Single platform solutions are just one example of how innovation is finally modernizing the B2B payments sector.

By Gavin Cicchinelli

Despite disruption in virtually every aspect of the economy, the growth forecast for the global payments market looks encouraging. A report from ResearchAndMarkets.com states the sector is expected to grow from $518 billion in 2021 to $735 billion in 2025 – but it’s important to note what is driving this growth and where it is focused.

Much of the market’s growth thus far has been driven by innovation and consolidation in the consumer pay sector. It’s fascinating to see how this market is maturing and how new capabilities are unfolding as behemoths like Square and Afterpay combine forces and new players emerge.

The picture is a bit different on the B2B payments front, however. While there are massive waves of innovation regarding how consumers pay businesses, the same can’t be said for how payments are processed across the supply chain. This process is still complicated and costly for buyers to pay their suppliers. Studies suggest the average cost to process a single invoice can be up to USD$15.

At a time when consumers can pay for a cup of coffee with a swipe of their mobile device, B2B payments across many supply chains remain surprisingly analog. There are a number of reasons for this. Most supply chains are global, meaning buyers are paying suppliers across multiple jurisdictions and currencies. Supplier payment regulations vary as do payment terms and methods.

Then there’s the technical complexity. In many cases, the accounting department uses multiple payment platforms. Every time a supplier’s information changes, it must be updated across multiple systems. Not only is this tedious and manual, but it also creates vulnerability to errors that an already overtaxed accounts payable team later has to fix.

The resource burden extends beyond the payor. The lack of streamlining in B2B payments makes it hard for companies to pay their suppliers on time. Consequently, late payments and a lack of visibility into payment status make it difficult for suppliers to forecast cash flow. That has massive negative implications for suppliers – particularly smaller businesses – who are trying to invest in ways to make their businesses more agile.

It’s time to end the stagnation in B2B payments and invest in transformative innovation. This requires tech-enabling B2B payments to reduce the hassle and resource burden currently required to pay suppliers. We’ve recently started to see advancements in this area, specifically the emergence of new B2B payment solutions that consolidate all supplier payments onto a single platform. From a single solution, a buyer can pay all suppliers – regardless of size or geography – and facilitate both on-time payments and early payment programs with ease and simplicity.

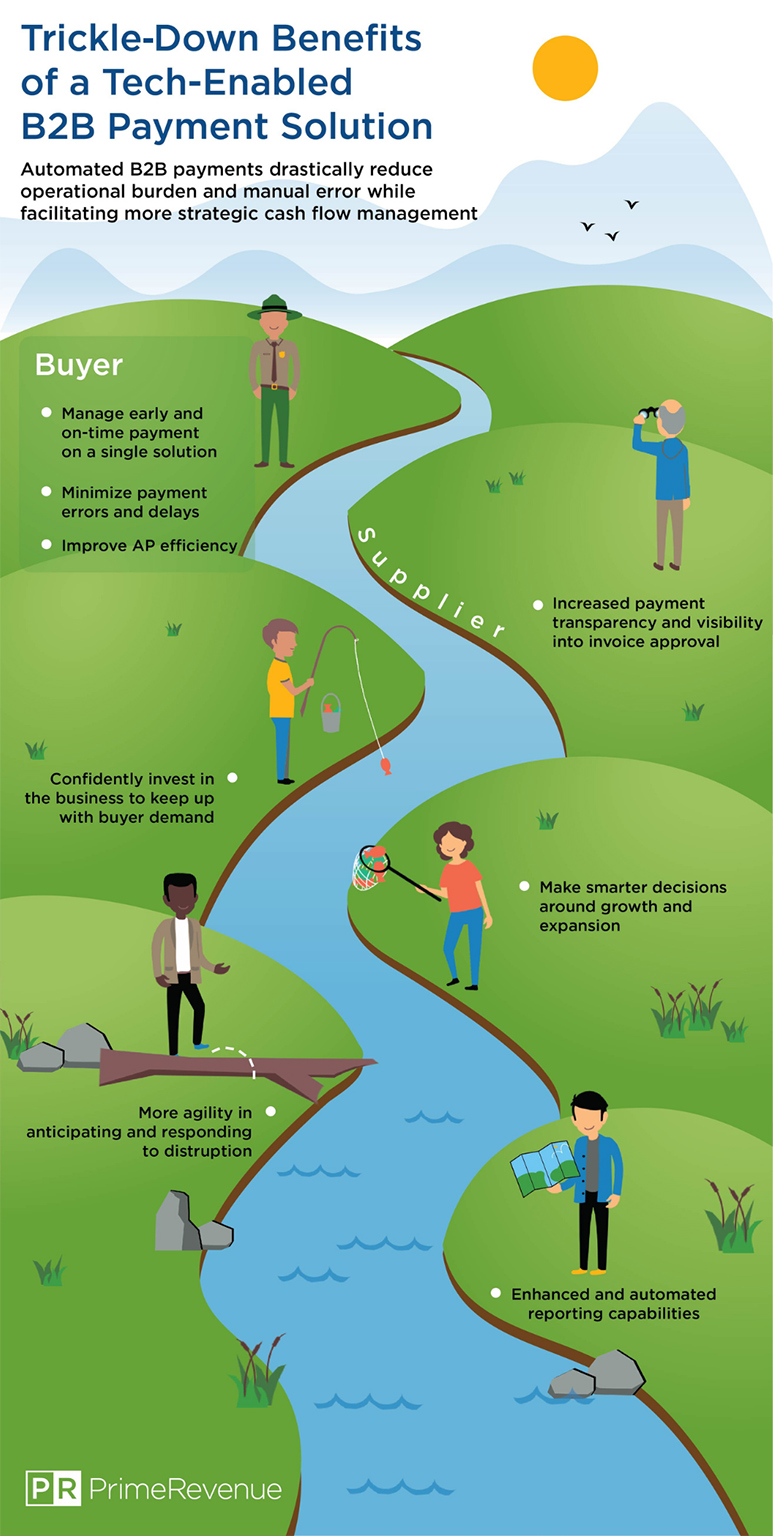

Both buyers and suppliers can benefit from a single platform that automates B2B payments. Suppliers can experience improved payment visibility and certainty, which will result in more predictable cash flow. Buyers, on the other hand, can pay suppliers on time with minimal involvement. They simply need to approve invoices and the platform’s automation capabilities takes care of the rest. Errors, delays, and the back-and-forth required to track payment status are no longer a concern.

Single platform solutions are just one example of how innovation is finally modernizing the B2B payments sector. Momentum is gaining as buyers and suppliers demand new ways to improve cash flow forecasting and payment visibility – and automated solutions are driving that forward.

Contact Information:

Gavin Cicchinelli, Chief Operating Officer of PrimeRevenue

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.