5 ways paying with credit cards can help businesses grow.

With rising costs and tough competition, businesses need to make the most of every dollar. For many, moving from check, ACH, debit card, or wire transfer to credit card payments has been an important step. Using credit cards to pay for expenses can have a big impact on finances. It can also unlock additional benefits. Here are just five reasons businesses are modernizing how they make payments.

Credit cards don’t just offer a convenient way to pay for everything from equipment to utilities. They also deliver rewards. Rewards can be redeemed in many ways. Businesses can choose deposits to their checking account or account credits. Then they can use that money to buy what they need most, such as supplies. Some companies are even using the extra cash to hire new employees – or are able to afford benefits that keep their existing employees.

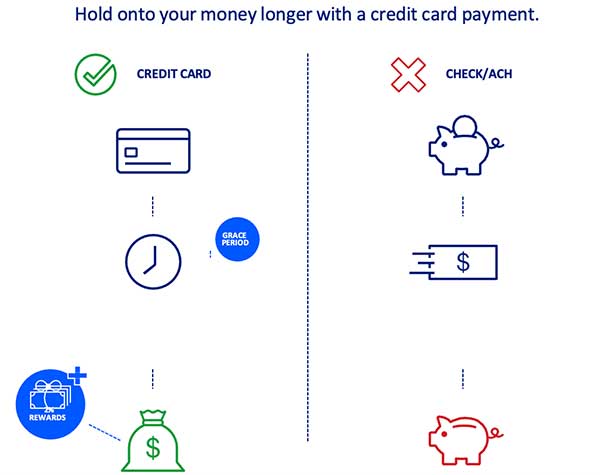

Unlike checks, credit cards let businesses pay right on time. And unlike ACH payments, they provide a grace period. That means businesses don’t actually need to pay their credit card bill for several weeks. So using credit cards increases purchasing power: the ability to buy needed goods and services. In today’s economic climate, ready access to cash is particularly important for managing expenses, staying competitive and preparing for what’s ahead.

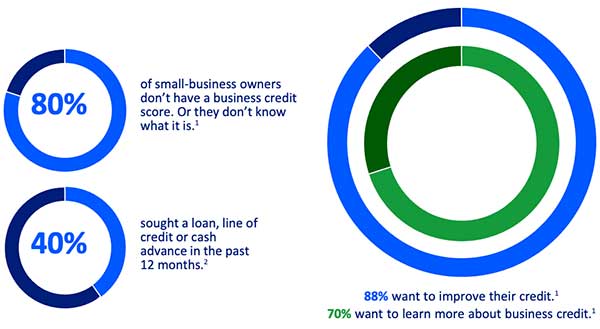

No matter how successful a business may be, at some point it will likely need a loan or line of credit. Using a business credit card regularly can build business credit. This is essential for getting a loan. Creating a strong relationship with a banker is also important for a growing business. A banker can give tips on how to better manage money and help secure lending when it’s needed.

Using credit cards can help protect practices from fraud. That’s because they don’t have to give out their checking account number. Card payments also make everyday tasks simpler. Built-in expense reporting and receipt capture makes submitting expense reports easy for employees. It also saves time for the accounting team. They can quickly issue cards, set card controls, and review customizable reports that track and organize expenses.

Many vendors actually prefer credit card payments because they save time. Businesses thinking about making the switch might just be surprised at how many companies accept them. Some credit card partners, such as the Business Card Consultants at U.S. Bank, even offer to help. They’ll check the vendor list and report back on which vendors accept card payments.

What if a vendor doesn’t accept credit cards? Companies such as Plastiq may be an option. Plastiq will take credit card payments from a purchaser and then deliver them in the method a vendor wants: ACH, wire or check. While there is a fee, the credit card rewards and ease may be worth it.

To stay strong, businesses need to pay attention to their processes and find ways to save and earn money. Credit card payments can cut time-consuming tasks. They can free up money for days or even weeks. And at the same time, they can offer big rewards. To explore how credit card payments could help build your business, schedule a complimentary consultation at usbank.com/bankerconnect.

This article is sponsored by U.S. Bancorp.

U.S. Bancorp, with approximately 77,000 employees and $675 billion in assets as of Dec. 31, 2022, is the parent company of U.S. Bank National Association. The Minneapolis-based company serves millions of customers locally, nationally and globally through a diversified mix of businesses: Consumer and Business Banking; Payment Services; Corporate and Commercial Banking; and Wealth Management and Investment Services. The company has been recognized for its approach to digital innovation, social responsibility, and customer service, including being named one of the 2022 World’s Most Ethical Companies and Fortune’s most admired superregional bank. Union bank, consisting primarily of retail banking branches on the West Coast, joined U.S. Bancorp in 2022.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.