Manufacturers planning the acquisition of robots should consider RaaS instead of purchase for both the savings and long-term partnership.

I recently looked at five press releases for industrial robotics marketing studies. They covered the next five to seven years and predict the market growth rate at between 4.6% and 17.5% with an average CAGR of 10.3%.

I also found a 2018 research report predicting the growth of Robotics as a Service (RaaS) at a CAGR of 23% by 2026. I also read a number of reports and articles stating that the RaaS market is still it it’s early days and the idea of RaaS is quickly catching on with Industrial and other robotics markets.

My conclusion is that whatever forecasts you believe, the number of robots installed under the RaaS model will be a significant and growing percent of all robotic sales. And that makes sense to me. Here’s why.

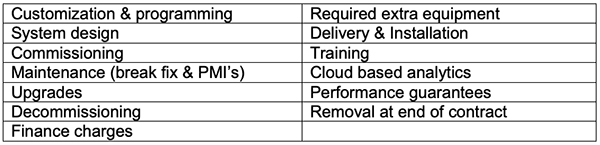

Services – all the activities supplied by a vendor that are required to specify, install, support, and remove a product.

RaaS – Robot as a Service. A business model designed to create a recurring revenue stream for the seller by providing the most cost-effective solution possible to create value for the buyer. RaaS suppliers frequently bases their fee on a price per outcome basis. This may mean total operating hours per period, pieces produced per period, or pieces handled per period.

Operating lease – a contract that allows a leasee to use a product without transferring ownership from the leasor. The cost is an operating expense (OpEx) and not a Capital Expense (CapEx) and the equipment does not become an asset and appear on the balance sheet.

It is the services that add extra value to the end user and makes a RaaS business model both cost effective and desirable.

About the Author:

In addition to a successful career as a leader of two high-tech, B2B, Customer Service organizations, Sam Klaidman, Founder & Principal Adviser at Middlesex Consulting, utilizes his prior 20+ years’ hands-on experience in Engineering, Manufacturing, Consulting and General Management to help clients grow their services business and increase Customer Loyalty. He applies the methodologies and techniques associated with the Customer Value Creation and Service Marketing professions to assist his clients to achieve their growth objectives by designing and commercializing new services and the associated business transformations.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.