In this report, Pinnacle analyzes the economics of reliability in the metal and fertilizer mining space.

The health of our global economy depends critically on the success of metal and fertilizer miners. Metals like copper, nickel, and lithium are increasingly in demand given the exploding popularity of electric vehicles. Gold and silver are important means of wealth storage, in addition to various industrial applications. Aluminum and steel have countless uses in manufacturing, from food and beverage containment to automobile and airplane fabrication. Mined fertilizers, specifically phosphates and potash, are necessary to improve the productivity of agriculture worldwide, helping us feed our growing global population.

What is reliability? In its analyses, Pinnacle defines reliability as the measure of how often something runs when you want it to. As we think about the economics of reliability, this draws into consideration how organizations make investments to maintain or improve reliability. In other words, are they being effective in their pursuit of reliability, or not?

In this report, we analyze the economics of reliability in the metal and fertilizer mining space, including the resource extraction, transportation, and processing activities in which large global miners commonly engage. Specifically, we consider the following base metals – aluminum, cobalt, copper, iron ore, lead, lithium, molybdenum, nickel, tin, uranium, and zinc. We also cover the precious metals of gold, palladium, platinum, and silver. Finally, we also include the two major classes of mined fertilizers – phosphates and potash.

As we saw with our previous Economics of Reliability reports, the world of reliability poses some unique analytical challenges. Reliability is ubiquitous, but only rarely do operators publish detailed, reliability-specific data sets. The much more common case is for operators to discuss the importance of reliability in words while reporting holistic operational results with little indication of the quantitative impact of reliability on business performance.

Mining is no different. Some publicly traded operators do indeed provide great visibility into their reliability spend patterns. Other operators offer next to no visibility in this area. As a result, like we have in our previous reports, we bring together different data sets to form a complete picture of the reliability landscape. Our picture, however, is necessarily blurry. Unfortunately, some uncertainty is unresolvable, given the lack of detail in some publicly traded company disclosures and the fact that other players are private and have little to no public reporting responsibilities.

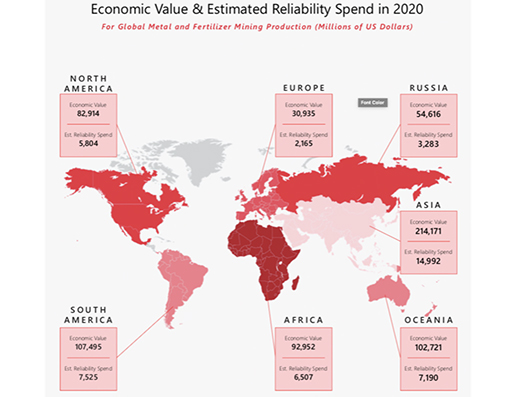

Following a detailed analysis of performance data published by large, publicly traded miners, we estimate that the mining sector spends nominally 7% of the economic value of produced resources on reliability-related activities. In other words, for every US$100 million in produced metals or fertilizers, miners spend about US$7 million on reliability-related activities such as inspections, preventive maintenance, reactive repairs of broken equipment, and other efforts aimed at ensuring assets operate as expected.

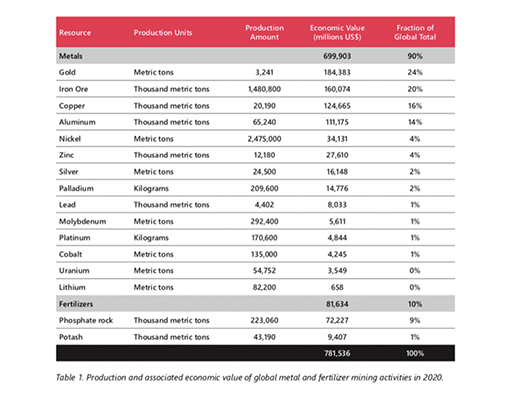

Table 1 below shows the global production and associated economic value of the mined resources we track for 2020. We estimate the total economic value of this basket of mined metals and fertilizers was US$782 billion in 2020. Metals accounted for $700 billion, or 90%, of this group of resources. Gold alone accounted for US$184 billion, or 24% of the total. In terms of economic value, we note a big four, so to speak, in mined metals – gold, iron ore, copper, and aluminum, each contributing at least 14% of the total mined value for this commodity portfolio. Nickel is next in line, contributing only 4% of the total value, well below each of the big four metals. We also see considerable skew in the fertilizer space, with phosphate rock accounting for nearly eight times the economic value of potash.

Reliability receives a great deal of attention in the world of refining. When failures happen, fires and explosions can follow with catastrophic consequences for people and the environment. Because some refineries are located near population centers, failures can be broadcast widely, increasing their salience with the public. As a result, regulators and management teams steer considerable resources toward mitigating reliability failures in the petroleum refining sector. Mines, on the other hand, are often much more remote than refineries. Also, the more common reliability failures at mines typically capture less public attention than they would at refineries. Still, miners spend on par with, if not slightly more than, petroleum refiners when it comes to reliability. This substantial investment that owners and operators of metal and fertilizer mines make on reliability is one of our strongest motivations to craft and share this particular report.

