Amid the recent tariff noise influencing supply chains, sale leasebacks can be a key financing tool for industrial companies to consider.

By Dave Rosenberg, CFA

While it is unclear where the steady state of tariffs may ultimately land, it is safe to say that global trade tensions have intensified over recent months.

For industrial and manufacturing companies, the implications are immediate and substantial. Domestic U.S. companies who source components from abroad have seen a substantial uptick in costs. Companies who have manufacturing operations in China, for example, may be hit twice – once by a 125% tariff to import components and then another 145% to export the final project to the U.S. This affects large U.S. companies such as Apple and Tesla, as well as many smaller producers that rely on China as a manufacturing base. These companies often import raw materials or components from the U.S. for assembly into products that are then exported.

Many companies have been evaluating re-shoring of operations over recent years, with amplified focus arising in the COVID era due to the acute supply chain impact. In a post-COVID Deloitte survey, which pre-dated tariff noise, about six in ten manufacturers surveyed indicated that they are reshoring or near-shoring production capabilities in the U.S. market. In 2023, according to The Economist’s “Trade in Transition 2024” survey, 97% of companies surveyed indicated that they were reconfiguring their supply chain in some way, as compared to 92% in 2022.

As one example, in March ‘25, Johnson & Johnson announced plans to invest more than $55 billion to build four domestic manufacturing facilities over the next four years and expand other sites, in response to tariffs.

As recent tariff noise further influences companies to rethink their global supply chains and evaluate domestic targets for acquisition, the sale leaseback financing tool can be an important one to consider.

Unlike traditional debt financing, a sale leaseback allows a company to sell its owned real estate, or the real estate of an acquisition target, and lease it back for the long term. This frees up capital tied up in real estate without giving up operational control. In sectors like manufacturing and logistics, where companies often hold significant property assets, the sale leaseback can be an ideal corporate finance solution.

One of the most critical elements of a successful sale leaseback transaction is the negotiation of the long-term lease for the property once it has been sold. Owners need to be comfortable that the real estate they rely on remains firmly within their control, even if they don’t outright own the property. Lease terms of 15 or 20 years are common, with an extension that can push control up past 40 years. Moreover, lease escalations are also negotiated in advance to enable owners to accurately forecast their costs.

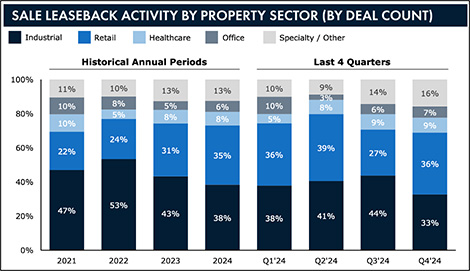

In 2024, industrial properties accounted for 38% of all sale leaseback transactions. The appetite of investors for these investments remains robust because the assets offer steady, long-term income from creditworthy tenants that are in many cases critical to U.S. supply chains.

This dynamic creates a favorable environment for industrial firms. Companies with owned facilities, even in remote locations, may find that their real estate is worth more than they realize. The arbitrage between asset value and the company’s valuation can also yield significant returns when monetized through a sale leaseback.

A number of industrial and manufacturing companies have utilized sale leasebacks in late 2024 and early 2025 to raise capital to fund growth initiatives or pay down debt, among other uses, demonstrating the broad applicability of this financing tool.

One advantage of a sale leaseback is the ability to unlock 100% of a property’s market value, compared to traditional mortgages, which often allow access to only 70% to 80% of the asset’s worth. By tapping into the full value of their real estate, companies gain immediate liquidity without having to take additional debt on their balance sheet. Additionally, the predictable lease payments help stabilize financial forecasting, while the capital raised can be used to pay down existing debt, invest in new technology, expand operations, or buffer against cash flow strains such as impending tariff obligations.

A strong financial profile can lead to better lease terms because investors prioritize the tenant’s creditworthiness. This allows companies with healthy balance sheets and consistent profitability to command competitive pricing and flexible lease structures, making the sale leaseback an even more attractive option in today’s market environment.

Senior executives may be aware of sale leasebacks, but many are less informed about their nuances and advantages.

It is not uncommon for there to be a natural emotional attachment to a facility which has been owned by a company for a long period of time. However, selling a property in a sale leaseback does not mean loss of control. With properly negotiated leases, companies can retain long-term stability in their locations. Standard sale leaseback base terms are 15 to 20 years, with renewal periods of 20 years or more, providing control for 35 to 40+ years.

In addition, some senior executives express concern that third-party ownership of mission-critical real estate assets may hinder a change of control, i.e., the sale of the business. While this is a valid concern, it is also one that can be effectively managed in the lease negotiation.

While sale leasebacks offer companies many benefits, executive leadership has many corporate finance tools at their disposal, and debt and equity financing can be accessed from multiple sources. In this respect, sale leasebacks have their place in the toolkit of the financing options executives have at their disposal.

At the moment, sale leasebacks are a particularly useful tool for responding to macroeconomic volatility or preparing for tariffs. For those that own their facilities, the sale leaseback offers a flexible, efficient way to raise capital without taking on new debt or sacrificing operational control.

Further, while the tariff war creates uncertainty, it could also drive a surge in mergers and acquisitions activity as companies reposition themselves for long-term competitiveness. A resurgence in the M&A market would bode well for the sale leaseback market, which is highly correlated to M&A activity.

In an era where liquidity can make or break growth plans, this financing tool deserves a closer look by any industrial leader with real property on the books.

About the Author:

Dave Rosenberg, CFA is a Principal at SLB Capital Advisors, which advises corporates and private equity sponsors on a wide range of sale leaseback transactions. Mr. Rosenberg has over 14 years of investment banking and sale leaseback experience, having advised clients on a broad array of transactions, including company sales, capital raises, recapitalizations, and buyside advisory.

Read more from the author:

Unlocking Capital for Business Growth: A CEO’s Guide to Sale Leasebacks | CEOWORLD magazine, January 28, 2025

Sale Leasebacks Offer Packagers Growth Capital | Packaging Technology Today, January 22, 2024

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.