Prices for rare-earth battery metals reached an all-time high in 2022. What is the long-term trend for forklift electrification?

Prices for some metals, including the rare-earth metals used in battery manufacturing, reached an all-time high in 2022. The main contributing factors were the COVID-related supply-chain disruptions in China and around the world, the Russian war against Ukraine, and subsequent US and EU sanctions against Russia.

At the same time, demand continues to accelerate for advanced lithium batteries in electric vehicles, off-highway vehicles, material handling and other industrial equipment, stemming from the need to move away from diesel and propane fuels, and to replace lead-acid batteries with more efficient power source alternatives.

Some experts, however, predict that metal prices will follow a “super-cycle” scenario: a rush of investors into raw materials production in 2022 will result in a sharp decrease in prices in 2023–24 and a subsequent price surge into 2026, with new demand coming to the market.

Lithium battery price increases are unequal for different chemistries, resulting in a preference for less expensive and more reliable LFP batteries over NMC and NCA options.

Still, despite this pricing volatility, the long-term trend for the electrification of industrial trucks and other equipment will continue into 2030 and beyond.

In 2022, the electric vehicle (EV) market faced shortages of lithium, nickel, and cobalt, as mining operations haven’t kept pace with the demand for EV batteries.

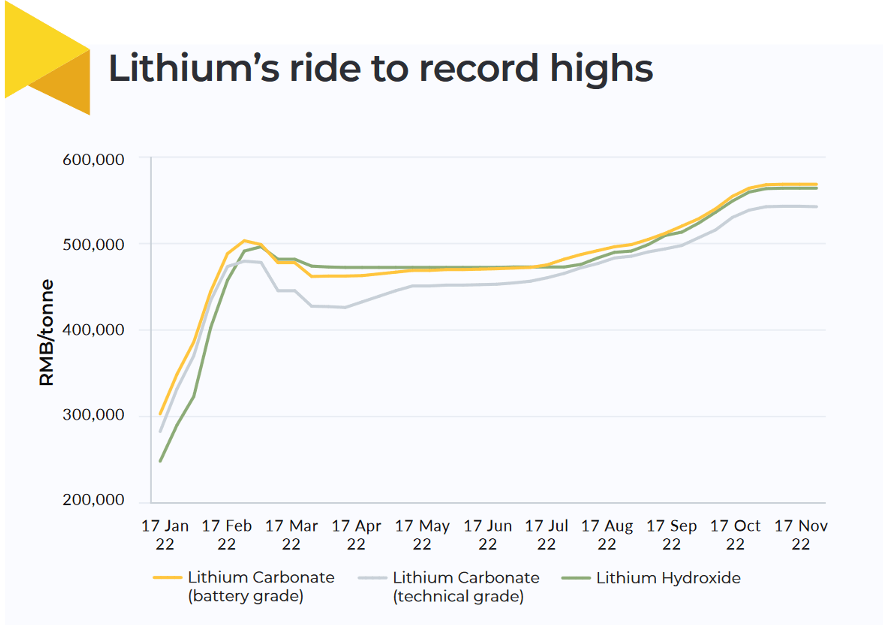

For instance, battery-grade lithium carbonate reached a price of 500,000 RMB per metric tonne ($72,000), in February 2022, nine times more than its 2020 price. In response, prices for battery cells have increased, which, in turn, increases costs for vehicles and technologies powered by those batteries, including portable devices with lithium-ion battery packs.

The nickel market also faced price swings, primarily because of the war against Ukraine and COVID lockdowns in China. The uncertainty of these events created an increased demand for nickel, as did fears that the nickel supply will be insufficient for future EV battery production.

Still, by April 2022, nickel prices had mostly stabilized at $30,000–$35,000 per tonne, with one analyst, Andrew Cole, Fastmarkets’ principal metals and mining analyst, noting, “given that its fundamentals have started to look softer than we previously envisaged, we would not be surprised if nickel starts to trade lower” that same month.

According to Benchmark Mineral Intelligence, a price reporting agency and data provider, global demand for lithium-ion batteries is on track to grow 36 percent this year, to 610 gigawatt-hours. At the same time, lithium supply is expected to grow by 33 percent, noted Benchmark’s Lithium Forecast.

In December 2022, lithium-ion battery packs increased in price for the first time since BloombergNEF (BNEF) started tracking prices in 2010, to an average of $151/kWh.

These inflated battery metal prices are expected to follow a “super-cycle” pattern during which too many over-enthusiastic and green-energy investors will rush into the mining market.

In May 2022 Goldman Sachs predicted that this excess of lithium, nickel, and cobalt mines will lead to a supply that outstrips battery demand, which would again bring down pricing for these metals in 2023. By 2025, mines will produce a 23 percent oversupply of lithium, compared to an 11 percent undersupply in 2021.

