By Marian Mueller, Bobby Bono, Steve Pillsbury, and Barry Misthal

To take advantage of digitization, industrial manufacturers need new operating models, aggressive hiring, smart partnerships, and targeted investments.

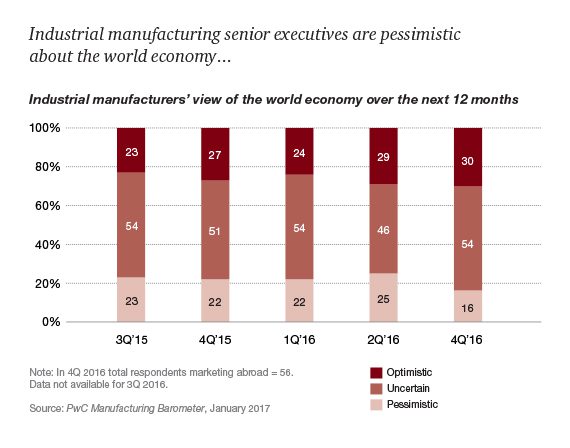

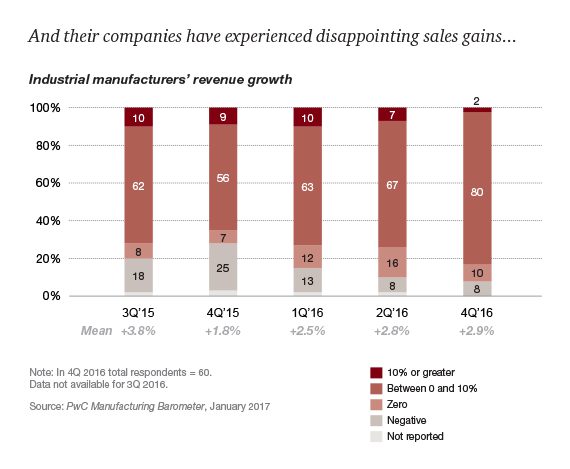

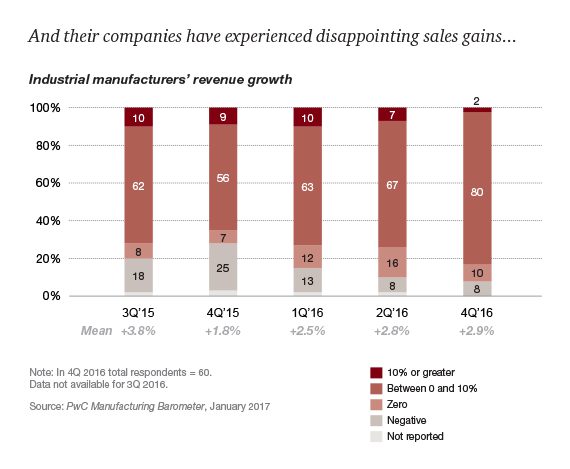

Industrial manufacturers inhabit a world littered with uneasiness. Global demand for manufactured products is growing at a snail’s pace. Output is expected to increase just 3.1 percent in 2016 and 3.4 percent in 2017, according to the International Monetary Fund. Growth is dampened by Brexit concerns and political uncertainties. Foreign trade is at historically low levels, and, although oil prices have recovered a bit recently, they are not rising enough to undo the collapse in drilling and concomitant retraction in the rest of the energy supply chain.

More problems could be in the offing. New nationalist governments around the world, including the United States, are threatening to further undermine the free flow of goods, creating more uncertainty and constraints upon manufacturing growth. The ripple effects of any attempts to reset trade agreements would be felt in the industrial manufacturing sector; manufacturers with plants in Mexico and China could see their business models decline quickly under the weight of increased import duties and tariffs. Many will take a wait-and-see approach, delaying capital expenditure investments until more clarity on actual policies emerges.

In a slow-growth environment such as this, productivity gains are paramount. And that could be a boon for industrial manufacturers. Indeed, industrial manufacturers can best serve their customers (and themselves) by designing tools and equipment that improve the efficiency, costs, and performance of factories and other capital projects. Whether enhancing their or their customers’ plants, industrial manufacturers have an opportunity to profit from innovation strategies that build upon advanced manufacturing concepts and the potential of the industrial Internet.

