Texas crisis offers guidance for U.S. energy policy.

An extreme coast-to-coast storm and historic cold snap fueled by a polar vortex has recently hit large swathes of the U.S., delivering severe, record-setting winter weather, including areas which rarely see such conditions. It left tens of millions facing subzero temperatures, and multiple states under emergency declarations. The polar vortex has also caused significant power shortages and price spikes.

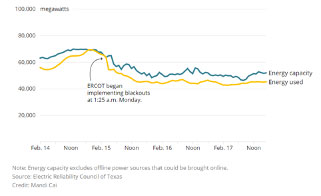

In Texas, the Regional Transmission Operator is the Electric Reliability Council of Texas, or ERCOT. During the week of February 15th, ERCOT lost about a third of its generating capacity (46,000MW).

With generation failing to meet demand, ERCOT was left with no other option other than to cut off customers’ access to power. This resulted in rolling blackouts across Texas, causing millions of residents and business to lose power. It also impacted water systems, as water demand increased to prevent pipes and water mains from freezing.

At this point, we understand that weather and system planning played a major role. Texas’ electric needs typically peak in the summer, but the extremely cold weather pushed the ERCOT demand to record levels. According to Utility Dive, peak demand was estimated at 67,512 MW, based on “normal weather” conditions, but actual demand in February 2021 hit a record-breaking 69,150 MW.

But what caused the electric transmission constraints? Issues in the natural gas supply system and freezing of plant cooling water in-takes were just a few of the issues. It was also found that wind turbines and solar panels were impacted by ice, leading to capacity shortages.

Natural gas production fell from 22.5 billion cubic feet of gas produced per day in December to between 10 to 12 billion cubic feet of gas per day during the February cold snap, according to estimates from BTU Analytics.

That drop-off in production was due to freeze-offs at wellheads where oil and gas are pumped out of the ground. The cold also stopped equipment from working properly at gas processing plants.

While the frigid cold reduced fuel supply, it also drove up demand for natural gas to heat homes. That “mismatch” drove the blackouts: there simply wasn’t enough fuel on hand to power the state’s electricity needs.

As investigations continue, several issues will be reviewed:

The investigation may impact U.S. energy policy changes taking place now, helping to answer questions such as: Will the ongoing push toward electric energy to capitalize on renewal options be the most prudent? Is relying on just one fuel source wise? Are impacts to national and regional transmission networks and local distribution systems being fully analyzed to ensure they can effectively and reliably support the change?

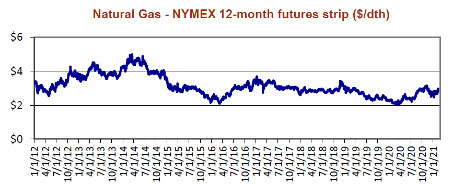

Natural gas and electric rates in the U.S. had been moving in a downward trend since 2019, due to greater supply and COVID-19 limiting use as people stayed home.

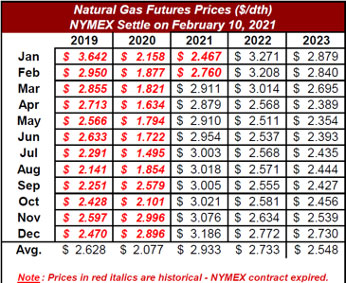

In January of 2018, the NYMEX gas futures price was $3.642 / Dekatherm (dth); by July of 2020, the price dropped to $1.495 – a 59% drop. And the average price in 2020 was $2.077 – a 21% drop compared to 2019. But through early February of this year, the price was $2.76/ dth – a 47% increase over last February.

Natural gas price increases are expected to continue. The Energy Information Agency (EIA) is forecasting a 2021 average price of $2.933 – a 41% increase from 2020 – before moderating in 2022 and 2023.

The above gas price discussion does not reflect the significant impact of the recent weather in the Midwest into South Texas. According to the Natural Gas Intelligence, natural gas prices reached an historic high in Oklahoma. The American Gas Association reports a two-day gas delivery record of over 300 billion cubic feet (Bcf) of natural gas in February 2021.

So what should high energy users – including data center operators – do now to manage costs? While electric and natural gas prices have been stable the past few years, there is a major upward trend and as we have recently seen, major weather events will trigger significant price fluctuations. And as the Texas situation has shown, index or variable price contracts are highly risky and must be analyzed carefully to determine tolerance of risk. There will most likely be more periods of volatility and price spikes like we saw the past few weeks. At this point in time, pricing for contract terms of three to five years is very attractive and should be given strong consideration.

Takeaway: One thing the energy markets have us shown over the years is that market factors can and will change. Take advantage of the current market conditions as they are trending upward.

Timothy Comerford, Senior Vice President, Biggins Lacy Shapiro

Tim Comerford is SVP of Biggins Lacy Shapiro’s energy-services group and principal of Sugarloaf Associates. He focuses on assisting companies, developers, municipalities, and real-estate advisors with issues that pertain to energy procurement, renewable installation, infrastructure assessments, and utility relocation, with a special focus on mission-critical facilities. tcomerford@blsstrategies.com, www.blsstrategies.com

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.