A lack of digitization places U.S. manufacturing at risk. Technology readiness—not just patriotism—will drive future American production.

By Joe Fetter, Director, Manufacturing Practice Integris

Walk through almost any U.S. factory today, and you’ll feel two things at once: optimism and unease. There’s real momentum behind American manufacturing—federal funding, reshoring efforts, and rising consumer interest in locally made goods. But there’s also a quiet strain, audible only if you know what to listen for: aging tech, frustrated workers, and systems struggling to keep pace.

To better understand the current landscape, we surveyed over 1,000 individuals—including 700 U.S. consumers and 300 manufacturing professionals—for the “2025 U.S. Manufacturing Technology Readiness Report.” The findings point to a growing gap between manufacturing ambition and digital readiness.

Seventy-six percent of consumers say they prefer products made in the U.S. That’s encouraging, but preference doesn’t guarantee purchase. Sixty-two percent say quality and price matter more than country of origin.

In other words, patriotism may influence interest, but it doesn’t close the deal. Manufacturers must compete on performance and value—not geography.

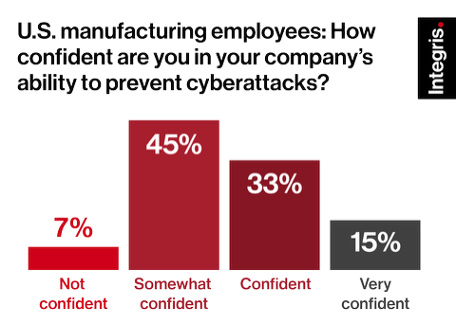

Trust also hinges on digital resilience. Ninety-one percent of consumers worry about cybersecurity risks in U.S. manufacturers, with nearly one-third especially concerned about goods tied to critical sectors like infrastructure, defense, or healthcare.

That concern is justified. In 2022, manufacturing surpassed finance as the most-targeted industry for cyberattacks. Ransomware incidents have disrupted operations, exposed sensitive data, and weakened supply chains. For buyers, a data breach isn’t just a security issue, it reflects systemic failure.

Today, “Made in America” signals more than geographic origin. It conveys a standard—secure, modern, and efficient. When companies fall short, the label loses credibility.

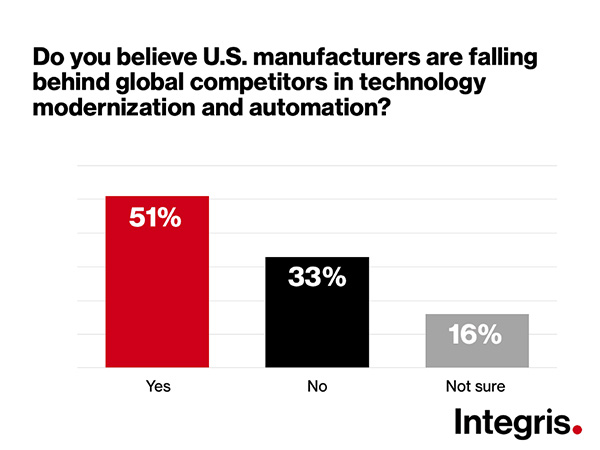

Fifty-one percent of surveyed manufacturing employees say their companies lag behind global competitors in automation and modernization. That perception matters. It doesn’t just suggest operational weakness, it affects worker morale, performance, and retention.

More than one in five respondents report they’ve seen colleagues quit over outdated technology. That’s understandable when today’s demands are met with yesterday’s tools: manual data entry, glitch-prone equipment, and disconnected workflows.

In a sector already facing a skilled-labor shortage—with more than 600,000 roles unfilled by some estimates—every departure ripples throughout operations.

Outdated tools aren’t minor inefficiencies. They’re enterprise-wide liabilities.

Fifty-seven percent of manufacturing leaders cited cost as the top barrier to tech modernization. But it’s not just about budget—it’s also about prioritization. Many companies lack a clear digital roadmap. They know transformation is necessary but aren’t sure where to start.

Meanwhile, competitors—both domestic and international—are investing in predictive maintenance, cloud-based production visibility, and cybersecurity frameworks. They’re moving faster, attracting better talent, and meeting evolving compliance demands.

Inaction deepens the gap, and the market isn’t waiting.

Smart modernization is about precision. Start with what’s mission-critical, such as adapting an infrastructure to become more resilient and scalable. Here’s where to begin:

1. Assess your digital environment

Begin with an audit of systems, infrastructure, and workflows. Where are the pain points? Where is data siloed or inaccessible? This kind of visibility becomes a practical starting point for modernization.

2. Fix the foundation first

Target low-friction, high-impact upgrades:

These solutions aren’t futuristic. They’re baseline requirements for any manufacturer operating at scale.

3. Reframe technology as a performance lever

Too often, IT investment is treated as an expense to manage, not a lever to pull. But the return on investment is tangible and measurable. Companies that modernize their systems see reduced rework and scrap, faster production cycle times, improved compliance outcomes, and fewer audit findings. Just as important, they also experience higher employee satisfaction and retention, because workers are more likely to stay in environments where they have the tools they need to succeed.

Shifting from reactive maintenance to proactive investment changes what’s possible.

America’s manufacturing resurgence is real, but fragile. Rising tariffs, shifting trade dynamics, and new government incentives are bringing opportunity back to U.S. shores, but that door swings both ways. If production systems remain outdated, the opportunity may slip away. Customers will look elsewhere, workers will quit, and contracts will go to more digitally capable providers.

Meanwhile, global players are building factories equipped with smart sensors, cloud integrations, and secure networks. They’re not speculating—they’re building—and they’re raising the bar for everyone else.

The “Made in America” label still carries real weight but it now carries a question: Made with what?

Quality, reliability, and national pride still define the brand. But without the infrastructure to deliver on that promise, the value fades.

This isn’t just a technology gap, it’s a leadership test. The companies that thrive in the coming decade will be those that plan deliberately, act decisively, and align digital systems with strategic goals.

If you’re in leadership, now is the time to define your path. If you’re on the front lines, your experience can shape smarter systems. Everyone has a role to play.

And the answer to that question—Made with what?—will define the next era of American manufacturing.

About the Author:

Joe Fetter is the director of the Manufacturing Practice at Integris, a managed IT services provider specializing in secure, scalable solutions for the manufacturing sector and beyond. With over two decades of experience in strategic sales leadership, Joe helps manufacturers modernize their infrastructure to improve efficiency, reduce risk, and stay competitive.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.