocation.

The impact on efficiency is equally compelling. Organizations using contract management software report an 80% faster average cycle time from bid to signed agreement. For manufacturers competing on speed-to-market, that advantage is significant.

If you’re convinced but unsure where to start, here’s my practical advice based on working with manufacturing clients:

Looking ahead, I believe two major trends will reshape contract management for manufacturers:

First, AI will continue to transform how contracts are created, negotiated, and managed. By 2025, AI is expected to be embedded in 90% of enterprise software, making intelligent contract management the norm rather than the exception.

Second, contracts themselves will evolve. The traditional lengthy, text-heavy documents will give way to more structured, data-driven agreements optimized for machine readability and automation. Think of term sheets and tabular formats that clearly outline commitments, rather than burying them in dense paragraphs.

For manufacturers specifically, these changes will drive increased supply chain resilience. Nearly half of manufacturers are now using AI to enhance their supply chain management, helping them better gather and analyze data, optimize inventory levels, forecast demand, and improve logistics.

The shift I’m describing isn’t just technological—it’s philosophical. It’s about recognizing that in manufacturing, contracts aren’t documents to be filed away; they’re operational assets that should be actively managed to drive business outcomes.

The manufacturers who embrace this perspective, who bring contracts out of legal departments and into operational processes, who leverage AI to transform contract data into business intelligence—these are the companies gaining competitive advantage.

In a manufacturing landscape where margins are continually pressured and supply chains increasingly complex, smart contract management isn’t just nice to have—it’s essential infrastructure for the modern factory.

About the Author:

Matt Lhoumeau is the co-founder and CEO of Concord, a leading contract management platform used by over 1,500 companies worldwide. After experiencing the pain of manual contract management firsthand while working at a major telecom company, Matt built Concord to ensure no one would have to endure the same frustrations. Concord now helps manufacturing companies of all sizes automate their contract processes and extract maximum value from their agreements.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.