After a slow 2023, the insurance M&A market is poised to rev up this year as more buyers come off the sidelines.

By Barry Chen, Principal, and Mark Purowitz, Principal, Deloitte Consulting, LLP

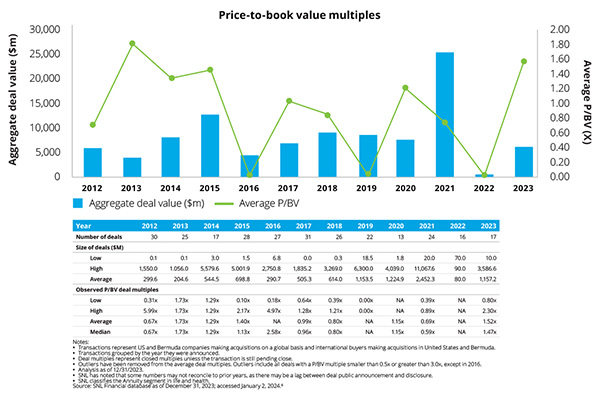

In the world of insurance mergers and acquisitions, 2023 was a sleepy year. Although many insurers and investors used the time to rebalance their portfolios, fewer transactions took place, likely due to banking woes and rising interest rates.

By the end of the year, however, inflation had moderated and the economic outlook had brightened. As interest rates settled and sellers made peace with the passing of pandemic-era valuations, some of the variability around valuations seemed poised to stabilize, encouraging what was an uptick in transaction interest.

Against that backdrop, what trends and developments should dealmakers keep an eye on in 2024? Let’s break it down.

A slowdown in premium sales, paired with a premium outflow issue, means insurers should think about how they reposition themselves. Some may go on the offensive to acquire some scale. On the flip side, more insurers may shed life and annuity products in favor of selling through investment management and wealth management.

Those looking for economic cash flows or additional exposure may be able to acquire blocks of business for a relative bargain. Last year, new accounting rules known as long-duration targeted improvements, or LDTI, took effect for public companies. Now that the rules’ impact is better known, more public insurance companies may turn to divestiture as a strategy for mitigating its impact.

In addition, some life and annuity companies have been offering pension buyouts or pension risk transfers, which entails taking over the management of longevity risk associated with other companies’ defined benefit pension plans. The resulting asset mix may make these insurers more attractive for acquisition.

Either way, investors will likely be looking for organizations to get back to a narrative of growth. Private equity investors are likely to drive further M&A activity as they acquire life and annuity insurers in a bid to grow books of business and, in some cases, take balanced risks to extract a greater degree of return from underlying assets.

Property catastrophe rates have been going up, which may prompt some companies to look for scale in the reinsurance market. But others may decide to reap the rewards of the high-rate interest environment for another 12 months. There’s also the chance that some will exit the market altogether.

In any case, if climate-related perils—think extreme weather, flooding, and wildfires—become more severe and frequent, those who stay in the P&C game may face additional capital requirements from regulators to maintain a sufficient buffer. This, in turn, may lead to more consolidation as insurers strengthen their balance sheet and decide where to do business in the future.

As the broader market pulls away from certain risk classes, expect some carriers to expand their footprint with creative, flexible solutions tailored to specific risk profiles. This may draw interest from private equity investors looking for opportunities that are capital light and bring less risk than traditional lines.

Although pricing pressures may continue, expect the market to stay competitive as private equity goes head-to-head with corporate buyers looking to grow through M&A in the middle market.

Undeterred by higher premiums, many private equity investors will likely continue to pursue a strategy of aggregating smaller brokerages. Meanwhile, large brokerage houses will likely continue to see where they can consolidate and expand their footprint in the middle market.

However, new regulations may change the M&A calculation. On October 31, 2023, the Department of Labor proposed new standards for fiduciary advice around certain retirement products. The proposal aims to improve the quality and fairness of the investment recommendations that professional advisers provide. If the proposed regulations are adopted this year, it may encourage life insurance companies to revisit the value of an independent sales force that can give advice across a range of products.

By the end of 2023, the insurance M&A market was approaching a two-year slowdown. However, if optimists are right about the direction of the US economy, the market may rev up in 2024 as more buyers come off the sidelines.

Once it does, consider approaching M&A as a way to broaden the insurance industry’s historical focus from risk and cost reduction to ongoing innovation, competitive differentiation, and profitability. A clear, concise playbook can help organizations execute quickly on those goals, reap the rewards, and move on to the next phase of growth.

Barry Chen is a Principal in the Mergers and Acquisitions practice and leads our US Insurance M&A offering. He partners closely with Insurance executives across the M&A lifecycle to plan M&A integration / carve-out strategies, front load go-to-market value capture, design organizations and workforce strategies, and leverage transformative technology solutions to accelerate value realization of the deal.

Barry has led various Insurance M&A deals across the lifecycle including due diligence, post merger integration, and divestitures. Barry has led a diverse set of strategic client projects including large technology / cost transformation initiatives post deal close.

Some examples include:

Barry holds a Bachelor of Science (BS) from University of California Los Angeles and a Master in Business Administration (MBA) from the University of Southern California.

Mark Purowitz is a Senior Partner in the Mergers & Acquisitions practice of Deloitte where he globally co-leads the Insurance Mergers & Acquisitions team, globally co-leads Deloitte’s efforts in defining the Future of M&A, as well as Deloitte’s internal incubator called Startup Deloitte.

He has over 35 years of broad experience in the United States and internationally across the disciplines of mergers & acquisitions, new venture development, and overall strategic growth.

Mark has participated in over 500 transactions x-sector globally spanning M&A strategy, diligence, integration, divestiture and restructuring as well as helping to set up multiple Corporate Venture Capital arms for clients.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.