The focus for supply chains appears to be shifting back to efficiency as companies balance resilience with costs and margin pressures.

By John Coykendall

For many industrial manufacturers, the response of the supply network to the COVID-19 pandemic, geopolitical challenges, and natural disasters thrust supply chain resilience into the limelight. But the pendulum appears to be swinging back, with costs and margin pressures once again at the forefront as companies reevaluate and restructure their supply chains.

Deloitte’s new report, “Restructuring the supply base: Prioritizing a resilient, yet efficient supply chain”, highlights why and how many companies are now prioritizing a resilient yet efficient supply chain as they work to optimize the balance between performance and cost. These approaches often include expanding to locations in the United States, or to locations closer to end consumers, and also working more closely with free trade partners of the United States. However, this restructuring is not exclusive to the US, or North America, but is occurring globally.

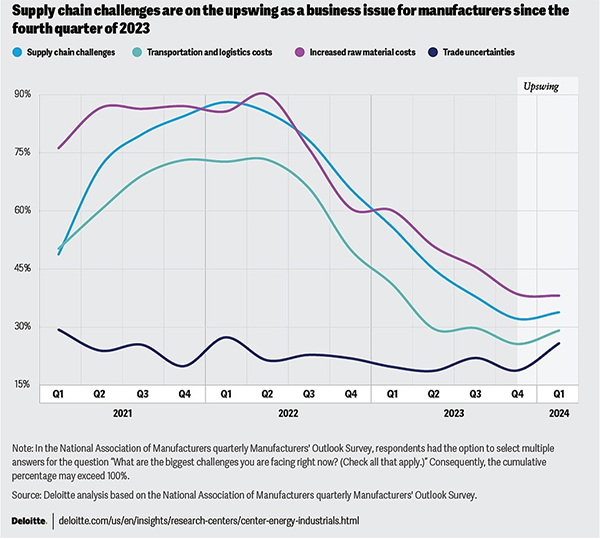

For many, part of the strategy for maintaining healthy margins and achieving profitable growth is rooted in reducing company exposure to supply chain disruption, while employing cost reduction techniques and capitalizing on government policies supporting domestic growth.1 Presently, concerns over the indirect impacts of geopolitical instabilities on supply chains have grown2 as the first quarter of 2024 saw an uptick in supply chain challenges as a primary business issue for manufacturers (Figure 1).3 Both global transit times and the Manufacturing Supplier Deliveries Index have increased during the first quarter of 2024 and will likely motivate companies to maintain a focus on resilience.4

To help reduce exposure to global disruptions while maintaining margins, some leading companies are exploring ways in which they can balance workforce requirements with labor costs and delivery times with shipping costs. Between 2022 and 2023, a wage rate comparison reveals that a Chinese manufacturing worker makes the equivalent of approximately 26% of their American counterpart, while a Mexican worker makes approximately 14%.5 Workers in Malaysia and Thailand make approximately 1% and 15% of US hourly wages, respectively, and workers in India earn approximately 4-5% of the US hourly wages, according to Deloitte’s analysis. On the logistics front, as of February 1, 2024, the rate for shipping from China to the East Coast of the United States was US$6,589 forty-foot equivalent unit, a 193% rate increase since October 2023.6

