Our industry is operating in an increasingly uncertain environment, faced with many emerging risks.

by Allen Kwan, Head of Customer and Distribution Management, North America, Swiss Re Corporate Solutions

Climate change continues to be one of the most pervasive threats facing our planet. Today, annual global insured losses of more than USD 100 billion from natural catastrophes are standard, resulting from a combination of worsening Nat Cats, rapid urbanization and the accumulation of economic wealth in disaster-prone areas.

COVID-19 undoubtedly taught us how such disruptions can ripple through supply chains – something that remains apparent as our businesses become ever more interconnected.

At the same time, we continue to face a prevailing economic storm underpinned by high inflation. Raising the nominal value of buildings and other fixed assets, claims to cover the cost of repairs have continued to rise. And while inflation in major economies is moderating, we expect it to persist through 2024.

Despite these challenges, many companies still lack the risk detection infrastructure and analytical tools that are becoming increasingly necessary to gather and analyze growing volumes of risk data on interconnected risks, leaving them ill-prepared.

Risk data is dispersed. It’s sometimes contradictory. And it is proliferating at a scorching pace. Still, it is a challenge we must get a handle on if we are to succeed in seeing the full complexity of the dynamic risk landscape in front of us, and thus make informed decisions on the path forward to mitigate threats.

At Swiss Re Corporate Solutions, we see that our customers align with that vision. They want to look at risk strategically and holistically. However, they face difficulties in doing so at present.

Speaking with CEOs, CFOs, board members and risk professionals, three common challenges were highlighted:

In response, we set out with the goal of empowering corporates to take back control of their risk and achieve greater resilience through enabling technology.

Working closely with clients, we’ve gained an understanding of their risk and resilience needs – and how climate change, property risks and supply chain disruptions can impact their businesses.

Sustainability managers highlighted how they would benefit from analytical models to assess climate-related risks; supply chain managers could use clearer oversight of hidden risks to anticipate supply chain disruptions; while risk managers require better data, insights and communication to protect the business – it’s production, assets, employees and, of course, reputation.

Working to address these needs, we have launched a new platform: Swiss Re Risk Data & Services (RDS).

RDS helps companies build a digital twin of their assets to get an accurate overview of their exposure. With this virtual representation of their business, clients can create simulations based on real-world scenarios and access risk insights.

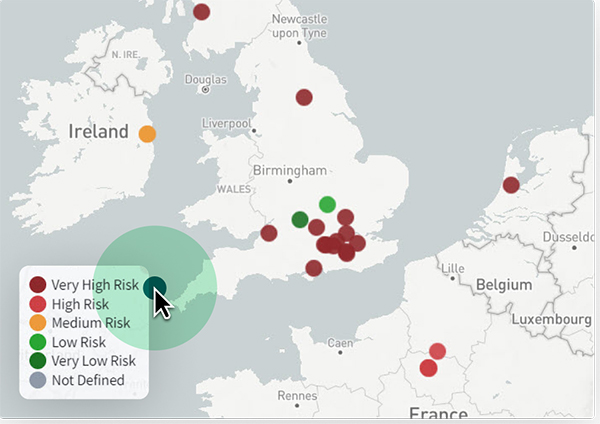

RDS also provides access to Swiss Re Corporate Solutions’ select models so that they can view their exposure in context and make better decisions on risk. For example, clients can use the CatNet® and Nat Cat Modelling Engine (NCME) to understand the risk profile of their overall property portfolio and different sub-portfolios. They can look at individual loss drivers to identify hotspots and how that relates to insurance placement.

Tools such as these demonstrate how digitalization can be a great lever for insurance to reduce the protection gap, opening up a whole new spectrum for insurers to collectively cover risk, including those that were previously ‘uninsurable’.

Modelling risk with more granular data and analytics provides exceptional risk information, allowing the insurer to rate a risk based on individual exposure and propose tailored solutions. It can also help businesses and individuals to overcome obstacles such as affordability, ease of access, attractiveness of the product and transaction costs.

We see RDS as a vital step in the right direction. It embodies our philosophy that whatever technology we produce for ourselves, we make it available to all. In this way, we can all advance corporate insurance together.

Allen Kwan is Head of Customer & Distribution Management North America at Swiss Re Corporate Solutions, appointed to the role in January 2023. He is responsible for customer and distribution engagement & strategy.

Allen brings 15+ years of insurance experience to this role. Since joining Swiss Re Corporate Solutions in 2012, he has held various positions within underwriting and sales. Most recently, Allen was the Head Sales Customer & Distribution Management for the West Region. Before joining Swiss Re, he was an underwriter for global highly protected risk property.

Allen holds a bachelor’s degree from California State University, East Bay and received his MBA with honors from Saint Mary’s College of California. He currently serves on the boards for Golden Gate RIMS, California Association of Insurance Professionals and the Pacific Northwest Chapter of the Insurance Industry Charitable Foundation.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.