As the world economy continues to transform, more activity is being digitized, and more effort is being steered toward decarbonizing our energy infrastructure, metal and fertilizer miners are navigating particularly turbulent waters. In addition to responding to the secular demand shifts impacting every industry around the world, these miners must also deftly respond to unpredictable commodity price dynamics. This response often comes in the form of putting mines into “care and maintenance” mode, where most mining activities are idled, but the site is actively managed to allow for reactivation when economic conditions improve.

Responding to dramatic price inflections is a known challenge across the resource extraction sector. For miners, the challenge is more dramatic in specific ways than it is for oil and gas producers, for instance. In the oil and gas space, operators can throttle or idle production at the level of individual wells, allowing for some nuance in calibrating production against prevailing economic conditions. In the mining space, operations are concentrated in relatively few active mining sites, compared with the thousands of wells that oil and gas operators may manage. The stakes are high when management teams must decide whether to transition a whole site into care and maintenance mode. Then, these teams must manage the back end of the process, where these sites are either reactivated, sold, or decommissioned.

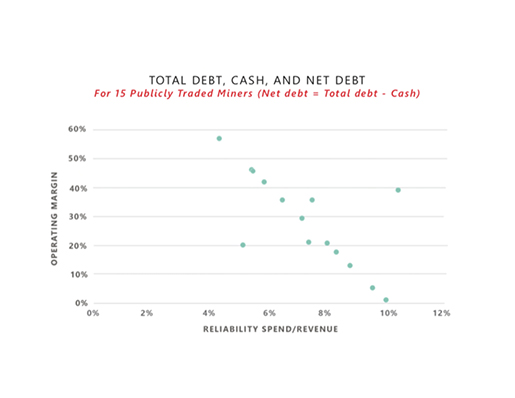

The final comparison we want to make within this portfolio of miners is between reliability spend and profitability. Several of these miners report their maintenance spend directly, which we classify as reliability spend. For the others, we estimate their reliability spend using their reported data, plus assumptions we have gathered from studying other process industries and rules of thumb we have developed in working with customers.

In a sense, Figure 2 shows an unsurprising result – the less an operator spends on reliability, the greater their operating margin. In other words, we should expect, as we reduce the size of a particular operating cost, for the operating margin to go up. While this logic is sound, we highlight these results to demonstrate the plausibility of operators overspending on reliability. If reliability spend had been perfectly optimized going into this three-year period of 2018-2020, then we would expect the operators with less reliability spend to incur more cost in other ways, e.g., from failing equipment and undermanaged processes. However, over a period of three years, the operators with the least reliability spend indeed generated more robust profits, suggesting that operators with heavier reliability spend patterns are unlikely to get a return on this added spend.

Given the history of the 2015 commodity price crash, and the 2020 pandemic-driven demand crash, the tension in these results emerge. We have argued that, in response to these market disruptions, miners would too hastily cut reliability spending so they could use that cash to pay down their previously excessive debt loads. If many operators are over-spending on reliability, then is it truly problematic for them to cut their spend in this area?

There is undoubtedly excess reliability spend that indeed should be cut or redeployed. Our fear, given what we have seen in these miners’ public reports and how other industries have responded to similar challenges in the past, is that these operators quickly reach for the hatchet instead of the scalpel when cutting spend. One important reason that reliability programs are often bloated or improperly calibrated to begin with is because they are pieced together using incongruent tools without regard to unit-wide, facility-wide, and portfolio-wide outcomes. The same problems remain when operators rip out large chunks of spending without the care, intention, and analysis required to ensure we protect our most important performance outcomes while recapturing previously wasted spending. Figure 4 suggests miners can indeed reduce and redeploy excess reliability spend while protecting profitability. The challenge is not to make those reductions. The challenge is to reduce spend in the right way, protecting near-term profitability and mid- to long-term performance outcomes simultaneously.

Metal and fertilizer miners spend $55 billion on reliability initiatives, which is about 10% more than is spent by petroleum refiners.

For a few reasons, reliability receives a relatively smaller spotlight in mining than it does in refining. Through our economic analysis, we learned that across the world, we actually have more opportunity to make gains in optimizing ongoing efforts in mining than we do in petroleum refining.

Metal and fertilizer miners have been focused on balance sheet management over the past half decade, likely creating vulnerabilities in their existing reliability programs.

Commodity prices began to crash in late 2014 and languished through most of 2015. The pandemic then dramatically suppressed demand through 2020. The miners we studied responded capably to these disruptions, cutting costs so they could preserve their profitability and pay down excessive debt. Unfortunately, these drastic maneuvers have likely left holes in existing reliability programs that can negatively impact operational and financial performance going forward.

Some miners achieve better results while spending less on reliability, suggesting the best path is to spend less while targeting that spend surgically.

In the portfolio of miners we analyzed, operators typically spend 4% to 10% of their revenue on reliability programs. Interestingly, the operators that spent the least often see the largest margins, even when we group results over three-year periods to smooth out single year anomalies. We infer that many reliability programs are bloated. In our experience, anywhere from 10% to 30% of this spend may not produce any material impact on performance. While these programs are almost certainly leaner than they were before the 2015 price crash and 2020 pandemic, substantial opportunity remains to further rationalize and optimize this spend. Intentional, multi-dimensional, system-wide analysis is the best tool to ensure reliability investments are framed in a proper returns-based context.

This article provides a condensed version of Pinnacle’s reliability report for the mining industry. Download the full report here.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.