Middle market part manufacturers, which have long enjoyed relative stability, must prepare for disruption in order to stay relevant.

By Shruti Gupta, RSM industrials senior analyst

While the pandemic has forced middle market industrial component part manufacturers (CPMs) to become more resilient for the immediate future, companies still need to prepare for longer term disruptive trends. Middle market CPMs generally sell to original equipment manufacturers (OEMs) or larger industrial conglomerates, which themselves are navigating new frontiers. In addition, automotive and aerospace are huge industrial end-markets, requiring thousands to millions of parts from middle market CPMs. The disruptive trends these OEMs and sectors are experiencing will require the middle market supplier base to plan for the longer-term future of their core business.

Below are three disruptive trends, how they may affect middle market CPMs and what companies can do to keep up with these changes.

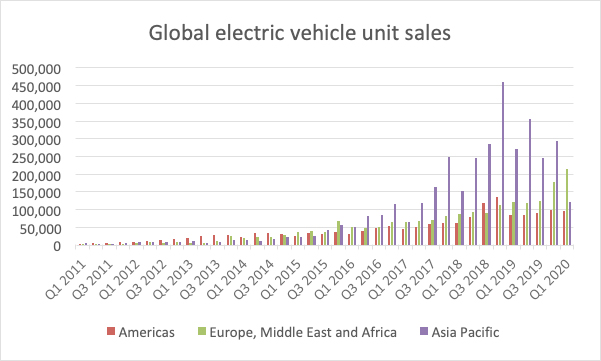

Electric vehicles (EVs) – Traditional internal combustion engine (ICE) cars need about 20,000 to 30,000 parts, while EVs need a fraction of this. This reduction in parts does not bode well for auto part manufacturers that focus on ICE cars, since as many parts or the same core products may no longer be needed. Suppliers may face the threat of irrelevant products, equipment and skill sets, especially as EVs become more prevalent.

While the EV sector is growing rapidly, it has yet to gain a significant market share. Still, automakers are investing billions of dollars into developing EVs, and that will also impact sourcing decisions. Auto suppliers are aware of the potential threat that EVs pose to their core products, but unless and until EVs demonstrate real commercial success, suppliers may not be willing to adapt their business models.

Unit sales of electric vehicles from 2011 to 2020. (Source: Bloomberg NEF)

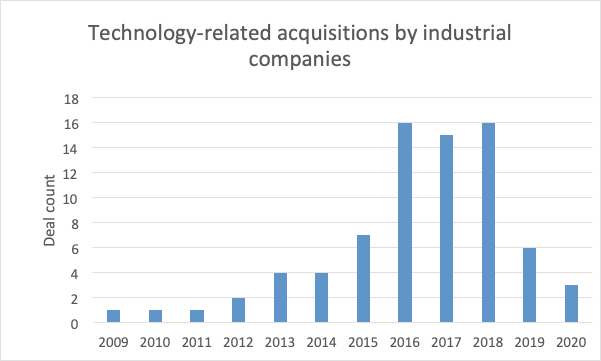

Industrial software companies – Industrial conglomerates like Honeywell, Siemens, ABB and others have pivoted from pure industrial product companies to “software-industrial” companies; they provide industrial-software platforms to enable customers to digitize their manufacturing operations and take advantage of various exponential technologies. This often involves a focus on analytics and software service offerings as traditional hardware sales have slowed. This pivot indicates a preference to asset-light business models that bring in recurring subscription revenues complementing tangible product offerings. While the impact of this pivot on CPMs is not yet clear, they may encounter less demand for their hardware components or lower margins on account of increased commoditization.

Technology-related acquisitions by industrial companies by deal count, from 2009 to 2020. (Source: PitchBook Data)

3D printing – Manufacturing companies, especially in the aerospace sector, are increasingly adopting 3D printing technologies to design, manufacture, and drive efficiencies. ArianeGroup, a joint venture by Airbus and Safran, designed and manufactured an injection head for rocket engines with a single 3D printed part, instead of the 248 individual parts that were originally required. Right now, 3D printing is mostly viable for low-volume production and prototyping, but the pace of technology advancements and investments is expected to expand the areas of application for 3D printing.

The impact on middle market CPMs is not just a reduction in parts due to 3D printing-enabled designs but also the relative flexibility that this technology provides companies, especially spare parts manufacturers, to make products themselves.

The three trends above may vary in terms of timing and/or impact. However, the main issue is that companies are able to adapt or prepare for any overarching trends, foreseeable or not, that can disrupt the core business model.

Even well-established businesses can be at risk if they don’t adapt, according to 2017 research from Accenture. That company’s analysis of “the performance of more than 1,200 companies in six of the most asset-heavy sectors — telecommunications, utilities, energy, materials, automotive, and industrials — revealed an equally worrying trend,” according to an article from the MIT Sloan Management Review. “Incumbents throughout these industries are falling prey to ‘industry compression’—a form of slow, but dangerous change that results in a prolonged decline of both operating profits and revenues.”

CPMs can transform and use disruption to their advantage if they have an adaptable mindset. Companies can sharpen their competitive edge by using Industry 4.0-enabled technologies such as advanced data analytics and IIoT. These technologies allow them to collaborate with customers and suppliers in innovative ways and position them for change.

Developing smart components can provide insights on how to make improvements, address unmet needs or enable sustained customer engagement. Data-enabled business models would support recurring revenues from subscription-based services that increase customer engagement and loyalty. Data analytics will help companies understand all of their customers better – not only their larger customers – and develop customized products, services and strategies. Direct engagement with end-market customers can help CPMs shape better products, services and capabilities.

Traditional approaches to growth – make or acquire – require significant investments. Another growth strategy is collaboration with third parties, through which companies can add value without owning added resources or assets. UPS, for instance, partnered with 3D printing company Fast Radius to set up printers across multiple global locations to enable customers to print parts as needed, closer to the customer, with UPS providing the last-mile delivery.

Making a change to a company’s core business is not easy, but businesses need to start somewhere. Regardless of the approach, CPMs need to move forward, and fast, to keep pace with change.

Shruti Gupta

Shruti Gupta has more than 15 years of experience advising multinational clients on their transfer pricing planning, supply chain structuring, global compliance and controversy management strategies. She is a senior analyst in RSM’s cutting-edge Industry Eminence Program, which positions its analysts to understand, forecast and communicate economic, business and technology trends shaping the industries RSM serves.

Contact:

Shruti.Gupta@rsmus.com

www.rsmus.com

From tradition to transformation Sequoia Brass & Copper has stood for excellence in American manufacturing. In this episode, we sit down with Kim MacFarlane, President of Sequoia Brass & Copper, to hear the inspiring story of a family-owned company founded by her father, built on craftsmanship, trust, and a relentless commitment to quality. Kim shares how she’s guided the company through the challenges of modern industry while honoring its heritage, and how the next chapter will be carried forward by her son Kyle. This is more than a story of brass and copper; it’s about resilience, innovation, and the enduring strength of family legacy. If you’ve ever wondered how tradition can meet the demands of today’s industry hit play and be inspired.