This article provides an overview, of market shares and growth trends, competitive landscape, and future trends of the China crane industry.

The crane industry is a vital part of the industrial sector. Its core function is lifting and transporting heavy objects. These devices are crucial in various industries such as manufacturing, construction, and logistics. Cranes’ working principle mainly relies on lever and pulley systems, which, when driven by power sources such as electric motors, hydraulics, or pneumatics, enable the lifting, moving, and rotating of heavy loads.

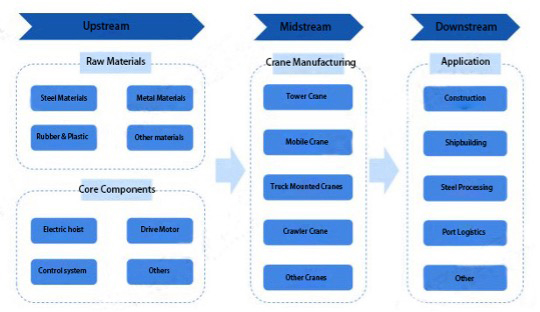

Cranes can be classified in different ways. By application, cranes are divided into general-purpose cranes and specialized cranes. General-purpose cranes are suitable for various work environments and tasks, such as factories and warehouses, while specialized cranes are designed for specific tasks, such as cranes on ships or tower cranes on construction sites. By structure, cranes can be classified into overhead, jib, and elevators. Overhead cranes are usually installed on indoor tracks and use electric trolleys to move loads; jib cranes operate by extending or rotating the jib to handle loads; elevators are primarily used for vertical lifting operations. These different types of cranes vary in performance, application range, and price to meet the needs of different users. Cranes are widely used in fields such as infrastructure, power, oilfields, petrochemicals, ports, and military industries for lifting operations.

After the founding of New China, through the introduction of foreign technology and the self-initiated technological research and development efforts of domestic universities and research institutes, the manufacturing capacity of domestic cranes was rapidly enhanced. In the 21st century, with the nationwide expansion of infrastructure construction and industrial development, the demand for crane products rapidly grew, further driving the expansion of domestic crane production capacity, and the industry entered a phase of rapid growth. After 2016, with the continued advancement of national industrial restructuring and intelligent manufacturing upgrading policies, the domestic crane manufacturing industry has been making strong progress toward digitization and intelligence.

In 1954, China began importing blueprints and technical materials for the K32 model 3-ton truck crane from the former Soviet Union, starting trials at Dalian Crane Factory.

1957 Beijing Machinery Factory trial-manufactured the K32 crane using domestically produced Jiefang truck chassis.

In 1961, the First Mechanical Engineering Department’s Fifth Bureau was established, leading to comprehensive crane planning, the addition of specialized manufacturing plants, and accelerated technological upgrades in factories.

After the 1980s, with the acceleration of foreign technology introduction and collaboration, the level of domestic technology experienced a leap, and the pace of product updates accelerated.

With the nationwide expansion of infrastructure construction and industrial development, the demand for crane products rapidly expanded, further promoting the production capacity of domestic cranes and ushering the industry into a phase of rapid development.

Digital, intelligent, and integrated products began to emerge, and the industry made significant leaps in technological innovation, manufacturing capability, and control over the industrial chain, actively moving towards digital and intelligent upgrades.

Industry Policy Background: Policies Promoting High-End, Intelligent, and Green Development. Cranes are essential industrial equipment in fields such as infrastructure construction, industrial production, and logistics transportation. As one of the key sectors in China’s large-scale equipment manufacturing industry, the development of the crane industry is highly emphasized by national policies.

For example, the 14th Five-Year Plan for National Economic and Social Development and Vision 2035 highlights the importance of promoting the optimization and upgrading of the manufacturing industry, cultivating advanced manufacturing clusters, and driving innovation in industries such as construction machinery. The plan also advocates for the deep implementation of intelligent and green manufacturing projects, the development of new service-oriented manufacturing models, and the promotion of high-end, intelligent, and green manufacturing in the industry.

The crane industry’s value chain is mainly divided into three parts: upstream, midstream, and downstream, with each part playing a different role in the industry.

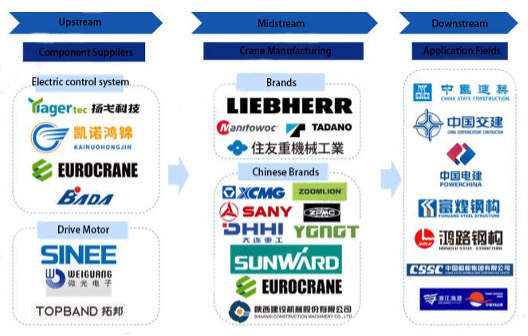

Overall, the crane manufacturing industry chain is characterized by a significant diversity of market participants.