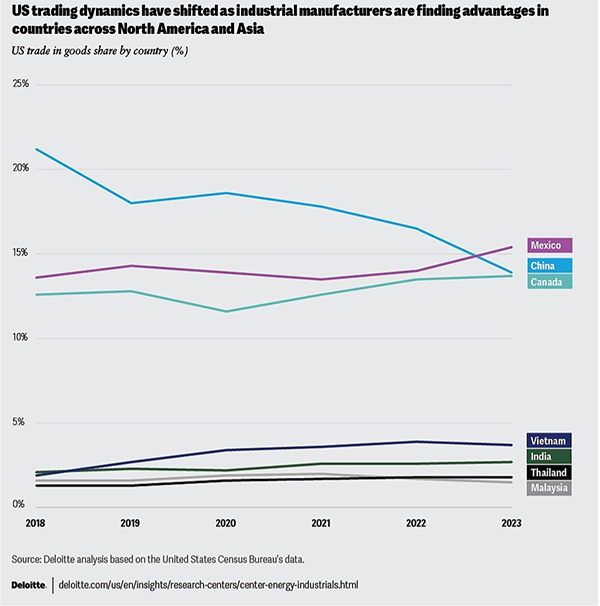

Manufacturers’ strategic approach to restructuring their supply base by targeting these components of the broader cost equation may be impacting trade. In fact, Mexico now sits as the lead US trading partner, accounting for a 15.4% share with Canada also seeing an increase in trade (Figure 2).

Furthermore, many companies are shaping their restructuring approaches to take advantage of evolving industrial policy. According to data from the Reshoring Initiative 1H 2023 Report, the top reason manufacturers conduct foreign direct investment (FDI) is government incentives.7 With legislation like the Inflation Reduction Act and the CHIPS and Science Act, the US government is incentivizing businesses across the sector to reshore their most advanced operations with a number of tax and investment opportunities. Private fixed investment in US manufacturing increased nearly 2.5 times in 2023 from 2021, to reach US$799.2 billion.8

According to the report, some global industrial manufacturing and construction companies are employing everything from traditional strategies to advanced technologies in a quest to capitalize on opportunities to create efficient supply chain performance.

Companies are using dual sourcing and/or multi-sourcing (three or more suppliers) to reduce their supply chain reliance on a single supplier or country and achieve extensive risk mitigation, Deloitte found. Additionally, they are often employing mergers and acquisitions (M&A), strategic partnerships and new supplier investment agreements, and expanded internal capabilities to restructure and build resilience into their supply chains.

Internally, analysis shows they are enhancing their product capabilities by investing in new hardware and software solutions. As supply chains restructure, manufacturers are likely to find digitalization critical to help ensure visibility throughout supplier tiers. In fact, one study conducted revealed that supply chain management and optimization is the top use case for artificial intelligence (AI), as reported by 41% of surveyed respondents.9

These strategies can mitigate risks by addressing material flow and business continuity issues. Further, they are often accompanied by cost reductions and increased innovation. The modernization of existing facilities, incorporation of advanced technologies (both hardware and software), and support for suppliers to meet current demand are strategic moves that can help strengthen the supply chain for manufacturers and suppliers.

Companies across the sector are continuously seeking opportunities to maximize resilience while keeping margins high. They are finding motivations for restructuring through delivery performance, cost reductions, and government incentives. To help achieve their goals, industrial manufacturing and construction companies are often leveraging a multitude of strategies all in an effort to help create high performing and efficient supply chains.

This article contains general information only and Deloitte is not, by means of this article, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This article is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor.

Deloitte shall not be responsible for any loss sustained by any person who relies on this article.

About Deloitte

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee (“DTTL”), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as “Deloitte Global”) does not provide services to clients. In the United States, Deloitte refers to one or more of the US member firms of DTTL, their related entities that operate using the “Deloitte” name in the United States and their respective affiliates. Certain services may not be available to attest clients under the rules and regulations of public accounting. Please see www.deloitte.com/about to learn more about our global network of member firms.

Copyright © 2024 Deloitte Development LLC. All rights reserved.

Endnotes

About the Author:

John is vice chair, US Industrial Products & Construction, and principal, in Deloitte Consulting LLP. John has more than 25 years of consulting experience focusing on global companies with highly-engineered products in the Aerospace & Defense, Industrial Products and Automotive industries. John advises senior executives on driving impactful and sustained performance improvement, through both top-line growth and margin improvement initiatives. He has led large-scale transformation efforts to help businesses with strategic cost transformation and operations/supply chain initiatives.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.