To realize the full economic potential from electric vehicles requires investing over $100 billion in the domestic battery industry.

By Alan Wilkinson and Srinath Rengarajan

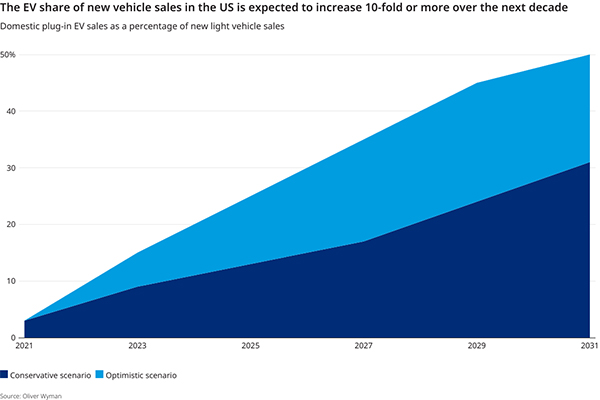

President Joe Biden wants 50% of new vehicle sales in the United States to be zero-emission by 2030. And the two largest US automakers just pledged at the UN climate summit in Glasgow that 100% of their new car sales would be zero-emission by 2040. But for the US to benefit fully from the economic opportunity this new production represents, we really also need to be asking where all the batteries for those cars are coming from.

The key to dominance in EV production is the battery because it accounts for as much as 50% of an EV’s total value. Countries that don’t make their own batteries may miss out on the bulk of the economic contribution possible from an EV industry, including the new, good-paying jobs related to the propulsion systems of electric vehicles. In the case of EVs and batteries, the US is playing catch up with China’s dominance and Europe’s potential.

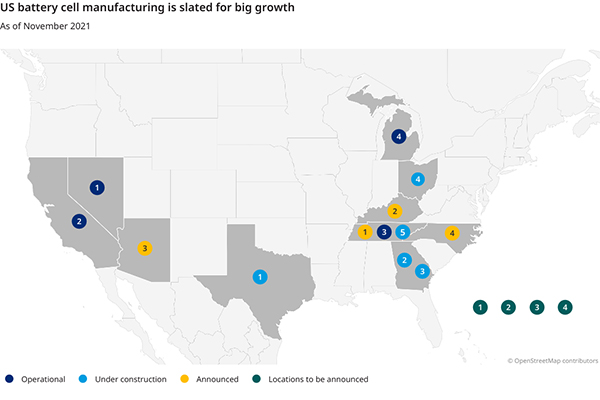

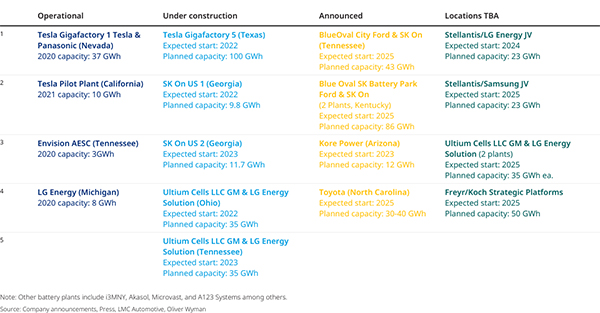

While Americans may have as many as 240 EV models to choose from by 2030, they won’t have enough domestic battery production to power them. To reach Biden’s goal and guarantee that the EVs sold here are truly “Made in the USA,” the nation would need over 1,000 gigawatt-hours (GWh) of annual battery production by our calculations. Currently, the US only has 59 GWh of cell production capacity — with most of the needed components and raw materials imported from Asia.

Between now and 2030, we calculate that as much as $100 billion would need to be invested in battery gigafactories alone for the US to have sufficient capacity. Current levels of investment would not even get us halfway there. On top of that, billions more are needed to develop a domestic supply chain to support those battery gigafactories.

The failure to create a domestic battery manufacturing infrastructure would leave the entire EV industry dependent on imports and thus vulnerable to trade conflicts and supply shortages like those we are currently seeing in semiconductors — another key EV component. Shipping battery cells and materials around the world also involves a huge carbon footprint, which may eventually pose a heightened risk to the industry from regulation around decarbonization.

