This financial management methodology is transforming the way people run profitable businesses by taking your profits before your expenses.

By: Emily Glass, CEO of Syncro

I sat down with Lori Hardtke, CEO of MSP, ByteWize, to talk about how she’s implemented and benefited from Profit First Methodology in her business. Profit First is a book by Mike Michalowicz that outlines a financial management methodology for businesses. Here’s are key takeaways:

Profit First advocates the principle of “take your profit first” by switching the traditional accounting formula to “sales minus profits equals expenses.” Simply put it’s a way to pay yourself first and work with what’s left. Oftentimes when you do it the other way around there is nothing left to pay yourself.

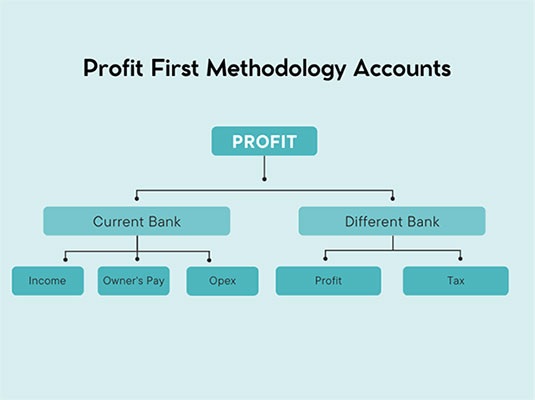

You can do this by having five accounts. Three of these accounts can be with your current bank. Label these accounts: Income, Owner’s Pay, and Opex (operating expense). The other two at a different bank should be called Profit and Tax. From here, determine a target allocation percentage (TAPS) and a current allocation percentages (CAPS).

The TAPS are what we’re striving for over a period of time while the CAPS are what you’re going to start with. Lori recommends starting small in order to get into a habit of taking profits first. Your goal over the next 12-18 months is to increase a couple percentages until you can get to your target allocation percentages. When you do this, your operating expense may be 50-60% higher than you want it to be because you are just starting out, and that’s okay.

Choose two dates a month to transfer your funds from the income accounts to these other accounts based on your percentages. Every quarter, take 50% of the money from the Profit account and distribute it to you, the owner, or with other employees.

Pay off your debt first if you have any. In this case, the book recommends celebrating your accomplishments even if it’s taking $10 for yourself. It’s rewarding to see growth over time.

When Lori started, her Opex was close to 67% and her owner’s pay was 16% and she could only put 1% to my Tax and Profit account. Now her Opex is down to 37%, owner’s is up to 27%, Profit is 10%, and Taxes 15%. The Profit Methodology is a night and day difference for her and her business.

The Profit First system works for improving existing businesses, like Lori’s, but it also works for brand new companies. You just want to prioritize your profits, allocate funds based on those percentages, and maintain that financial discipline.

Startups especially benefit because it creates the proper rhythm and sets good habits from the get-go. Larger businesses can be complex because they have multiple accounts for different departments or divisions, but the underlying principles are always the same.

Five accounts across two banks, multiple transactions and transfers a month sounds like a lot. Many think that it can create problems in terms of bank fees or complexity for bookkeepers.

Lori found it was actually less work. The first three months getting your bank accounts set up can be a little time consuming, but like in your Tax account, there’s just money going into it two times a month and then money’s coming out of it once a quarter. So to reconcile those bank statements doesn’t take a huge investment in time.

Another misconception is that there aren’t many banks that can work well with the Profit First Methodology due to minimum balance standards. While it may take a little bit more time to find a bank with minimal fees that works for you, it isn’t impossible.

Profit First is a game-changer for financial management. Through its simple yet transformative approach of prioritizing profits before expenses, it empowers business owners to cultivate financial stability and growth. As Lori’s success story exemplifies, adopting Profit First can lead to remarkable transformations in businesses of any size or industry.

Emily Glass is president and CEO of Syncro, an all-in-one RMM, PSA, and remote access tool that helps managed service providers run more profitable businesses.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.