Are we in a recession? Maybe, but for logistics operations, it will probably look more like a return to pre-pandemic conditions than a crash.

The economy is in a strange state today. Some analysts insist we’re already in (or soon will be in) a recession, and they may be right. Inflation rates recently hit a 40-year high before somewhat easing, and consumer confidence is low. On the other hand, the U.S. labor market is at near full-employment status, and wages are higher, though inflation is taking a massive bite out of consumer paychecks.

The truth is no one knows for sure what will happen next, but now is a good time for logistics leaders to consider how a recession might impact operations and develop a strategy to mitigate its effects. That said, while planning ahead is smart, it’s important to understand the unique circumstances of this time and avoid reaching for outdated frameworks to determine next steps.

For everyone who lived through it, the Great Recession of 2008 was a jolt. It was the worst downturn since the Great Depression, wiping out about $19 trillion from the net worth of U.S. households and costing nearly 9 million jobs in the U.S. alone. When the housing bubble burst and the subprime mortgage crisis led to a credit collapse, the economy fell off a cliff.

U.S. employment followed suit in 2020 when 9.4 million jobs were lost in the largest drop ever recorded in a single year. But the similarities to the Great Recession end there. The pandemic caused the 2020 jobs crisis, and while the personal and economic pain were just as real, they weren’t the result of flaws in the underlying economic infrastructure as was the case in 2008.

Compared to 2008, consumer spending has remained relatively stable in the pandemic years. The cliff-like employment dive in the first quarter of 2020 was followed by a strong jobs recovery that remains ongoing. And it’s worth noting that the pandemic’s effect on jobs was uneven across industries, with sectors like hospitality and travel hit hard while other segments of the economy thrived.

The effect of the two downturns on logistics was markedly different too. Back then, the industry didn’t have the data capabilities we have today, so apples-to-apples comparisons are difficult, but freight tonnage data from that era shows that volumes fell significantly in 2008. The pandemic disrupted supply chains, especially in 2020, but logistics operations ultimately proved resilient.

Production may be slowing, but it’s still relatively strong now, and there’s evidence that shippers and retailers that limited SKUs when supply chains snapped are building back up to offer a wider range of products, which should fuel greater demand. No one has a crystal ball to see into the future, but the current downturn looks more like a pullback from strong demand than falling off a cliff.

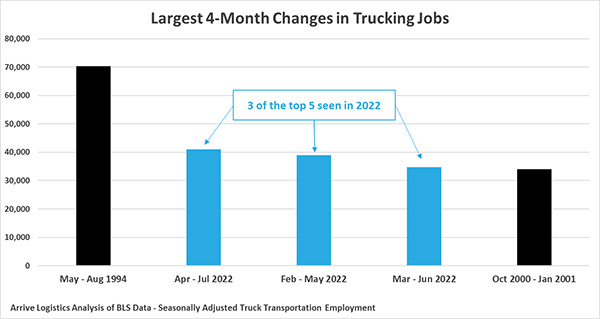

So, what does all this mean for the logistics sector? Capacity is more readily available than it was at the height of the pandemic, and as production slows, freight brokers are seeing what looks like a return to pre-pandemic conditions. Contract vs. spot rates for hauling is a good example. Before the pandemic, the contract/spot rate ratio was about 85/15. Spot rate usage doubled when capacity was tight, and now it’s moving back toward the pre-pandemic equilibrium.

The bottom line for everyone in the supply chain is that this isn’t the time to let your guard down, but it’s not a time for panic either. Sourcing difficulties, prices and congestion challenges may persist, and sky-high growth import growth may continue to snarl supply chains as retailers diversify sources and import more goods from manufacturers in Europe and India and less from China.

As always, it will be critical to assess procurement, sourcing and transportation operations and drive efficiency as much as possible. If capacity continues to grow, shippers will have more leeway on price and service, and carriers will have a harder time maintaining volume. And if there is indeed a recession on the horizon, there’s no reason to believe it will be anything like the Great Recession. This isn’t 2008.

About the Author

David Spencer is the Director of Business Intelligence at Arrive Logistics. He delivers regular market data analysis to internal teams as well as the Monthly Market Update to Arrive customers and carriers to help them make real-time business decisions. Prior to joining Arrive in 2017, David spent six years at AFN focused on business intelligence. David lives in Austin and graduated from the University of Illinois with a degree in applied mathematics and actuarial science.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.