What makes this scenario so tragic is the fact that much of the best early-stage battery research in the world is being done by US universities and national labs through federal grants. While the ability to innovate should give the US a leg up — especially with Tesla, the largest EV maker in the world, based here — American manufacturers face heavily subsidized EV industries in both China and Europe.

China is the largest global producer of EVs and represents the biggest consumer market for them, thanks to years of extensive subsidies to the automotive and battery industries and to consumers purchasing EVs. It also accounts for the bulk of global battery cell production capacity as well as 80% the world’s total output of raw materials for advanced batteries. Currently, China controls the processing of pretty much all of the critical minerals needed for batteries — including rare earth, lithium, cobalt, and graphite, according to the Institute for Energy Research.

Meanwhile, Europe is working to create its own EV market by imposing regulations that make it more expensive to drive internal combustion vehicles and others that will eventually outlaw new sales of them in some places. European governments are also encouraging foreign battery makers to open factories locally with financial and regulatory incentives. This was extended to other parts of the supply chain. Europe is also providing domestic players with technological support and access to capital for new gigafactories.

Among the lessons the US should take away: The industry needs industrial policy and federal funding, as well as coordination among federal, state, and local governments. To make the kind of investments required, automakers need some kind of guarantee that a sizable domestic EV market will develop, and as we’ve seen in China and Europe, subsidies and regulation can help provide that.

To have a hope of taking the lead — or even keeping up — the US also must begin building a comprehensive domestic EV supply chain. Not having these capabilities at scale makes battery production less efficient and less competitive. In these early days, that will require car makers and investors to help the many innovative US startups and university spinoffs looking to commercialize cutting-edge technologies.

For instance, US companies have developed unique recycling processes to extract raw materials from used batteries economically. But with almost no domestic battery material production capacity, raw materials are shipped overseas for processing and manufacturing electrodes. The good news: Investment is beginning to flow into battery capacity and the processing of active materials and downstream recycling.

US players should also look to collaborate with global firms along the value chain. Securing long-term raw material supplies — especially for critical minerals like lithium, nickel, and cobalt — will require upstream partnerships created today. One potential avenue could be long-terms agreements with Canada, which mines many of the metals used in batteries and has recently invested in developing lithium production.

Another challenge faced in the US and Europe is a shortage of skilled labor. Legacy automotive workforces offer skillsets that emphasize mechanical engineering and machining capabilities rather than knowledge in battery chemistries, electronics, and industrial engineering needed for EVs and battery manufacturing. Right now, the industry and government are not sufficiently addressing what may become a potential obstacle to growth.

None of these challenges can be addressed overnight. While historical strengths in research and development and abundant, cheap capital should help the US auto industry, much will depend on whether automakers and government are aligned and fully committed to a new future of electric mobility.

Simon Schnurrer, an Oliver Wyman partner in Frankfurt, Germany, also contributed to this article.

Alan Wilkinson is a partner in Oliver Wyman’s global automotive and manufacturing industries practice. Alan has 14 years of product development engineering, strategy, and planning experience at Ford Motor Co. and another 14 as a consultant on cost and warranty reduction, operational efficiency, market and technology strategy, and revenue enhancement. He holds a Master of Business Administration from the University of Michigan, Ann Arbor, and a Master of Science degree in engineering from the University of California, San Diego. Alan is based in Southfield, Michigan.

Dr. Srinath Rengarajan is Oliver Wyman’s global head of automotive research. He also leads the firm’s Battery Competence Center and is the senior automotive researcher for Oliver Wyman’s Climate & Sustainability Initiative. Based in the firm’s Munich office, Srinath has over a decade of experience working in the auto industry in Europe and Asia. He focuses on future mobility solutions with particular expertise in alternative propulsion and electric vehicle battery and charging technologies. He holds a Master of Science degree in automotive engineering from RWTH Aachen and a PhD in strategy management from FAU Erlangen-Nürnberg.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.