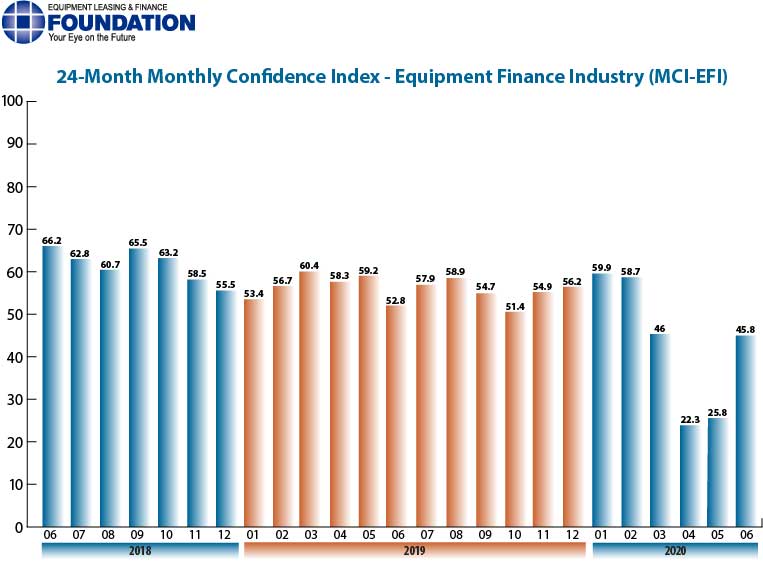

Confidence in the equipment finance market increased to 45.8, up from the May index of 25.8.

Washington, DC, June 18, 2020 – The Equipment Leasing & Finance Foundation (the Foundation) releases the June 2020 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $900 billion equipment finance sector. Overall, confidence in the equipment finance market increased to 45.8, up from the May index of 25.8.

The Foundation also releases highlights of the COVID-19 Impact Survey of the Equipment Finance Industry, a monthly survey of industry leaders designed to track the impact of the coronavirus pandemic on the equipment finance industry. From 98 survey responses collected from June 1-11, results show that 92% of equipment finance companies have offered payment deferrals. 82% of companies expect that the default rate will be greater in 2020 than in 2019. A majority (81%) of companies have not furloughed or laid off employees. Comments from survey respondents follow MCI-EFI survey comments below, and additional survey results are available at https://www.leasefoundation.org/industry-resources/covid-impact-survey/.

When asked about the outlook for the future, MCI-EFI survey respondent Daniel Krajewski, President and CEO, Sertant Capital, LLC, said, “Despite the reduction in overall demand, the market size still remains extensive. We continue to find opportunity and have seen an uptick in application activity. We do have continued concern over the political environment and the divide that continues to exist in Washington.”

The overall MCI-EFI is 45.8, an increase from 25.8 in May.

Bank, Small Ticket

“I am encouraged that businesses are re-opening and getting back to work. Over the next three to six months many businesses will recover and others will forever be changed in detrimental ways. I believe in the adaptive spirit of business leaders and their ability to change business models and find ways to build and grow in new directions to find success.” David Normandin, CLFP, President and CEO, Wintrust Specialty Finance

Independent, Small Ticket

“I’m hopeful that the PPP loan relief programs have had a positive impact on keeping small businesses afloat. I think we will see in the next two months whether it helped limit failures or just postponed them.” Quentin Cote, CLFP, President, Mintaka Financial, LLC

Bank, Middle Ticket

“The team is adjusting to the new normal. We are conducting a small number of customer visits based on customer requests and where physical distancing is practiced. All visits are day trips and we have not presently activated overnight travel. We are adapting sales strategies to ensure we are meeting customers’ expectations and to grow market share.” Michael Romanowski, President, Farm Credit Leasing

Independent, Middle Ticket

“As most jurisdictions across the U.S. begin to reopen, many of America’s businesses will find a way to restart and prosper again. Never underestimate the tenacity of American entrepreneurs.” Bruce J. Winter, President, FSG Capital, Inc.