In a slow-growth environment such as this, productivity gains are paramount. And that could be a boon for industrial manufacturers. Indeed, industrial manufacturers can best serve their customers (and themselves) by designing tools and equipment that improve the efficiency, costs, and performance of factories and other capital projects. Whether enhancing their or their customers’ plants, industrial manufacturers have an opportunity to profit from innovation strategies that build upon advanced manufacturing concepts and the potential of the industrial Internet.

In order to do this, industrial manufacturers must become more aggressive and deliberate in their investments. They should focus on developing technology platforms and new operating models that enable connected products and services and integrate their customers’ operations. For customers, the desire for efficiency and quality improvements are a given, but companies increasingly want visibility deep into their supply chains: They want connectivity tools that provide insight into production levels, inventory and capacity availability, quality levels, and order status from all their suppliers. Capital asset developers are seeking similar capabilities in dealing with the engineering and construction firms that build their projects.

In order to do this, industrial manufacturers must become more aggressive and deliberate in their investments. They should focus on developing technology platforms and new operating models that enable connected products and services and integrate their customers’ operations. For customers, the desire for efficiency and quality improvements are a given, but companies increasingly want visibility deep into their supply chains: They want connectivity tools that provide insight into production levels, inventory and capacity availability, quality levels, and order status from all their suppliers. Capital asset developers are seeking similar capabilities in dealing with the engineering and construction firms that build their projects.

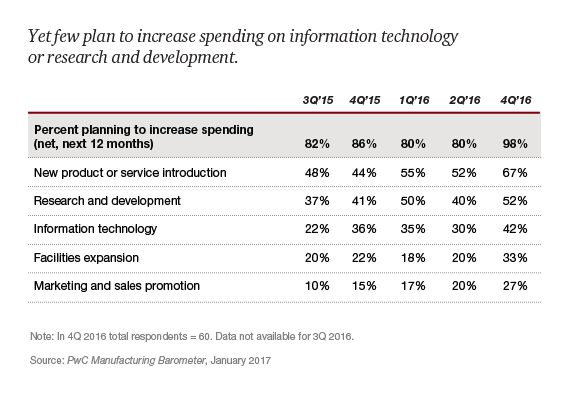

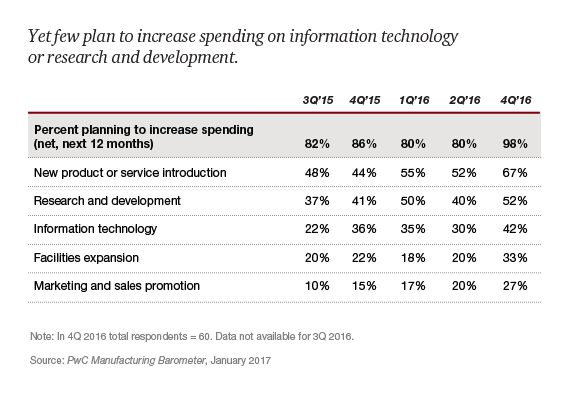

There is a remarkable opportunity here. Yet the industrial manufacturing sector remains risk averse, unwilling to spend on new machinery, software, and talent during a period of protracted slow growth and limited proven solutions. In a recent PwC survey, only 30 percent of U.S.-based industrial manufacturing senior executives said that their companies were planning to increase spending on information technology in the subsequent 12 months. The remaining companies are likely to fall behind.

There is a remarkable opportunity here. Yet the industrial manufacturing sector remains risk averse, unwilling to spend on new machinery, software, and talent during a period of protracted slow growth and limited proven solutions. In a recent PwC survey, only 30 percent of U.S.-based industrial manufacturing senior executives said that their companies were planning to increase spending on information technology in the subsequent 12 months. The remaining companies are likely to fall behind.

Of course, new investments alone aren’t enough. Industrial manufacturers need additional skills as well; they must figure out how to manage a superabundance of new data so that it becomes useful and not overwhelming; adapt technology to run their own supply chains and operations more seamlessly; monetize digitization; find talent adept at industrial software programming and analytics; and build strategic partnerships that won’t compete for market share. Below are six actions for 2017 that can help industrial manufacturers profit despite the significant challenges they face.

