New data suggests the US supply chain activity is now outpacing China in terms of post-pandemic recovery.

San Francisco – Data from Tradeshift reveals that B2B trade activity across US supply chains accelerated past China in Q2, with the world’s largest economy now setting the pace for global trade recovery heading into the second half of the year.

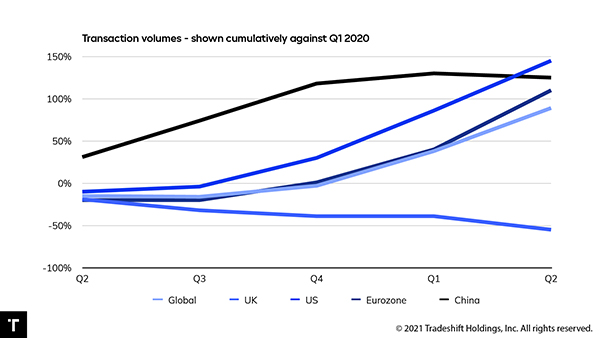

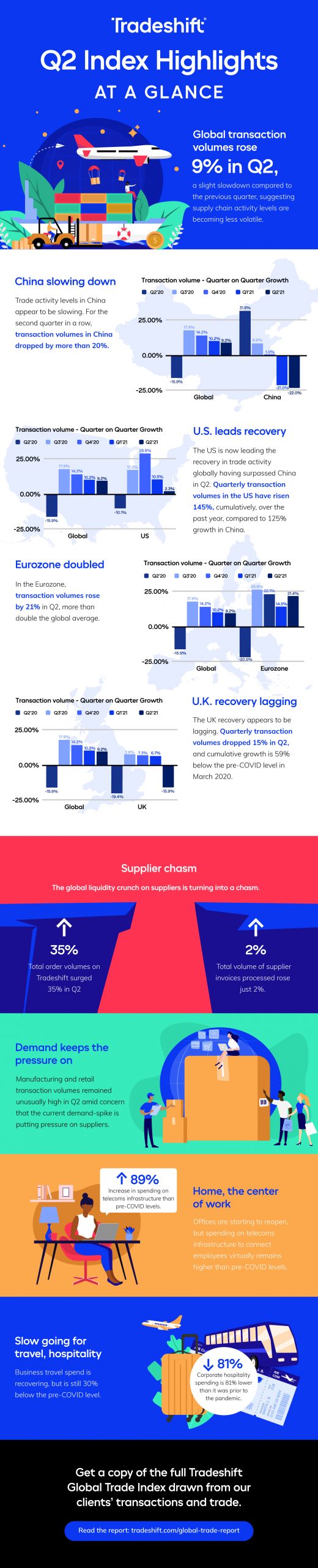

According to Tradeshift’s latest Index of Global Trade Health, which analyzes transaction data between buyers and suppliers, activity levels across US supply chains rose by a relatively modest 2.4% quarter on quarter. This was sufficient to overtake China in terms of cumulative growth compared to pre-pandemic levels.

Transaction volumes across Chinese supply chains had been growing at a phenomenal rate in the second half of 2020, but Tradeshift’s data suggests a significant slowdown since the beginning of 2021. Transaction volumes in China dropped 22% in Q2, the second quarter in a row that activity levels have fallen by a double-digit margin.

According to China’s National Bureau of Statistics, Chinese factory outputs have been affected by supply chain bottlenecks. Tradeshift’s data suggests supply chains in the US and the Eurozone could also start to encounter challenges as suppliers struggle to keep up with demand.

“The recent slowdown in China shows how quickly external factors can start to impact momentum,” said Christian Lanng, CEO, Tradeshift. “Supply chain operators are walking a tightrope in order to keep recovery on track. Large buyers are understandably keen to capitalise on the current spike in demand, but if suppliers are left to pick up the check then the whole system will start to cave in to pressure.”

Total order volumes rose 35% in Q2 compared to the previous quarter. By contrast, the number of supplier invoices processed during the same period grew by just 2%, well below the rate seen in previous quarters. The more this gap widens, the more challenging it becomes for suppliers to build up sufficient cash reserves to fulfil new orders. Tradeshift’s data suggests that this imbalance is particularly acute across supply chains in the Eurozone where order volumes rose 62% in Q2 while the total number of invoices rose just 8% during the same period.

“Finance teams have a critical role to play in ensuring that there is sufficient flexibility in the system to provide suppliers with the fuel they need to support a speedy recovery,” said Lanng. “There are technology-driven solutions available right now that can eliminate many of the current liquidity pressures without transferring any additional risk to the buyer.”

Tradeshift has developed a range of digitized financing solutions to provide suppliers with options that facilitate the early payment of invoices.

About Tradeshift

Tradeshift is a market leader in e-invoicing and accounts payable automation and an innovator in B2B marketplaces and providing access to supplier financing. Its cloud-based platform helps buyers and suppliers digitize invoice processing, automate accounts payable workflows and scale quickly. Headquartered in San Francisco, Tradeshift’s vision is to connect every company in the world, creating economic opportunity for all. Today, the Tradeshift platform is home to a rapidly growing community of buyers and sellers operating in more than 190 countries. Find out more at: Tradeshift.com

About the Tradeshift Index of Global Trade Health

Many of the world’s largest buyers and their suppliers use Tradeshift’s trade technology platform to exchange digitized purchasing and invoicing information. Tradeshift’s Index of Global Trade Health analyses anonymized transaction data flowing across our platform to reveal a timely perspective of how external events are impacting business-to-business commerce.

Forward-looking statements

Any statements contained in this document that are not historical facts are forward-looking statements as defined in the U.S. Private Securities Litigation Reform Act of 1995. Tradeshift undertakes no obligation to publicly update or revise any forward-looking statements. All forward-looking statements are subject to various risks and uncertainties that could cause actual results to differ materially from expectations.

© 2021 Tradeshift Holdings Inc. All rights reserved.

Tradeshift products and services mentioned herein as well as their respective logos are trademarks or registered trademarks of Tradeshift Holdings Inc. in the US and other countries.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.