In a polycrisis era, resilience isn’t optional. Build autonomous supply chains that sense, adapt, and turn chaos into competitive edge.

By Kris Timmermans, Global Supply Chain and Operations Lead at Accenture and

Max Blanchet, Global Supply Chain & Operations Strategy Lead at Accenture

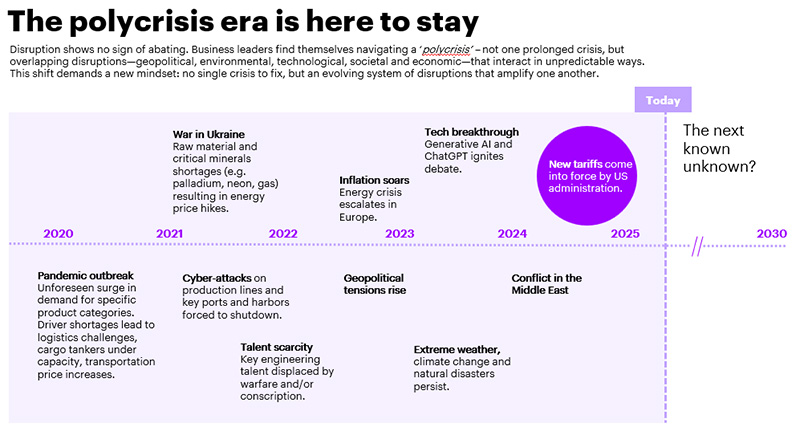

Supply chains are stuck in a “polycrisis”. Since 2020, organizations have been navigating an evolving system of overlapping disruptions that amplify one another: the pandemic, geopolitical tensions, climate disasters, cyber threats, and now, a resurgence of tariffs. And companies keep scrambling to adapt their supply chain networks, never knowing what will hit them next.

Adaptability is necessary but also inherently reactive. In contrast, the polycrisis calls for resilience by design, powered by data, and structured for autonomous response that is proactive and predictive. It’s about building the capacity to sense, respond, and adapt faster than the competition, and doing so in ways that directly protect and grow enterprise value.

Yet today, many companies remain stuck in reactive mode. On average, supply chains are only 21% autonomous, with most tactical adjustments (e.g., sourcing shifts, logistics reroutes) still handled manually.

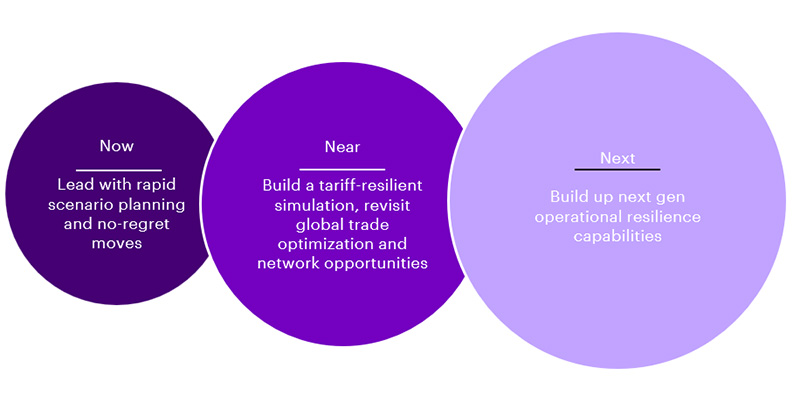

It may seem counterintuitive to build long-term capability during a crisis, but now is the time to hardwire resilience into the system. Because this won’t be the last disruption, and those who act now will be better equipped to turn adversity into a lasting advantage.

Companies that embed resilience into their operating model recover faster, maintain customer trust, and protect margins. These outcomes directly support enterprise value by reducing risk exposure and sustaining performance through disruption.

Forward-looking leaders understand that supply chain disruptions like the tariff policy shifts are more than just short-term threats. They are inflection points that are prompting a re-evaluation of sourcing strategies, regionalization, and ecosystem partnerships. Operations leaders, including COOs, CSCOs, and CPOs, are now confronting challenges across many fronts: managing margin pressure, adapting to volatile production volumes, improving forecast accuracy, simplifying complexity, accelerating speed-to-market, addressing skilled labor shortages, building trust in data, planning for risk, re-evaluating regional considerations and strengthening supplier continuity.

All of these converge on optimizing net working capital and safeguarding enterprise value. Resilience is increasingly seen not just as a risk buffer but as a value creation lever, impacting shareholder returns, customer retention, and market share.

Enterprise and financial resilience aren’t rooted in a single area, it stems from a broad set of cross-functional capabilities that enable organizations to absorb disruption, recover quickly, and adapt to change. It spans four key dimensions: Operational, Commercial, People, and Technology resilience. Among these, operational resilience is often the first to be tested and demands the most immediate attention when disruptions occur. It must be built in stages: starting with rapid response, evolving into structural change, and culminating in autonomous operations.

Building resilience pays off. Accenture’s new global study reveals that a fully autonomous, AI-driven supply chain, where intelligent agents manage operations end-to-end, can respond to disruption in just four days and fully recover within 11. In contrast, traditional supply chains may take anywhere from one to five months to stabilize. Companies with autonomous, AI-enabled supply chains are already seeing the difference: they respond 62% faster and recover 60% quicker than their peers.

Reaching this level of resilience won’t happen overnight. Most organizations will progress in stages, advancing steadily toward a future where speed, agility, and performance are woven into the fabric of day-to-day operations. The benefits are both operational and financial. Executives anticipate a 27% reduction in order lead times and a 25% boost in labor productivity. Most notably, they expect disruption recovery times to shrink by nearly 60%, a game-changing advantage in today’s volatile environment. Financially, these improvements translate into a projected 5% increase in EBIT and a 7% uplift in return on capital employed (ROCE) as autonomous capabilities mature.

In an era defined by constant disruption, mere adaptability isn’t enough. True competitive advantage lies in becoming resilient, able not only to absorb shocks, but to emerge stronger from them. Companies that start building autonomous resilience today won’t just survive the next crisis, they’ll lead through it.

About the Authors:

Kris Timmermans is the Global Lead of Accenture’s Supply Chain & Operations practice. With over 30 years of experience, he has led large-scale transformations across industries including consumer goods, automotive, chemicals, pharmaceuticals, industrial equipment, and life sciences. Kris is driving a bold agenda to help clients build intelligent, autonomous, and sustainable supply chains that deliver impact for business, society, and the planet. He holds a master’s degree in mechanical and electronics engineering from KU Leuven, Belgium, with research completed at the Massachusetts Institute of Technology.

Max Blanchet leads Accenture’s global Supply Chain & Operations Strategy practice. With three decades of consulting experience, he has guided some of the world’s largest industrial groups through complex transformations. He is a recognized voice on industrial strategy and manufacturing innovation, particularly on Industry 4.0 and supply chain reinvention.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.