Wipfli’s manufacturing study highlights challenges and opportunities amid pressures from tariffs, workforce issues and operational costs.

By Cara Walton

Volatility and uncertainty mark the current manufacturing landscape as the industry faces a critical turning point. Wipfli’s Q1 2025 manufacturing pulse study reveals valuable insights into the sector’s challenges and opportunities amid pressures from tariffs, workforce issues and escalating operational costs.

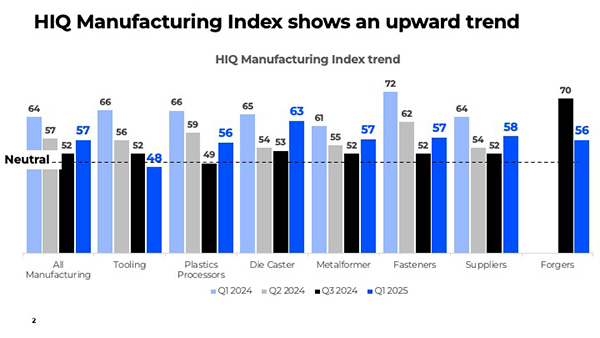

Industry sentiment shows modest lift, with 55% of respondents projecting higher profits in 2025 compared to last year and an average anticipated revenue growth of 2.7%. This early-year optimism typically characterizes the sector, though such positive outlooks often diminish as the year progresses. Nevertheless, it’s encouraging that manufacturers maintain hopeful projections despite rising material and labor expenses.

It’s worth noting that this survey was conducted early in the quarter, before the implementation of the Trump administration’s new tariff plan. While tariffs clearly concerned manufacturers across all sectors, their full impact remains to be seen, with Q2 results likely to provide more insight into these policy effects.

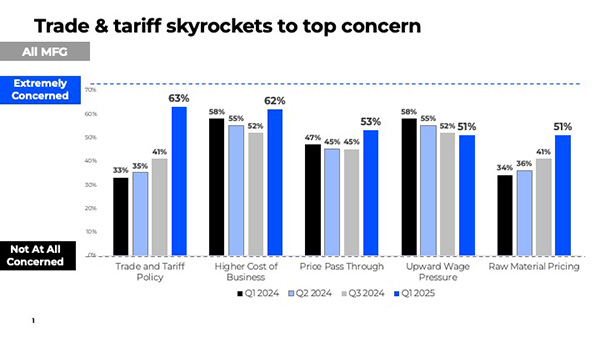

Tariff concerns have resurfaced as the dominant issue for manufacturers across multiple sectors, reaching prominence levels not seen since 2018.

The anxiety surrounding tariffs extends throughout the manufacturing ecosystem:

Manufacturers anticipate growing negative sentiment related to tariffs as 2025 progresses. The unpredictability of trade policies and their effects on pricing strategies and profitability will likely increase, requiring proactive planning from industry leaders.

The study highlights a persistent forecasting gap, with manufacturers routinely missing their revenue and production targets.

Companies report a consistent 3 to 5 percentage point discrepancy between projected and actual performance. This gap underscores the need for more sophisticated forecasting approaches incorporating both internal metrics and external data.

In today’s data-driven environment, manufacturers must prioritize developing robust forecasting systems. A data-centric approach helps companies better align production capabilities with market demand, reducing risks associated with inaccurate projections.

The manufacturing sector continues to face significant workforce obstacles, particularly regarding skilled labor access and wage pressures.

Despite growing demand for manufacturing services, companies struggle to secure qualified workers. The labor market remains constricted, with unemployment at historic lows, complicating manufacturers’ efforts to fill crucial positions. Key challenges include:

As manufacturers work to maintain their workforce, wage inflation has become a significant concern. Companies must offer competitive compensation packages to retain employees, potentially compressing profit margins.

Manufacturers need innovative retention strategies, including enhanced training programs, career advancement opportunities and workplace culture improvements, to maintain their talent base.

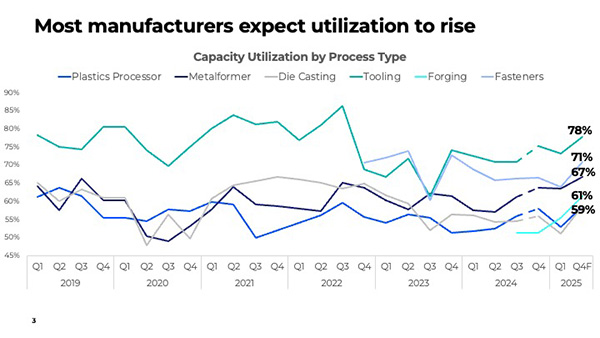

Manufacturers face converging cost pressures from inflation, material price increases and higher interest rates. These rising expenses significantly challenge profitability, as many companies struggle to pass costs to customers, resulting in compressed margins.

Raw material price volatility particularly affects production costs and pricing strategies. Potential interest rate increases further complicate matters by raising borrowing costs and impacting capital investments.

With operational expenses continuing to rise, manufacturers must adopt strategies to protect profitability, including reassessing pricing models, optimizing supply chains and implementing cost-reduction initiatives.

Navigating these challenges requires strategic planning. With tariffs, workforce issues and rising costs creating simultaneous pressures, manufacturers must focus on controllable factors.

This survey preceded the implementation of the Trump administration’s tariff policies. Given subsequent market uncertainty, the Q2 survey will likely show significant shifts in sentiment.

As 2025’s second quarter unfolds, manufacturers can expect heightened concerns regarding tariffs and profitability. The environment will likely remain challenging, with continued uncertainty surrounding trade policies and their manufacturing sector implications.

Companies may continue struggling to meet profit projections, necessitating focused cost management and operational efficiency efforts.

By embracing proactive strategies and leveraging data insights, companies can enhance resilience and succeed despite market uncertainty. The path forward requires commitment to adaptability, collaboration and continuous improvement, helping ensure manufacturers remain well-positioned to meet future challenges.

About the Author:

Cara Walton leads Wipfli’s manufacturing benchmarking intelligence tool, overseeing its strategic growth, data acquisition and intelligence gathering. Under her leadership, the tool has analyzed millions of data points from thousands of manufacturers, become the top resource for manufacturing benchmarking with 7+ years of trended data and launched a division for custom market studies across durable goods industries.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.