- Leverage data and analytics in a new business model

By upgrading their technical capabilities, industrial manufacturers can bundle a variety of services enabled by connectivity and data, replacing the increasingly outmoded model of selling one big complex machine under warranty and a service agreement for maintenance and repair. These new services can include condition-based maintenance, which involves ongoing real-time monitoring of equipment to determine its maintenance needs; collaboration with customers on a day-to-day basis to customize asset optimization; and predictive performance management for large and small projects and equipment. With this approach, the breadth and value of the services provided by the industrial manufacturer can enhance customer retention and lead to deeper and more lucrative commercial engagements.

- Innovate pricing

As technology begins to alter the relationship between industrial manufacturers and their customers, the traditional pricing model for the service contract must be changed as well, from pay-for-product to pay-for-performance. Condition-based maintenance (discussed above), driven by predictive and interconnected industrial technology, will become commonplace. This should translate into fewer visits from repair technicians. As a result, customers will naturally expect more favorable terms, which can be facilitated by sharing risk. Instead of basing equipment pricing on products and fixed maintenance or warranty costs, industrial manufacturers should establish fee structures tied to outcomes. For example, the industrial manufacturer may be paid more if equipment downtime is reduced or if an upgrade improves productivity. Some industrial manufacturers — flinching at this drastic shift in pricing structure — will adopt a blended approach, with fixed fees to cover some costs and a variable component based on efficiency and productivity gains realized by the customer.

- Develop strategic partnerships — carefully

Industrial manufacturers must become more active players in the technology ecosystem, seeking expertise outside the industry in order to develop equipment connectivity, data analysis, and software that are beyond their current abilities. For example, recognizing that it cannot grow the ecosystem alone, at least one major industrial company has aligned with a wide range of technology firms to create a dedicated cloud-based platform that can run industrial workplaces. These joint arrangements are necessary because startup technology companies have begun to whittle away at bits and pieces of the Internet of Things’ corner of the industrial manufacturing market. But these alliances are not without risk. Leaders have to balance the practice of close collaboration with strategic partners against the need to stay flexible in contracting and partner selection, all while maintaining their hold on their markets. Given the rapid advances of technology, it is possible that a partnership will fall apart because two collaborating companies suddenly realize that their customer base, once distinct, has morphed and they have become direct competitors, vying for the same customers with the same product.

- Mine operational data

If connected machines — the primary components of the Internet of Things (IoT) — are to be the backbone of industry in the near future, industrial manufacturers will have to figure out how to manage the data coming from an avalanche of sensors, integrated equipment and platforms, and faster information processing systems. There is a critical need to hire people who can mine these bits and bytes of information and work more closely with customers to use the data to improve equipment performance and open new revenue streams. Indeed, the anticipated efficiency returns from digitization over the next five years across all major industrial sectors are substantial: nearly 3 percent in additional revenue and 3.6 percent in reduced costs per year, according to a recent PwC survey of companies. By proactively leading the digitization effort, industrial manufacturers can earn a growing portion of these gains.

Facing a climate of depressed prices, oil and gas companies are good illustrators of the potential for these improved returns. Instead of building a new well — not viable in the current market — they can squeeze greater production out of existing sites by using more efficient digital control systems and sensor-fed data (such as data on pressure, temperature, and flow rates) to manage the wells more effectively. One drill manufacturer has been helping its customers — chemical plants, oil refineries, and other process manufacturers — operate their plants more effectively by leveraging IoT in the form of wireless drill sensors, which can detect potential failures in valves before they lead to a spill or shutdown. In the past, installing drill sensors to capture critical data was a lengthy and expensive process because it required running a wire down into the wellhead. This new technology makes it easier to safely capture, monitor, and analyze this constantly changing data in real time, enabling oil and gas companies to save millions by reducing the number of unforeseen outages by half, and increasing crude output by as much as 10 percent.

- Decide what intellectual property to share and what to develop

Many industrial manufacturers find it difficult to manage digitization and big data analytics because their internal IT systems are so unwieldy. As company operations have grown more complex, expanding into new global markets and product lines and integrating newly acquired firms over many years, the old enterprise resource planning (ERP) systems that were meant to drive efficiency and coordination have proliferated into a tangled mass of disparate networks. Many large industrial manufacturers have as many as 100 different ERP systems — not to mention hardware and software independent of IT — set up to solve specific problems quickly. In this landscape, it is difficult for IT to respond quickly or adequately to business and market demands and to facilitate digital solutions that are suddenly in favor in the executive suite.

