An insight into the current state of European supply chains regarding recent impactful events.

By Bart De Muynck

Europe has seen many geo-political, socio-economic and weather-related disruptions in the past few years. Some of these include the war in Ukraine, recent labor strikes in France and Germany, an earthquake in Turkey, inflation, and rising prices that impact consumer spend. Additionally, we have seen several recent regulations like the EU Supply Chain Law and Emissions Reporting mandate. These challenges have made European supply chains much more complex and have impacted logistics not only in the Eurozone but around the globe.

All these disruptions have a major impact on the European market. Supply chain challenges arising from the COVID-19 pandemic and Russia’s invasion of Ukraine could result in a potential €920 billion cumulative loss to gross domestic product (GDP) across the Eurozone by end of this year, according to a report by Accenture. This potential loss equates to 7.7% of the Eurozone GDP in 2023.

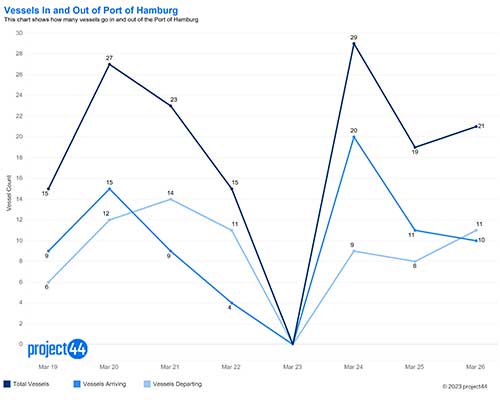

The strikes in France and Germany this past March impacted not only local freight logistics, but also had a global impact with international rail being effected as well as the ability for large ships to call at or depart from the port as in Hamburg, Germany’s largest port.

The last 2 years has seen massive increases in weather disruptions that have had major implications on the population as well as on supply chains. Natural disasters can disrupt import/export trade flows, disturb labor as to number of hours worked, impact on inventories due to damage, diversion of resources from innovation and expansion to reconstruction and replacement (and many others). As an example, July 2021’s floods across Germany, Belgium, Luxembourg and the Netherlands generated an estimated $43 billion in damages. This year experts are forecasting to be hotter than 2022, which was the 5th or 6th hottest year on record. This is caused by the El Nino effect which would have catastrophic impacts around the world, from searing heatwaves, droughts and fires to devastating floods.

Both the pandemic and the war in Ukraine have exacerbated ongoing constraints outside of Europe. They have a major impact on global supply chains, creating challenges when it comes to energy, transportation, and especially manufacturing, as it experiences limited access to raw materials. According to Coleman Parkes, “Tomorrow’s Supply Chain: Disruption Around Every Corner,” 50% of companies have experienced delays in production of goods or delivery of services. Such delays impact all industries but have reached an alarming 71% in the healthcare sector.

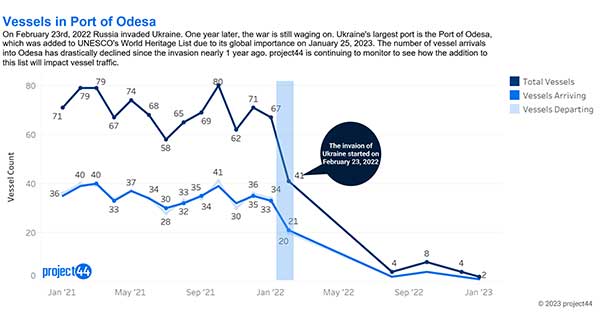

Ukraine and Russia are key exporters globally of wheat, barley, corn and cooking oil, but particularly to African and Middle Eastern countries. Russia is also a major producer of fertilizer and petroleum. Ukraine was China’s second-largest corn supplier, accounting for 29% of China’s total grain imports in 2021. Disruptions to the flow of these goods are compounding other supply chain and climate challenges, driving up food and gas prices and causing shortages.

And, the situation won’t improve soon. Current economic forecasts provide a bleak outlook for 2023. The European Commission forecasts GDP growth to subdue to 0.3% in the Euro area. Inflation reached 8.6% in January 2023. But with lower consumer spend, companies cannot increase prices. So, this will impact workers’ salaries and potential layoffs which in turn lead to more strikes which in turn impact manufacturing volumes.

New regulations are being introduced such as the EU Supply Chain law. The draft European Supply Chain Act requires EU companies to carefully manage social and environmental impacts along their entire value chain, including direct and indirect suppliers, their own operations, as well as products and services. The aim is to ensure compliance with applicable human rights standards and environmental protection to promote a fairer and more sustainable global economy as well as responsible corporate governance. But, these new regulations come at a cost. In Germany, the government’s own estimates of the law’s direct cost to the country’s firms in time and toil are €110m this year and €43.5m every year after.

These continued challenges require more agility and resilience from companies. Supply chains must be able to absorb, adapt to and recover from disruptions whenever and wherever they occur. This requires improved real-time visibility, risk identification, and mitigation solutions. Better and more real-time data to adjust and finetune demand and replenishment plans as well as scenario planning will help them adapt to evolving supply and demand.

About the Author:

Bart De Muynck is Chief Industry Officer at project44 where he drives supply chain industry thought leadership and supports customers with their strategies. A logistics industry thought leader with 30 years of experience, Bart previously served as VP of Research at Gartner. He has contributed to publications including WSJ, Inbound Logistics, Logistics Management, DC Velocity, Transport Topics, and Bloomberg. Earlier in his career, Bart held logistics roles with PepsiCo, Elemica, Penske Logistics, GE Capital, and EY. He enjoys spending time with family and his two dogs, Nico and Whiskey, traveling, listening to music, cooking, and wine tasting.

Nothing contained herein constitutes an offer to sell or solicits an offer to purchase any of the products and services described herein. Any such purchase or sale shall be made only upon execution of a definitive agreement, which shall be the sole and exclusive embodiment of the terms and conditions of sale as well as the representations and warranties, if any, related thereto.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.