Expert insights on the latest on the Canadian railway strike movement and potential impacts.

By David Spencer, VP of Market Intelligence at Arrive Logistics

Domestic and cross-border freight markets remain in limbo as the threat of a Canadian rail workers strike looms large over North America. Read on to learn more about the current state of negotiations and how a strike might impact supply chains on both sides of the border.

Before discussing the potential impact of a strike, here’s a rundown of what’s transpired thus far:

Negotiations have stalled again, with the two sides making no significant progress since failing to find a resolution during their meeting with the Federal Mediation and Conciliation Service (FMCS) on June 7th.

In their sixth update to union members, the TCRC said, “Canadian National had no intention of discussing or even considering our demands.”

In response, CN and CPKC are pushing for binding arbitration to break the deadlock and avoid a strike. This process would involve both parties empowering a mutually agreed-upon independent arbitrator to determine the settlement terms without further negotiation between parties.

The TCRC has also scheduled a strike vote from June 14 to June 29. Because the strike cannot move forward if enough members do not vote on and approve it within the last 60 days, this action essentially extends the time frame for the unions to strike.

Around 10,000 union workers have already voted in favor of a strike, three times more than in 2019 when, after seven months of unproductive negotiations, nearly 3,200 union workers at CN went on an eight-day strike due to chronic overwork and unsafe conditions.

Canadian National Railway and Canadian Pacific Kansas City own about 75% of all Canadian rail capacity, so the impact of a strike could be devastating. First and foremost, it would likely limit the flow of certain goods and increase over-the-road truckload transportation demand. Freight from Canadian ports could also land on U.S. soil, leading to capacity crunches stateside.

A single strike day will also create at least another three to four days of disruption. This exponential effect could have a significant downstream impact on U.S. automakers, which rely heavily on inbound shipments from Canada that would almost certainly see significant slowdowns should the railways close. Further, Canadian grain, potash and coal producers have commented anecdotally that the strike could disrupt their export operations.

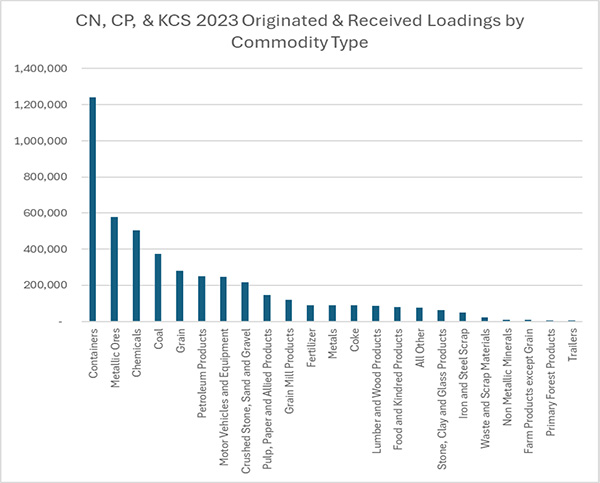

Jason Miller of Michigan State University recently completed a carload volume data analysis that revealed general containerized goods, metallic ores, chemicals, coal, grains and other petroleum products are the most heavily transported commodities. CN and CPKV account for 74% of the total carloads of metallic ores shipped, putting this freight type at a significant risk of disruption.

Ultimately, all of the above could lead to higher prices for consumers and businesses, put jobs at risk, and threaten Canada’s reputation as a reliable trading partner.

While stakeholders anxiously await a decision from the CIRB, rail customers are creating contingency plans without any certainty as to when or even if they will need to use them.

However, the latest OTRI data, which acts as a relative measure of truckload supply in the marketplace, does not indicate any signs of impacts on shipper routing guides out of Canada. This is likely because both the Canadian and U.S. capacity markets are oversupplied to the point that they could more easily absorb the railway volume. Still, rate increases would likely follow if the shutdown lasts long enough to drive sustained long-haul capacity demand.

The potential for significant disruption persists as negotiations remain at an impasse and the CIRB continues its assessment. Stakeholders across various industries must stay vigilant and prepared for any developments, with contingency plans in place to mitigate potential operational impacts. Though it is too soon to discern how the situation will play out, we hope the two sides can reach a deal in time to prevent the stoppage of this critical cog in the Canadian economy.

David Spencer is the Vice President of Market Intelligence at Arrive Logistics. He delivers regular market data analysis to internal teams as well as the monthly and quarterly Market Updates to Arrive customers and carriers to help them make real-time business decisions. He has been in the logistics industry, focused on business intelligence, since 2011.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.