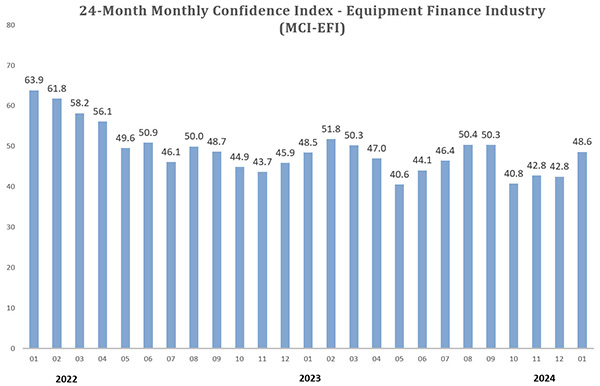

This month’s index is 48.6, up from the December index of 42.5.

Washington, DC – The Equipment Leasing & Finance Foundation (the Foundation) releases the January 2024 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market is 48.6, an increase from the December index of 42.5.

When asked about the outlook for the future, MCI-EFI survey respondent David Normandin, President and Chief Executive Officer, Wintrust Specialty Finance, said, “I expect that Wintrust will have a good year in the market as we have stable liquidity, attractive cost of funds, and an engaged and motivated team. I expect to continue to see challenges in the overall economy as well as specific segments, and we are diversified and nimble to move to the opportunity. The leasing industry has historically performed better than other asset classes through tougher times because of the nimble and creative nature of the industry. I expect that the industry will come through this next couple years stronger having learned from our experiences.”

The overall MCI-EFI is 48.6, an increase from the December index of 42.5.

Captive, Small Ticket

“We still see demand for light and medium-duty trucks to satisfy ever-growing e-commerce business. We also see thousands of light and medium-duty trucks waiting for bodies to be upfitted. When the body companies catch up with chassis awaiting upfitting, we will see a lot of opportunities for equipment finance companies in this sector over the next three to six months.” Jim DeFrank, EVP and Chief Operating Officer, Isuzu Finance of America, Inc.

ABOUT THE MCI

Why an MCI-EFI?

Confidence in the U.S. economy and the capital markets is a critical driver to the equipment finance industry. Throughout history, when confidence increases, consumers and businesses are more apt to acquire more consumer goods, equipment, and durables, and invest at prevailing prices. When confidence decreases, spending and risk-taking tend to fall. Investors are said to be confident when the news about the future is good and stock prices are rising.

Who participates in the MCI-EFI?

The respondents are comprised of a wide cross-section of industry executives, including large-ticket, middle-market and small-ticket banks, independents, and captive equipment finance companies. The MCI-EFI uses the same pool of 50 organization leaders to respond monthly to ensure the survey’s integrity. Since the same organizations provide the data from month to month, the results constitute a consistent barometer of the industry’s confidence.

How is the MCI-EFI designed?

The survey consists of seven questions and an area for comments, asking the respondents’ opinions about the following:

How may I access the MCI-EFI?

Survey results are posted on the Foundation website, https://www.leasefoundation.org/industry-resources/monthly-confidence-index/, included in the Foundation Forecast eNewsletter, and included in press releases. Survey respondent demographics and additional information about the MCI are also available at the link above.

JOIN THE CONVERSATION

X: https://twitter.com/LeaseFoundation

LinkedIn: https://www.linkedin.com/company/10989281/

Vimeo: https://vimeo.com/elffchannel

ABOUT THE FOUNDATION

The Equipment Leasing & Finance Foundation is a 501c3 non-profit organization that propels the equipment finance sector—and its people—forward through industry-specific knowledge, intelligence, and student talent development programs that contribute to industry innovation, individual careers, and the advancement of the equipment leasing and finance industry. The Foundation is funded through charitable individual and corporate donations. Learn more at www.leasefoundation.org

Media Contact: Kelli Nienaber, knienaber@leasefoundation.org

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.