From the perspective of representative enterprises at each stage of the industry chain:

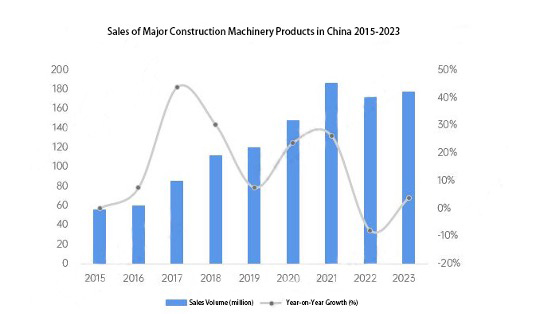

Market Size and Growth Rate

In recent years, China’s crane market has shown vigorous development, with the market size continuously expanding and the growth rate steadily increasing. It has become an important force in the global economy. Cranes account for nearly 4% of the total sales of construction machinery, and this trend is driven by the rapid growth in sectors such as infrastructure construction, real estate development, and transportation, all of which have led to a growing demand for cranes.

In terms of market size, China’s crane market has already formed a vast industrial chain and market scale. China’s construction machinery industry is diverse, and it is one of the countries with the most comprehensive range of product categories and varieties in the world, offering 20 major categories, 109 groups, 450 types of machines, 1,090 series, and thousands of models. The comprehensive nature of China’s construction machinery, with a distinct advantage in product series and integrated solutions, provides robust support for the country’s economic construction. At the same time, the continuous innovation and advancement in crane technology have also provided strong support for the expansion of the market.

According to the sales data for 2023 released by the China Construction Machinery Industry Association, which covers 12 major types of construction machinery products, including bulldozers, graders, truck cranes, and others, the total sales exceeded 1.7 million units in 2023, showing growth compared to 2022.

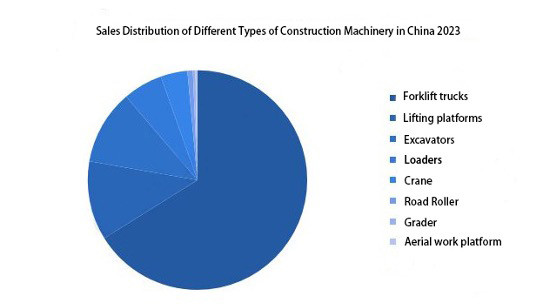

From the perspective of crane sales as a proportion of overall construction machinery sales, in 2023, the largest sales were from forklifts, followed by aerial work platforms, excavators, and others. Cranes accounted for no more than 4% of the total sales of construction machinery.

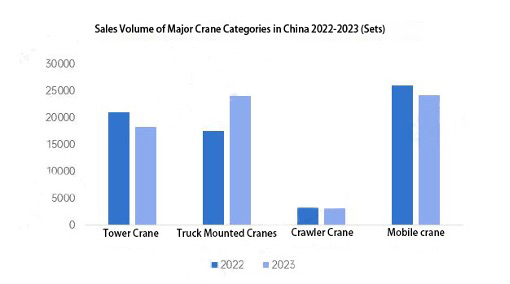

According to statistics from the China Construction Machinery Industry Association, the total sales of China’s four major types of cranes (tower cranes, truck-mounted cranes, crawler cranes, and truck cranes) exceeded 69,000 units in 2023, showing a slight increase compared to 2022. Among them, truck-mounted crane sales saw a significant increase, while sales of other crane types declined.

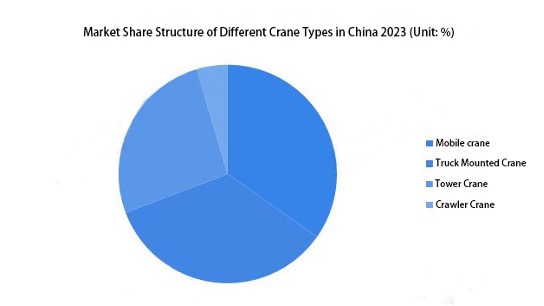

From the perspective of the sales of subcategories of cranes manufactured in China, truck cranes had the highest sales, followed by truck-mounted cranes. Both of these types accounted for over 30% of the total sales. Crawler cranes had the lowest sales, with a share of less than 5%.

The crane market is highly competitive, and Chinese crane companies still face certain challenges in the market. Crane companies from developed countries, with their mature technology and strong brand influence, hold a certain position in the market. Compared to these companies, Chinese crane manufacturers still have some gaps in areas such as technological innovation, product quality, and brand influence. However, with the increasing integration of the global economy and the deepening of international trade, Chinese crane companies are actively seeking international development paths. By focusing on technological innovation and quality improvement, Chinese crane manufacturers are continuously enhancing their competitiveness and gradually securing their place in the market. This effort not only helps raise the overall level of China’s crane industry but also supports the globalization of the Chinese economy.

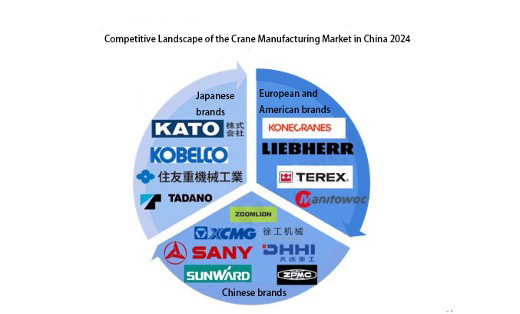

Corporate Competition: Formation of Three Major Competitive Factions — Japanese, European/American, and Domestic Brands

The domestic crane market has formed three major competitive factions: Japanese, European/American, and domestic brands.

