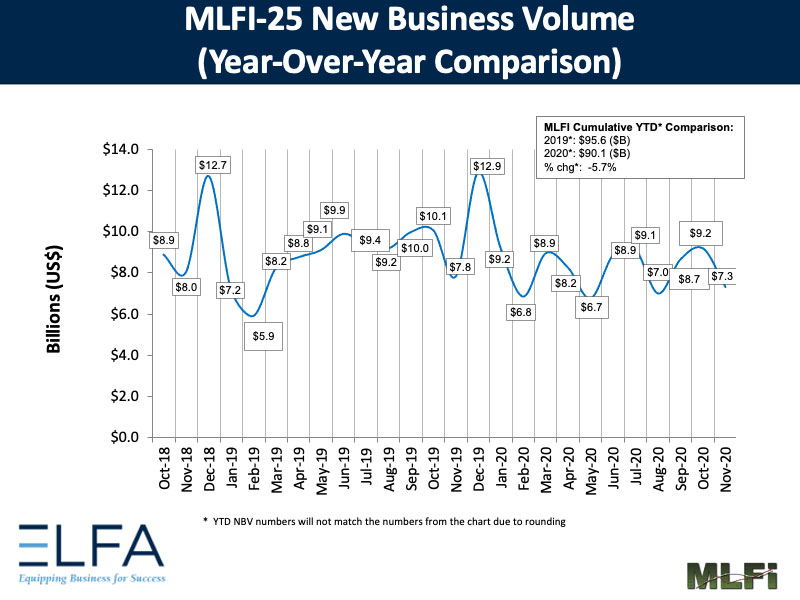

New business volume of surveyed ELFA member companies representing the nearly $1 trillion equipment finance industry was down 7% YOY in Nov.

Washington, DC—The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $900 billion equipment finance sector, showed their overall new business volume for November was $7.3 billion, down 7 percent year-over-year from new business volume in November 2019. Volume was down 21 percent month-to-month from $9.2 billion in October. Year-to-date, cumulative new business volume was down almost 6 percent compared to 2019.

Receivables over 30 days were 2.30 percent, up from 2.20 percent the previous month and up from 1.80 percent the same period in 2019. Charge-offs were 0.61 percent, a slight uptick from 0.60 percent the previous month and up from 0.43 percent in the year-earlier period.

Credit approvals totaled 70.4 percent, down from 72.3 percent in October. Total headcount for equipment finance companies was down 7.0 percent year-over-year.

Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index (MCI-EFI) in December is 59.7, up from the November index of 56.1.

ELFA President and CEO Ralph Petta said, “With a tumultuous election season behind us, the equipment finance industry reports slightly lower volume totals for the month. The effect of the COVID-19 pandemic on the U.S. economy surely has taken, and will continue to take, a toll on some members’ business operations. But, overall, the broader industry is performing well, with delinquencies and losses in very acceptable ranges. And, the roll out of vaccines should inject a renewed sense of optimism and hope by consumers and businesses alike, which will only bode well for our industry in the months ahead.”

Rick Matte, President and Chief Commercial Officer. Encina Equipment Finance, LLC, said, “As we can see from the data in this month’s report, COVID-19 continues to cause disruption in the equipment finance marketplace. We have seen some industries perform very well while others have essentially fallen off a cliff. Capital spending has been cut dramatically by most businesses as they look to preserve cash or re-evaluate their future growth prospects. With all that said, now that the election is behind us combined with the delivery of two FDA approved vaccinations, the market sentiment has begun to shift despite increasing COVID cases.”

About ELFA’s MLFI-25

The MLFI-25 is the only index that reflects capex, or the volume of commercial equipment financed in the U.S. The MLFI-25 is released globally at 8 a.m. Eastern time from Washington, D.C., each month on the day before the U.S. Department of Commerce releases the durable goods report. The MLFI-25 is a financial indicator that complements the durable goods report and other economic indexes, including the Institute for Supply Management Index, which reports economic activity in the manufacturing sector. Together with the MLFI-25 these reports provide a complete view of the status of productive assets in the U.S. economy: equipment produced, acquired and financed.

The MLFI-25 is a time series that reflects two years of business activity for the 25 companies currently participating in the survey. The latest MLFI-25, including methodology and participants, is available at www.elfaonline.org/Data/MLFI/.

MLFI-25 Methodology

ELFA produces the MLFI-25 survey to help member organizations achieve competitive advantage by providing them with leading-edge research and benchmarking information to support strategic business decision making.

The MLFI-25 is a barometer of the trends in U.S. capital equipment investment. Five components are included in the survey: new business volume (originations), aging of receivables, charge-offs, credit approval ratios, (approved vs. submitted) and headcount for the equipment finance business.

The MLFI-25 measures monthly commercial equipment lease and loan activity as reported by participating ELFA member equipment finance companies representing a cross section of the equipment finance sector, including small ticket, middle-market, large ticket, bank, captive and independent leasing and finance companies. Based on hard survey data, the responses mirror the economic activity of the broader equipment finance sector and current business conditions nationally.

About ELFA

The Equipment Leasing and Finance Association (ELFA) is the trade association that represents companies in the nearly $1 trillion equipment finance sector, which includes financial services companies and manufacturers engaged in financing capital goods. ELFA members are the driving force behind the growth in the commercial equipment finance market and contribute to capital formation in the U.S. and abroad. Its 575 members include independent and captive leasing and finance companies, banks, financial services corporations, broker/packagers and investment banks, as well as manufacturers and service providers. For more information, please visit www.elfaonline.org.

Follow ELFA:

Twitter: @ELFAonline

LinkedIn: www.linkedin.com/groups?gid=89692

Facebook: www.facebook.com/ELFApage

ELFA is the premier source for statistics and analyses concerning the equipment finance sector. Please visit www.elfaonline.org/Data/ for additional information.

The Equipment Leasing & Finance Foundation is a 501c3 non-profit organization that propels the equipment finance sector—and its people—forward through industry-specific knowledge, intelligence, and programs that contribute to industry innovation, individual careers, and the overall betterment of the equipment leasing and finance industry. The Foundation is funded through charitable individual and corporate donations. Learn more at www.leasefoundation.org.

Media/Press Contact: Amy Vogt, Vice President, Communications and Marketing, ELFA, 202-238-3438 or avogt@elfaonline.org

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.