Changes are coming to the spare parts market. TGW recommends that companies create the conditions for this new era now with automation.

(Marchtrenk) Climate change has driven the automotive market towards the use of alternative drives. Soon, this will also have consequences for the spare parts market and its logistics. TGW Logistics Group recommends that companies create the conditions for this new era now with automation and digitalization. Powerful technologies are available for a future that is increasingly hard to predict.

At the moment, most cars in Germany have a combustion engine, but about 14 percent of the vehicles newly registered in 2021 have an all-electric drive—almost doubling the share of electric vehicles from the previous year. Electric, hybrid, and hydrogen vehicles present car manufacturers and suppliers with enormous challenges: from program planning and the scheduling of production orders to an impending decrease in spare parts orders. Some manufacturers and dealers have been making up to 70 percent of their profits this way.

The triumph of electric vehicles leads to a reduction in spare part sales because a combustion engine consists of more than 1,400 components, while an electric motor has only about 200. Electric cars also require fewer repairs on average because they are constructed differently. However, fewer motor parts do not mean fewer logistics activities, at least in the medium-term. One reason is that cars in Europe are on average nine years old, which means that spare parts for electric cars sold today won’t be needed for several years, and until then, spare parts for combustion engines will continue to dominate the market. Another reason is current after-sales logistics are more complex than even a decade ago because of this parallel world of combustion engines, hybrid drives, and electric models. Parts for diesel- and gasoline-powered vehicles will still need to be stocked for a long time: many original equipment manufacturers (OEM) keep them in stock for ten to fifteen years after the end of production.

A high degree of unpredictability is another aspect that makes this topic complex. Zero-emissions does not mean zero problems. Many unanswered questions unsettle manufacturers and customers alike. Where will problems for the procurement of raw materials for battery production arise? How is recycling going to be regulated? These are only two of many questions. Additionally, it is currently unclear what market share fossil fuels, e-fuels, LPG, hydrogen, and electricity will have in the next decade or two.

3D printed spare parts are not a panacea either. One reason is that many spare parts have high quality requirements that 3D printed parts cannot fulfill (yet). Furthermore, the new production method so far has only paid off for small quantities.

Developments that are difficult to predict, more complex business deals, new services—experts agree that this situation can only be resolved with automation and digitalization. Admittedly, the market will not change overnight, but sitting back and waiting is the wrong strategy. In only three to four years, spare parts for hybrid models will be needed, which means, given the realization time of large automation projects, companies have little time to waste. Additionally, digitalization allows companies to launch retail platforms in the blink of an eye. If you cannot maintain your service level with competitors, you will lose customers. Winning them back is hard. Quality service and fast delivery are still the be-all and end-all in this business, which is why high availability and agile logistics are more important than ever for manufacturers and dealers.

Another argument for automation is the increasing labor shortage. The situation will continue to become even more difficult because demographic changes cannot be stopped. A high degree of automation helps companies to prepare for uncertain times.

Whether you are a manufacturer or a supplier, you should also keep an eye on new services. In Europe, for example, more and more spare parts specialists are offering equipment and material for repair shops. In the U.S., where profit generally comes from large volumes, paid trainings and consultations for customers have become an extra source of income. Battery replacement, storage, and repair will play a major role in the future. Even more training might be needed when not only lithium-ion batteries are used, but other technologies for energy storage exist.

Another driver for the service business is the changed consumer behavior. Back in the day, car enthusiasts would repair their own vehicles; some even had fun doing it. Today, the products on four wheels are so complex that customers are hardly able or willing to repair them themselves. They expect their car to run more reliably than ever before thanks to preventive maintenance, and they expect that more urgent help will arrive quickly at the click of a button on their smartphone if it comes down to it. As a result, more manufacturers are relying on self-diagnostic systems and preventive maintenance.

TGW continually keeps a close eye on these developments and ensures that their findings are incorporated into their solutions. The best of the best in the market have already established a global logistics network, digital processes, and structured inventory management—winning over customers with a high service level and fast delivery.

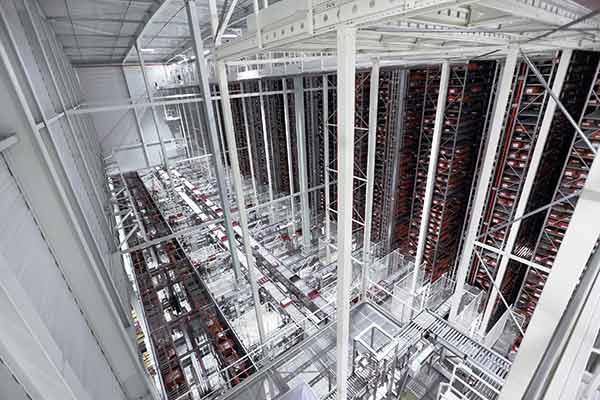

With FlashPick®, TGW has a system in its portfolio that allows companies to adapt flexibly to different scenarios and provides answers for the most important questions around efficiency and profitability. FlashPick® is all about reacting to fluctuations in demand, expectations for a high service level, and shortages in labor. In practice, this means, compared to other systems, express orders can be integrated into the daily business without problem. Only a few minutes pass from electronic order intake to the package being ready to ship.

For maintenance and support, TGW uses modern tools such as data glasses that provide employees in the installation with information via a live stream. The digital maintenance management CMMS is state-of-the-art. Condition-based monitoring is also used, meaning sensors are used to acquire status data for important components and compared to the empirical values in a centralized database. Maintenance models are then developed based on this data.

Furthermore, TGW is working on making the handling of slow-moving items more efficient by using the latest technology. These solutions are also very important for value added services, offering users the highest degree of flexibility.

In conclusion, the same principle applies to spare parts businesses and TGW: if you are prepared, you have an advantage.

About the Author

Erich Schlenkrich works at the headquarters of TGW Logistics Group in Marchtrenk, Austria, as Industry Manager for the industrial and consumer goods segments. A mechanical engineer by training, he completed a degree at the Hernstein Management Institute in Vienna and has more than 30 years of experience in warehouse automation. He has been able to pass on his knowledge in project management, development and sales in a variety of functions. Schlenkrich has been a key player in TGW’s business development in the European, U.S., and Chinese markets over the last 20 years.

About TGW Logistics Group:

TGW Logistics Group is a leading systems integrator of automated warehouse solutions. With over 50 years of experience the automation specialist designs, manufactures, implements, and maintains end-to-end fulfillment solutions for brands such as Urban Outfitters, the Gap, and TVH.

TGW Logistics Group has subsidiaries in the US, Europe, and China and employs more than 4,000 people worldwide. In the 2020/21 fiscal year, the foundation-owned company generated a revenue of $952 million US dollars.

Pictures:

Reprint with reference to TGW Logistics Group GmbH free of charge. Reprint is not permitted for promotional purposes.

Contact:

TGW Systems Inc.

3001 Orchard Vista Dr SE STE 300, Grand Rapids, MI 49546

T: 616-970-7163

tgw@tgw-group.com

Press contact, TGW North America:

Lisa Weilharter

Director of Marketing & Business Development

T: 616-970-7163

lisa.weilharter@tgw-group.com

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.