Executive Comments from COVID-19 Impact Survey of the Equipment Finance Industry

Bank, Small Ticket

“We are projecting to see minimal performance issues through Q3 2020, due primarily to contract modifications. As modification terms mature in Q4, we are projecting delinquency and defaults will begin to surface, resulting in a modest increase in defaults for 2020. Mid-term in the one- to two-year time frame, we will see stress with business closures and weaker secondary market valuations. We are projecting stabilized performance in 2022 with portfolio performance continuing to exhibit stress, albeit notably less than 2021. Overall, we see essential business segments producing consistent new business volume throughout all time periods.” Laurie Bakke, President, Western Equipment Finance

Independent, Small Ticket

“I believe the equipment finance industry will experience steady demand in the near term as a result of some pent-up buying slowed or delayed by COVID-19. There will likely be many different players in our industry as a result of the recent slowdown, with some exiting, others merging, and new entrants. With much infrastructure work to be done, along with likely new industries and products coming to market as a result of quarantine, I am hopeful the next one to three years will result in steady growth in our industry. While I believe we will see some short-term accelerated use of electronic transactions and processes, and those that adopt sooner will benefit, some will not adopt. It will be a must to harness the technology efficiencies available to remain relevant in our industry beyond the next few years, which is both exciting and scary for some.” Daryn Lecy, CLFP, Vice President of Operations, Oakmont Capital Services LLC

Independent, Small Ticket

“New originations have been strong over the past 60 days with several credits falling from A to B and C, which is our market. As A lenders tighten we benefit. I think we will see more defaults this year but if effective treatments and eventually vaccines are developed, I think long term the equipment finance industry should rebound and thrive.” Paul Fogle, CLFP, Managing Director, Quality Leasing Co., Inc.

To participate in the COVID-19 Impact Survey of the Equipment Finance Industry: The Foundation invites all regular ELFA member companies to participate each month. Survey responses are limited to one per company. If you did not receive a survey and would like to participate, please contact Stephanie Fisher, sfisher@leasefoundation.org, by June 30 to determine eligibility for inclusion in the July survey.

ABOUT THE MCI

Why an MCI-EFI?

Confidence in the U.S. economy and the capital markets is a critical driver to the equipment finance industry. Throughout history, when confidence increases, consumers and businesses are more apt to acquire more consumer goods, equipment, and durables, and invest at prevailing prices. When confidence decreases, spending and risk-taking tend to fall. Investors are said to be confident when the news about the future is good and stock prices are rising.

Who participates in the MCI-EFI?

The respondents are comprised of a wide cross-section of industry executives, including large-ticket, middle-market and small-ticket banks, independents and captive equipment finance companies. The MCI-EFI uses the same pool of 50 organization leaders to respond monthly to ensure the survey’s integrity. Since the same organizations provide the data from month to month, the results constitute a consistent barometer of the industry’s confidence.

How is the MCI-EFI designed?

The survey consists of seven questions and an area for comments, asking the respondents’ opinions about the following:

How may I access the MCI-EFI?

Survey results are posted on the Foundation website, https://www.leasefoundation.org/industry-resources/monthly-confidence-index/, included in the Foundation Forecast eNewsletter, and included in press releases. Survey respondent demographics and additional information about the MCI are also available at the link above.

JOIN THE CONVERSATION

Twitter: https://twitter.com/LeaseFoundation

Facebook: https://www.facebook.com/LeaseFoundation

LinkedIn: https://www.linkedin.com/company/10989281/

Instagram: https://www.instagram.com/leasefoundation/

Vimeo: https://vimeo.com/elffchannel

ABOUT THE FOUNDATION

The Equipment Leasing & Finance Foundation is a 501c3 non-profit organization that propels the equipment finance sector and its people forward through industry-specific knowledge, intelligence, and academic outreach programs that contribute to industry innovation, individual careers, and the overall betterment of the $900 billion equipment leasing and finance industry. The Foundation is funded through individual and corporate donations. Learn more at www.leasefoundation.org

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.