Business environment volatility and standardization in automation drive American manufacturers home.

By: John D’Silva

Reshoring manufacturing to the US has gained increased attention post-COVID, as companies seek to secure their supply chains, reduce logistics and transportation costs, and take advantage of industrial energy cost advantages in the US. Automation technology has also played a significant role in this trend, making it possible for US manufacturers to remain competitive in terms of cost, quality, and speed.

There are several considerations at play. First, the competitive advantage of industrial energy cost in the United States is not a secret, but it rarely grabs headlines. It is a well-known fact that the US is home to abundant natural gas supplies, leading to lower energy costs compared to many other countries. Energy inputs are a significant cost component for many manufacturers. Low industrial energy cost has made it possible for US manufacturers to produce goods competitively in the global market for decades. The US trend of industrial investment in renewable energy is helping to drive down the cost of energy even further for many plants.

Another driver of the reshoring movement is the need for manufacturers to secure supply chains. The COVID-19 pandemic highlighted the vulnerabilities of relying on overseas suppliers and exposed the risks associated with depending on just-in-time (JIT) delivery systems. JIT is very effective at one thing, maximizing short-term profits. However, over the long term, a JIT supply chain for manufacturing has a substantial risk of financial losses when there are unexpected changes to the business environment, such as disruptions in logistics, unplanned changes to the supply chain, or unexpected shifts in demand. Companies that could not switch to alternative suppliers quickly faced significant disruptions in production, which negatively impacted their bottom line, some catastrophically.

The competitive advantages realized through the reduction in labor costs overseas are now narrowing or nonexistent, while the logistics cost of shipping overseas is rising. Coupled with the increased risk of a long single-source supply chain, many manufacturers see the obvious solution, sourcing and manufacturing directly within their target market, the United States. By bringing manufacturing back to the US, companies reduce logistics and transportation costs and improve supply chain security. As a result, many companies have begun reevaluating their supply chain strategies, are increasing redundancy, and looking to bring manufacturing back to the US to reduce these risks. To overcome the challenges of reshoring manufacturing operations manufacturers have to evaluate the best technology solutions that can enhance competitive advantage and work as seamlessly with legacy technologies as inside a greenfield plant.

Shipping goods overseas can be expensive and time-consuming, increasing the risk of supply chain disruptions. As energy costs for fossil fuels increase, so does the transportation cost component of long logistics chains, vastly increasing the cost per unit delivered to the target market and, when coupled with the enhanced risk, outweighing the advantages of outsourced manufacturing. Manufacturers that implement JIC systems or hybrid systems tiered based on risk work with multiple vendors, reduce single-source risk, and have a competitive advantage when the business environment has unexpected volatility. Reducing risk while making supply lines and distribution chains shorter reduces logistics and transportation costs, delivering immediate cost savings beyond risk mitigation. Making business choices that ensure there are multiple vendor alternatives mitigates the risks manufacturers have with only one available option to feed their supply chains in case of an unexpected event that disrupts a vendor.

Automation technology has played a crucial role in the reshoring trend. Advances in robotics and automation have made it possible for US manufacturers to remain competitive in terms of cost, quality, and speed. Automated systems can monitor production processes more closely, detect and correct issues more quickly, minimize the need for manual intervention, and increase safety. This results in a more streamlined and optimized production process, reducing the number of defects coming off the line and minimizing process waste. As a result, automation has made US manufacturing more cost-competitive, allowing manufacturers to both modernize their old lines and build highly competitive greenfield plants.

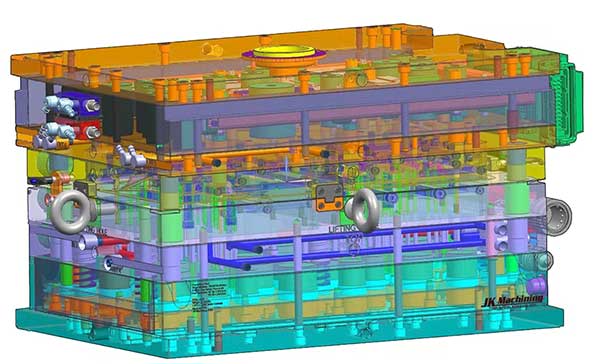

One aspect of modern automation technology that is helping companies choose to move manufacturing processes back to the US is the availability of open-architecture standardized automation platforms. Legacy systems that are only compatible with one vendor were once the standard but now have become a known liability as vendor supply chain risk is better understood and accounted for by manufacturers. There are numerous situations where a plant can experience risk if it is tied to a closed, proprietary system, creating a trend towards a standard of vendors offering open, customizable automation platforms. By implementing broad standardization in automation, open-architecture systems allow manufacturers to easily integrate legacy lines with new plant-wide systems as a plant expands – or to replace dated existing capacity with new, scalable open-architecture solutions.

Open-architecture standardized automation platforms are the basis of building a plant ecosystem compatible with many vendors. Single-source risks increase a plant’s vulnerability to the volatility of a single supply chain and can force businesses into costly upgrades to their plant’s systems. By being compatible with components and software from many vendors and sources, coupled with extensive customizability, open-architecture platforms reduce single-sourcing risks and help plants avoid forced upgrades due to changes in a vendor’s product offerings.

These modular, scalable systems are more than just widely compatible with various platforms, components, and vendors. They allow manufacturers to implement the best components for their applications instead of limiting them to choices within one vendor’s selection. In addition, as production needs evolve, plants can add capabilities such as cloud data connectivity, onboard edge computing for data analysis at the machine level, or remote access. For plants to make the most risk-averse choices, evaluating widely compatible technologies that can interface with any HMI, PLC, or cloud storage system is good for business.

Single-source risk needs to be considered by executive planning in today’s economy. Though choosing to implement technologies and platforms that offer broad compatibility is the first step, evaluating those solutions is critical. The priority focus needs to be on essential parts that are frequently replaced, then expanding outward based on prioritizing the likelihood of replacement and how crucial it is for the plant to function.

Manufacturers need robust, redundant supply chains as the business environment changes and unexpected volatility in supply chains occurs from disruptions such as war, pandemic, or environmental disasters. Standardization in automation enables manufacturers to create shorter, stronger supply chains, while working with various vendors, minimizing the risk of shutdown from a lack of spare parts or other critical inputs. In addition, the competitive advantages of automation coupled with low industrial energy costs continue to drive more manufacturers to locate production within the US market.

As the Automation Marketing, Promotions & Safety Technology Manager, Factory Automation at Siemens, John D’Silva is a professional engineer with over 28 years of industrial automation experience around the globe, including 20 years of functional safety in North America. He has been writing articles on machine safety for more than 15 years and is frequently a panelist on numerous safety discussion boards. OSHA- and TUV-certified, John also works closely with UL, NFPA, RIA, TUV, and other machine safety standards organizations to assist customers with their safety compliance and application requirements.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.