Industrial manufacturers must begin the process of overhauling their IT systems, creating a completely new architecture that can serve as the backbone for internal and external technology initiatives. In this new approach, it is imperative that IT systems communicate throughout the organization with standardized protocols that can manage data from thousands of varied pieces of equipment in the field, support visibility into supply chains, and produce customized analytical reports to immediately serve business needs. In other words, company leaders must employ more global thinking to make sense of this complex environment. Otherwise, digital confusion will cancel out any digital gains.

- Create strategies for talent development and retention

In the digitization sweepstakes, industrial manufacturers often find themselves at a disadvantage when trying to attract and retain talent. For example, in the U.S. many of the best and brightest STEM (science, technology, engineering, and math) students would prefer to work in Silicon Valley, where innovation is on the menu for breakfast, lunch, and dinner, rather than in the stodgier old-world locales where many industrial manufacturers have their plants and headquarters.

Complaining about this bias accomplishes nothing; instead, industrial manufacturers must purposefully map out an exciting technology strategy with specific benchmarks and achievements anticipated for the next 18 to 36 months — and then communicate this story clearly to job candidates. Even companies that have not yet felt the shortage of technology-savvy staffers need to take steps to prepare for it as the number of job openings in this field will continue to outpace the number of available hires for the foreseeable future. In developing this recruitment program, don’t just advertise for someone who can read data, only to find out he or she can’t understand how a giant turbine works. Balanced capabilities are important, allowing the machine maker to use smart operational data and sensor analysis in a real-time context in order to gain insight into how the equipment is used — and ultimately to drive innovation that improves the functions and performance of the equipment. Diversity of expertise and skill sets will help to shorten the learning curve in the organization.

This article is reprinted with permission from the “2017 Industrial Manufacturing Trends,” http://www.strategyand.pwc.com/trend/2017-industrial-manufacturing-trends, published by Strategy&, PwC’s strategy consulting group. © 2017 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

In a slow-growth environment such as this, productivity gains are paramount. And that could be a boon for industrial manufacturers. Indeed, industrial manufacturers can best serve their customers (and themselves) by designing tools and equipment that improve the efficiency, costs, and performance of factories and other capital projects. Whether enhancing their or their customers’ plants, industrial manufacturers have an opportunity to profit from innovation strategies that build upon advanced manufacturing concepts and the potential of the industrial Internet.

In a slow-growth environment such as this, productivity gains are paramount. And that could be a boon for industrial manufacturers. Indeed, industrial manufacturers can best serve their customers (and themselves) by designing tools and equipment that improve the efficiency, costs, and performance of factories and other capital projects. Whether enhancing their or their customers’ plants, industrial manufacturers have an opportunity to profit from innovation strategies that build upon advanced manufacturing concepts and the potential of the industrial Internet. In order to do this, industrial manufacturers must become more aggressive and deliberate in their investments. They should focus on developing technology platforms and new operating models that enable connected products and services and integrate their customers’ operations. For customers, the desire for efficiency and quality improvements are a given, but companies increasingly want visibility deep into their supply chains: They want connectivity tools that provide insight into production levels, inventory and capacity availability, quality levels, and order status from all their suppliers. Capital asset developers are seeking similar capabilities in dealing with the engineering and construction firms that build their projects.

In order to do this, industrial manufacturers must become more aggressive and deliberate in their investments. They should focus on developing technology platforms and new operating models that enable connected products and services and integrate their customers’ operations. For customers, the desire for efficiency and quality improvements are a given, but companies increasingly want visibility deep into their supply chains: They want connectivity tools that provide insight into production levels, inventory and capacity availability, quality levels, and order status from all their suppliers. Capital asset developers are seeking similar capabilities in dealing with the engineering and construction firms that build their projects. There is a remarkable opportunity here. Yet the industrial manufacturing sector remains risk averse, unwilling to spend on new machinery, software, and talent during a period of protracted slow growth and limited proven solutions. In a recent PwC survey, only 30 percent of U.S.-based industrial manufacturing senior executives said that their companies were planning to increase spending on information technology in the subsequent 12 months. The remaining companies are likely to fall behind.

There is a remarkable opportunity here. Yet the industrial manufacturing sector remains risk averse, unwilling to spend on new machinery, software, and talent during a period of protracted slow growth and limited proven solutions. In a recent PwC survey, only 30 percent of U.S.-based industrial manufacturing senior executives said that their companies were planning to increase spending on information technology in the subsequent 12 months. The remaining companies are likely to fall behind.