US manufacturers may need to rethink their approach to constructing new factory sites to meet rising demand efficiently.

By Erikhans Kok, McKinsey & Company

As global trade dynamics shift, the case for localizing production is getting stronger. Rising volatility in tariffs and trade policies, evolving incentives for domestic manufacturing, and the realignment of global trade corridors are pushing companies—particularly in the United States—to bring production closer to home. Yet, while nearshoring promises greater supply chain resilience and strategic advantage, the reality of building new factories is far more challenging.

Companies across sectors—from semiconductors and electronics to aerospace—are under pressure to ramp up production and reorganize their footprint, yet many struggle to scale their infrastructure at the required pace. Less than half of all major capital projects are delivered on time and on budget. Years of focus on growth through acquisitions and network consolidation over in-house expansion, have left even chief manufacturing officers with little to no experience in developing new sites.

To bridge this capacity gap, manufacturers may need to shift their mindset from conventional, sequential construction processes to an integrated, modular, and tech-driven approach. By rethinking how factories are built, companies could achieve significant improvements.

In recent years, industrial expansion in the US has been marked by promises of high-ambition investment. One North American semiconductor manufacturer, for instance, pledged billions toward a new fabrication plant, while a consumer electronics manufacturer sought to expand capacity to a site that was higher cost than its traditional low-cost-country base.

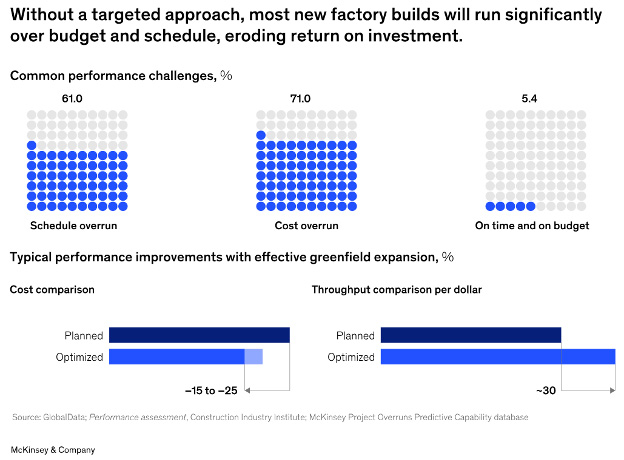

Yet, despite the injection of capital, the development of new factories is moving more slowly than they could, with the average capital project running approximately 60 percent over schedule and more than 70 percent over budget (Exhibit 1).

Some of the main reasons for slow pace of delivery include:

The result? The majority of factory projects become longer and far more expensive than initially planned. In addition, the factory construction delay equates to manufacturing delay—which translates to lost revenues and subjecting companies to possible loss of market opportunities.

Exhibit 1

Closing the capacity gap requires a substantial change in factory construction and building design. Top manufacturers are finding innovative ways to accelerate timelines and reduce risks, with four approaches standing out.

Instead of building everything on the job site, companies can speed up construction by utilizing modular and prefabricated building units. This approach involves building key sections of a factory in off-site plants and then assembling them at the destination site. It helps lower peak manpower demands on site.

The semiconductor manufacturer mentioned above used advanced construction technologies, including the latest modular-building techniques, to mitigate risks, shortening construction periods by months and reducing inefficiencies on site. The company also employed generative scheduling and performance transparency tools to optimize the construction timeline and reduce costs.

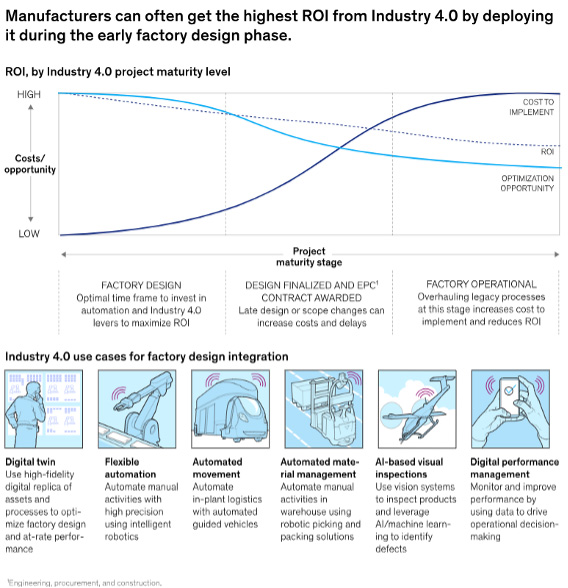

One of the main reasons for cost overruns and delays in factory construction is changing scope late in the project to accommodate changes to the layout or add new flexibility. Companies can eliminate such risks by leveraging Industry 4.0 technologies, such as digital twin technology—virtual replicas that reflect every detail of the building process in real time (Exhibit 2).

A medical-products company used a digital twin to optimize the layout of a new plant for its high-mix, high-volume product portfolio. It simulated future production, enabling engineers to build in additional flexibility and minimize the impact of frequent changeovers—leading to a 20 percent increase in overall equipment effectiveness and gross margin increases of nearly 50 percent. A multinational consumer electronics manufacturer doubled throughput and reduced cost per unit by 30 to 40 percent by implementing Industry 4.0 technologies during factory design.

Additionally, some manufacturers are implementing connected production lines with sensors and digital work instructions to improve supply chain coordination, ensuring smoother ramp-up times and better efficiency.

Exhibit 2

One of the biggest inefficiencies in factory construction is the traditional sequential approach—where each phase of building happens one after the other. Instead, companies may need to consider employing parallelized work streams, where multiple phases advance concurrently.

The aforementioned semiconductor manufacturer did this very effectively. It optimized its factory build by splitting up large work packages so that multiple contractors could work in parallel on-site. Using generative scheduling models, it tested alternative construction sequences and labor reallocations, identifying over 90 optimization opportunities that helped reduce timelines and costs.

Even when factory construction in complete, poor supply chain coordination can lead to delays in the production output from new factory projects. Improving and strengthening the supply chain before construction is completed can prevent disruptions and keep production on schedule.

One aerospace and defense manufacturer conducted an in-depth analysis of supplier capacity, geographic footprint, and logistics to ensure that its suppliers could meet projected demand. The semiconductor fab’s improved procurement coordination managed to triple the number of completed RFPs and align procurement with the construction schedule. Additionally, it saved more than $50 million by optimizing workforce allocation through its labor strategy.

Closing the manufacturing capacity gap requires reimagining traditional construction methods and embracing a more adaptable, technology-driven approach. With modular construction, digital twins, parallelized workstreams, and supply chain optimization, manufacturers can dramatically reduce costs, accelerate timelines, and reduce execution risk.

This shift is about making businesses capable of scaling production capacity in time to meet surging market demand. The factories that can update their factory construction models will be ahead of the game, while the ones stuck in outdated models of construction risk falling behind.

About the Author:

Erikhans Kok is a senior partner in McKinsey’s Houston office and the global co-leader of McKinsey’s Capital Excellence practice.

He offers deep expertise in optimizing capital project portfolios as well as developing and delivering mega capital projects, including pressure testing business cases, validating cost and schedule estimates, contracting strategy, design optimization, all the way into project field execution.

Read more from the author:

Smarter growth, lower risk: Rethinking how new factories are built | McKinsey & Company, February 2025

How capital expenditure management can drive performance | McKinsey & Company, June 2022

Capturing the net-zero opportunity with portfolio synergies | McKinsey & Company, April 2022

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.