In the domestic crane market, several companies have occupied important positions through their technological advantages and market strategies. Among them, Xuzhou Heavy Machinery Co., Ltd. (Xuzhou Heavy) stands out as an industry leader, demonstrating strong market influence and technological innovation capabilities. Xuzhou Heavy focuses on producing high-end, efficient, and energy-saving crane products, offering a complete range of crane models including truck cranes, all-terrain cranes, and rough-terrain cranes, catering to different customer needs. The company’s product design emphasizes stable performance, high reliability, and work efficiency, which has earned widespread recognition in the market. Xuzhou Heavy’s products not only lead the domestic market but are also actively expanding into international markets, enhancing its brand influence globally.

Zoomlion Heavy Industry Science & Technology Co., Ltd. (Zoomlion) also holds a significant position in the crane sector. Zoomlion’s crane products are primarily characterized by technological innovation and intelligence. By incorporating advanced control systems and sensor technologies, they have enhanced crane operation convenience and safety. Zoomlion also pays attention to product design and comfort, giving its crane models a unique competitive advantage in the market. The company invests heavily in product research and innovation, continuously improving product performance and quality to meet the growing market demand.

In addition to Xuzhou Heavy and Zoomlion, the domestic crane industry also includes other strong companies such as Shandong Heavy Industry Group Co., Ltd. (Shandong Heavy) and Shaanxi Automobile Holdings Group Co., Ltd. (Shaanxi Auto). These companies are also working tirelessly to improve product technology and quality to capture market share. Although their scale and market share vary, they all play an important role in the domestic crane market.

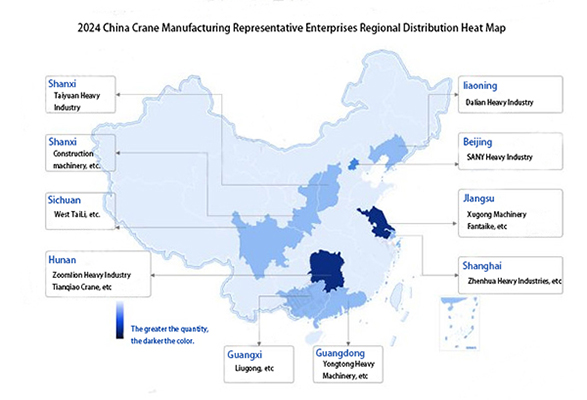

From the perspective of regional distribution of representative companies in the domestic crane manufacturing industry, Jiangsu and Hunan are home to the largest number of leading companies, making the crane manufacturing market in these areas highly competitive. The concentration of companies in these regions has led to intense competition within the domestic market.

1. Cranes Manufacturing Trends Toward Lightweight, Large-Scale, Intelligent, and Reliable Development

According to the “14th Five-Year Plan for the Construction Machinery Industry” released by the China Construction Machinery Industry Association, the development plan and key contents for the crane manufacturing industry include strengthening product safety and reliability, ergonomics, intelligent manufacturing, and green design, and advancing in directions such as lightweight, large-scale, intelligent, and reliability.

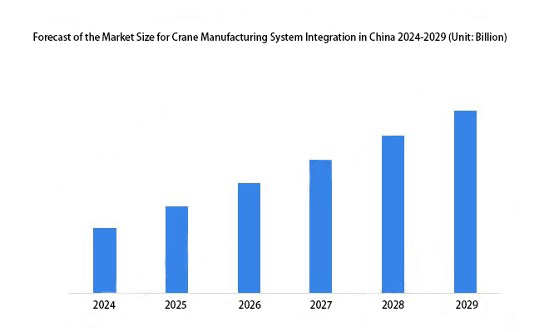

2. Estimated Market Size of China’s Crane Manufacturing System Integration Will Exceed 95 Billion Yuan by 2029

In the future, as the demand for crane product digitization upgrades and stock replacements is further released, along with the continuous deepening of the “Belt and Road” strategy, the crane market scale is expected to further increase, with sales in China expected to exceed 95 billion yuan by 2029.

About the Author:

Krystal is an experienced OEM crane expert at Henan Kuangshan Crane Co., Ltd., specializing in providing customized lifting solutions for clients. With years of industry expertise and a deep understanding of crane design, manufacturing, and applications, Krystal is dedicated to advancing crane technology. This industry report reflects her insights into the crane sector.

Tune in for a timely conversation with Susan Spence, MBA, the new Chair of the ISM Manufacturing Business Survey Committee. With decades of global sourcing leadership—from United Technologies to managing $25B in procurement at FedEx—Susan shares insights on the key trends shaping global supply chains and what they mean for the manufacturing outlook.