Industrial manufacturers are increasingly managing energy use to cut costs, meet ESG goals, and boost resilience from outage.

By Paul Wellener

Until recently, industrial companies may have considered energy management strategies not worth the time or capital required. But that appears to be changing. Reducing costs, meeting environmental, social and governance (ESG) targets and addressing the risk of power outages increasingly take center stage for manufacturing leaders and their key stakeholders. Fortunately, new developments in energy management are beginning to make projects that advance these aims more accessible and financially attractive.

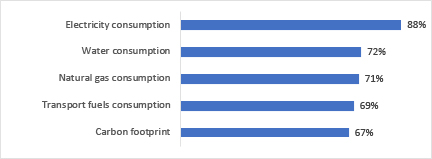

Half of the industrial companies surveyed in the Deloitte 2020 Resources Study said energy management is a key element of their corporate strategy. And more than half (60%) reported having a documented energy vision or mission. In addition, 76% said their companies have formal energy and resource management goals, ranging from reducing electricity consumption to shrinking carbon footprints (figure 1).

Figure 1 – Industrial respondents have set goals across five resource areas

The biggest motivator among those surveyed is cutting costs (48%). But achieving (ESG) goals and being able to meet future regulatory requirements were also highly rated. And when it comes to their electricity supply, resilience ranks high. Forty-six percent of respondents in Deloitte’s 2021 Industrial Grid Interaction survey identified power outages as their biggest concern related to electricity.

Distributed energy resources (DER) are increasingly finding their way into industrial environments and can be key to helping industrials cut costs and carbon emissions while boosting resilience. They range from the combined heat and power systems that many industrials have operated for decades to more recent installations of onsite solar or wind power, battery storage, energy mamagement systems, microgrids, and electric vehicle (EV) chargers.

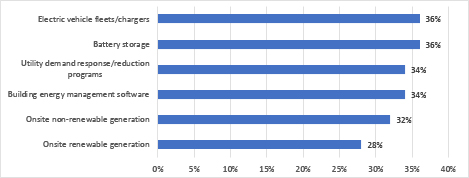

In fact, one of the most common energy management initiatives among industrial respondents is electrifying fleets and installing EV chargers (36%), which can reduce costs and carbon footprints (figure 2). The same percentage (36%) has installed battery storage, frequently used to time-shift electricity demand and reduce utility demand charges.

Industry 4.0 is expanding opportunities for industrial companies to manage energy use and interact with the electric grid. About a third of industrial respondents are using energy management software, which connects, monitors, and manages energy consuming systems such as HVAC and lighting and can optimize usage to reduce bills. The systems can also communicate with utilities to time energy purchases during cheaper, off-peak hours. And they can create new revenue streams by enabling easier participation in utility programs such as demand response and EV managed charging.

To enhance resilience and bolster self-sufficiency, some industrials are installing onsite generation and pairing it with energy storage. If they choose renewable generation such as wind and solar, they can reduce their carbon footprints too. And there may be revenue opportunities in selling excess output back to the utility in states and utilities with net metering policies. Revenue opportunities may expand further in the wake of a September 2020 federal ruling requiring large power markets to enable small DER to aggregate and participate.

Figure 2 – Energy solutions that industrial respondents have implemented/are implementing

In the past, many industrials hesitated to pursue energy management projects, often due to lack of energy expertise. It can be challenging to take that first step – getting a solid picture of the company’s current electricity consumption. That may be why 70% of industrial respondents count their utility as a key ally in the journey. Some are also tapping into an expanding ecosystem of service providers that includes technology platform providers, equipment suppliers, renewable energy developers, traders, and others who can help them orchestrate holistic energy solutions.

Another big roadblock has been a lack of capital. Half of industrial respondents said a 2-3-year breakeven or payback period is the most important financial condition that would drive them to install resources such as onsite generation and storage at their facilities.

While payback periods for many energy management investments are falling, new solutions can make them even more accessible. Energy-as-a-service is a turnkey delivery model that may combine installation, ownership, and operations and maintenance of onsite renewables, storage, microgrids, and other energy resources. These services may also be packaged with financing, carbon credit trading, and participation in utility or market programs to optimize returns. All for one monthly subscription price that could be significantly lower than the company’s monthly electricity costs. When it comes to energy management, it may be time for industrials to take a second look.

About Paul Wellener

Paul Wellener is a vice chairman, Deloitte LLP, and the leader of the US Industrial Products & Construction practice with Deloitte Consulting LLP. He has more than three decades of experience in the industrial products and automotive sectors and has focused on helping organizations address major transformations. Paul drives key sector industry initiatives to help companies adapt to an environment of rapid change and uncertainty—globalization, exponential technologies, the skills gap, and the evolution of Industry 4.0. Based in Cleveland, Paul also serves as the managing principal of Northeast Ohio.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.