With rising inflationary pressures on raw-material prices, procurement can turn volatile commodity prices into a competitive advantage.

By Joe Basar and Marta Mussacaleca

Amid constant reminders of COVID-19’s extraordinary human cost around the world, the pandemic’s ability to generate new challenges can seem almost relentless. The latest: inflationary pressures on raw-material prices, a consequence of factors ranging from rapid shifts in consumer demand to rebounding economic activity, lingering supply-chain disruptions, and expansionary economic policy. Some raw-material prices have hit all-time highs with little sign of falling anytime soon: lumber prices, for example, have skyrocketed by more than 90 percent. In certain regions, voracious raw-material demand has compounded supply scarcity in key commodities such as rare earths.

The resulting volatility is generating new forms of financial and operational risk—and steering many procurement functions into uncharted waters. They need answers about how to manage costs, mitigate earnings risks, and address threats, such as limited supplies and capacity underutilization.

In an inflationary environment, three steps can help procurement leaders capture the full value available to maximize supply availability, minimize unnecessary costs, and capture new opportunities:

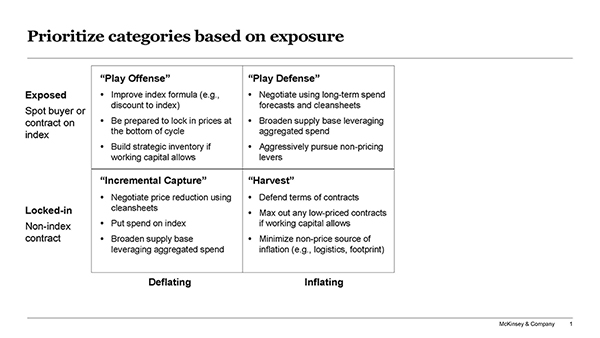

The first step is to prioritize categories. Identifying which ones are facing inflation—and how much of that inflation is structural—is essential. A nodal analysis can serve as an effective starting point: it allows the team to break down individual spend categories into different geographies (or “nodes”), and, depending on organizational structure, to plant level. These nodes can then be categorized by whether a contract exists and if it is indexed.

This approach helped an advanced industrial manufacturer in North America that had been unable to find a competitive source of steel supply after prices rose 45 percent in six months. Improved inventory planning, and expanding its own yard size, enabled the company to buy from other regions—delivering savings of $200 million.

If inflation presents challenges, deflation offers opportunities, which can be costly to ignore. Procurement teams can play offense, locking in prices at the bottom of cycle. They can switch to a defensive position during periods of inflation by establishing a wider supply base, developing a negotiations strategy with a long-term view, and pursuing non-pricing levers, which could include commodity or component substitution or product reconfiguration.

Where contracts are locked in—meaning they aren’t linked to a price index—periods of deflation are the time for incremental value capture, using strategies such as quickly negotiating price reductions, ideally putting the spend on index. When periods of inflation hit locked-in, nonindexed contracts, the time is ripe for aggressively pursuing non-pricing levers, defending the terms of contracts, and maxing out any low-priced contracts—if the necessary working capital is available.

An expansive set of levers is available to support a defensive position against inflation—both from a commercial and a technical (product-specification) point of view. Cleansheet analysis, for example, can inform negotiations with incumbent suppliers, while at the same time the company can pursue long-term technical levers, such as reducing product complexity.

Immediate commercial opportunities to mitigate volatility can be found by maximizing the spend on existing contracts that are not reflecting inflation, or issuing claw backs on commodity dips over the last 12 months where prices have remained flat. To improve future resilience, digital and analytics solutions are today able to deliver “should-cost” models quickly for large portions of spend, while supplier collaboration can drive joint efficiencies and improve the total cost of ownership.

Immediate defensive technical levers include accelerating value engineering to reduce demand, as well as adjusting batch sizes or order frequency, while a longer-term technical lever to improve resilience can be found through de-specifying to reduce SKUs. To challenge volatility in the short term, opportunities include passing along price increases to the end customer and optimizing the supplier footprint for better control logistics, cost, tariffs, and inventory. In the longer term, technical levers that challenge volatility include strategic stockpiling of inventory, linked to supply contract terms on volume, cost, timing, and payment terms.

An automotive supplier confronting steel and semiconductor inflation set up an inflation nerve center that applied both strategies in tandem. After identifying the specific categories under the most pressure, the procurement team took action to broaden the supply base, using analytics to sharpen negotiation tactics and craft deals for volume discounts. Meanwhile, value-engineering efforts reduced internal demand for high-cost components and enabled substitutions. The combination produced double-digit savings that not only met immediate needs, but also reduced costs at the structural level for higher long-term resilience.

It’s tempting to treat inflation as a problem for the procurement function alone. But that approach typically leaves procurement in a perpetual firefighting mode that favors rapid responses, often without a strategic framework to guide decision-making.

An inflation nerve center provides a more effective alternative. The structure brings together specialists across the value chain—in supply chain, planning, finance, operations, and engineering—to triage supply-availability problems for raw materials, components, and related inputs. In a centralized, strategically informed way, the never center can accelerate cost-saving initiatives, find and approve alternative commodities and their sources, and develop deeper partnerships with key suppliers.

From setup to impact can take as little as five weeks. Day 1 sets up crucial infrastructure, including activity cadence and dashboards that track progress. Within the first week, the team prioritizes categories based on an exposure matrix considering inflation (or deflation) on one axis and the degree of exposure on the other (exhibit). For each category, the team identifies an expansive set of potential mitigation levers, then spends the next one to two weeks conducting research to identify potential commercial and technical levers and estimate their effects. Time is of the essence throughout, so execution of a plan can begin as soon as it appears viable.

Taking a cross-functional stance to respond to rapidly shifting commodity prices allows organizations to track prices in real time, move quickly to address immediate issues, and implement plans to mitigate against future volatility.

The authors wish to thank Trevor Burns and Casper Bek for their contributions to this article.

About the Authors:

Marta is a Partner in McKinsey & Company’s Toronto office. Marta works with some of the world’s largest metals companies, across a broad range of functional topics to help metals companies solve their most important and complex problems.

Joe is an Associate Partner in McKinsey & Company’s Cleveland office. He predominately serves mining clients across a broad range of commodities, functional topics and geographies.

https://www.mckinsey.com/business-functions/operations/our-insights

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.