Coyote Logistics released a new research study that reveals how shippers approach outsourcing and in-house operations.

Today, Coyote Logistics released a new research study that reveals how shippers approach outsourcing and in-house operations across multiple areas of supply chain management.

If the last two years taught companies anything, it was the importance of a highly functioning supply chain.

And companies are responding — 81% of supply chain decision-makers agree that their corporate leadership is investing in improving their logistics capabilities.

But what exactly does improving look like? Does it mean hiring more people?

Building out internal capabilities is certainly part of the process, but businesses cannot (and should not) do it all by themselves, whether they ship two-pallets-a- month or twenty-truckloads-an-hour.

Every shipper relies on a myriad of third-party providers to manage inventory, fulfll orders and transport freight.

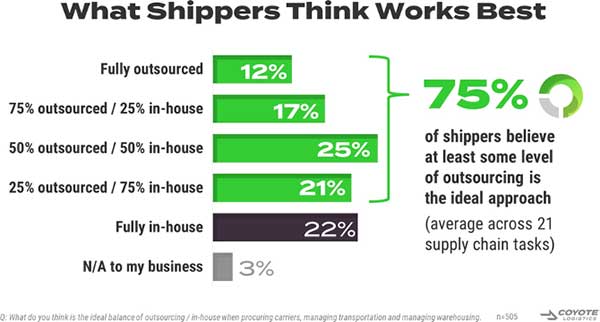

On average across 21 areas of supply chain management, 75% of shippers think at least some level of outsourcing is ideal.

But figuring out the best approach is not straightforward.

As shippers seek the right blend of insourcing and outsourcing, they should look to their peers for guidance.

In this independent research study, over 500 decision-makers shared how they use outsourcing in their transportation and warehousing operations.

We worked with a 3rd party research firm to survey 504 supply chain decision makers.

The C-suite has taken pandemic-era supply chain lessons the lesson to heart.

Companies are now treating supply chain with the same deference as fnance and sales.

Many companies are even giving supply chain its own seat in the board room — 29% of shippers have a Chief Supply Chain Offcer (CSCO), and that fgure jumps to 36% for companies with over $800M in annual revenue.

According to the 504 supply chain decision makers in our study, a vast majority agree that their corporate leadership has both a good understanding of how their supply chain works, and is investing in improving supply chain capabilities.

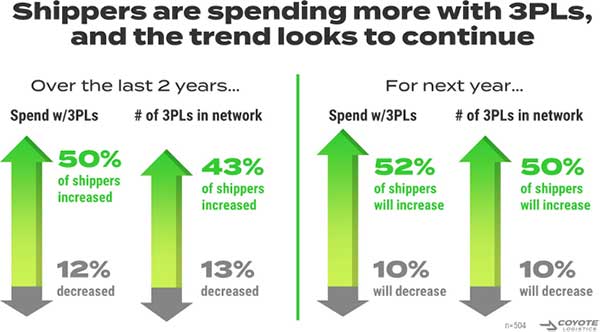

In the midst of historic volatility, shippers turned to their 3PLs for help.

The ready access to scalability, capacity and expertise proved to be a reliable way to stabilize operations.

Over the past two years, 50% of shippers increased their spend with outsourced providers, compared to only 12% that decreased spend.

Not only did shippers spend more overall, but they did so with more 3PLs — 43% of shippers expanded their provider base, compared to only 13% who decreased.

And while freight markets are in a very different place now, shippers are doubling down on their commitment to outsourcing.

Over half of respondents plan on increasing their spend with 3PLs again this year — a 2% jump compared to the last two years.

A majority also plan on increasing the number of 3PLs in their network, up 7% compared to the last two years.

Deciding to outsource is one thing. Finding the right third-party provider is another.

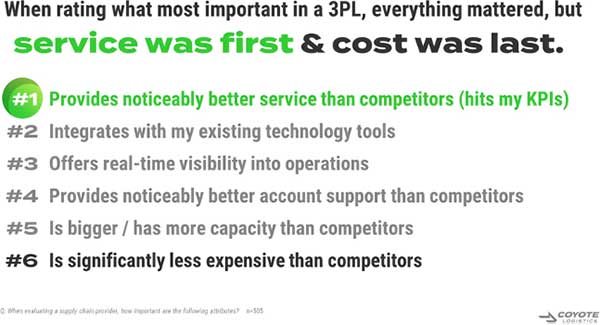

We asked shippers to rate how important different attributes are when choosing their outsourced providers.

Unsurprisingly, shippers want a provider that has it all (the lowest-rated attribute was at 70%), but some features were ahead of the rest.

As we found in our logistics KPI research study, when it comes down to cost vs. service, service wins.

82% of shippers agreed that provides noticeably better service than competitors (hits my KPIs) was important, making it the top consideration factor; is signifcantly less expensive than competitors (70% of shippers) was the bottom.

Looking across 21 different areas of supply chain management, there wasn’t a single area where a majority of shippers thought fully in-house or fully outsourced was the ideal approach (the closest was only at 36%).

Most shippers fall in between, preferring a blend of the two.

And they’re not mutually exclusive — most shippers think their outsourcing spend and supply chain team headcount will grow this year.

Check out the the full research study to learn more how shippers are apply outsourcing and in-house teams across 21 areas of supply chain management.

Learn about how they use private fleets, technology and what they really think about supply chain consultants.

P.S. You can also download it as a PDF.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.