In 2023, lithium prices are expected to drop to an average of $16,000 per tonne and $11,000 per tonne by 2024, a figure that is only double its 2020 price (compared to the nine-fold increase when it reached its peak).

However, after 2024, the battery market super-cycle is likely to go into overdrive again.

“This phase of oversupply will ultimately sow the seeds of the battery materials super cycle over the second half of this decade,” the Goldman Sachs group said, after which “the demand surge will more sustainably overcome current supply growth.”

Certain battery chemistries also saw different demand increases. According to Fastmarkets, between 2021 and 2022, lithium hydroxide prices soared 609 percent, while lithium carbonate prices increased by 570 percent—more significant increases than for any other raw battery materials. In absolute terms, though, prices for nickel- and cobalt-based Cathode Active Materials (CAM) batteries increased more than for lithium iron phosphate (LFP)-based batteries.

Certainly, rising lithium prices affected LFP battery cell prices, which, increased by 27 percent from 2021 to 2022. However, in 2022, LFPs were 20 percent less expensive than lithium nickel manganese cobalt oxide (NMC) cells.

“The energy density difference on the cell level between LFP and nickel-based Cathode Active Materials (CAM) is reduced at the pack-level, and this difference is reduced further by innovations such as cell-to-pack integration,” explains Fastmarkets cost modeler Muthu Krishna.

If these raw materials prices stay where they are, we may see an increased cost advantage for lithium iron phosphate (LFP) batteries, which offer more thermal stability than nickel-based CAMs, as well as a simpler pack design.

LFPs are not new, as Tesla has been using them since 2021; the company has been gradually switching from NMC to LFP technology. More recently, auto manufacturers like Volkswagen and Rivian also announced that they would be using LFPs in their lower-cost EVs.

Many companies are also switching from outdated lead-acid forklift batteries to more efficient LFP lithium battery alternatives.

A factor that will impact the future of battery metal pricing is the United States’ recently-passed Inflation Reduction Act. This act offers financial incentives for consumers if they purchase EV batteries with final assembly in North America. According to Ken Hoffman, Co-Head of EV Battery Materials Research at McKinsey & Company, by 2029 all EV batteries must be sourced onshore, including all battery materials. The incentives will further spur the growth of battery metals mining, and local manufacturing of LFP batteries in the United States and Canada, something that is already happening today.

This is a significant change, as the world’s leading mineral processor for EV batteries is China. In 2022, Canada became the world’s second-place producer of EV battery materials with the United States in third place in Bloomberg’s rankings despite the strong growth in battery demand due to the Inflation Reduction Act. The other top ten producers include Finland, Norway, Germany, South Korea, Sweden, Japan, and Australia.

“Canada gets among the highest marks on keeping the supply chain green, thanks in part to a generous supply of renewable energy but also to environmental regulations on mining. The BloombergNEF survey also credited Canada for its efforts to boost battery metals mining activity,” wrote the Financial Post.

The United States is teaming up with Canada to produce North American battery metals. Since 2021, these neighboring countries have been in talks to develop an EV supply chain similar to the ones already in place in Europe and Asia. The regional supply chain would be put in place primarily to compete with Chinese dominance.

China has increased its CAM production four-fold between 2018 and 2022, meaning that other countries are in a race to keep up. Benchmark’s Cathode Forecast predicts that this Asian market will maintain its control into 2030, even after the 2029 deadline by which the Inflation Reduction Act requires batteries to be sourced in North America. In fact, China is on track to increase its CAM production from 78 percent of the overall market in 2022 to 87 percent in 2030.

“The data highlight how China’s total output of battery grade lithium is set to increase by a further 5.3 times from now until 2030, despite efforts to develop cathode capacity in the rest of the world, which is only forecast to increase 2.8 times in the same period,” said Benchmark.

In the United States, we are already seeing a shift to more regional mining of battery metals. For instance, in 2021, General Motors contracted Controlled Thermal Resources’ Hell’s Kitchen lithium project in California for low-cost, American-mined lithium.

More sustainable mining practices are also on the horizon. Hard-rock and brine-based lithium sources cannot meet demand, so investors are turning to newer, experimental practices. As an example, Stellantis partnered with Germany’s Vulcan Resources, whose Zero Carbon Lithium Project uses geothermal energy to produce lithium hydroxide without fossil fuels and only a limited amount of water.

By 2024, lithium prices may see stabilization.

“Additional lithium supply could ease the pressure on prices in 2024, while geopolitics and trade tensions remain the biggest uncertainties for other key battery metal prices in the short term. Resolving these tensions could help calm prices in 2023 and beyond,” says Kwasi Ampofo, head of metals and mining at BloombergNEF.

Wood Mackenzie predicts that recycling as a source of battery metals will come into play around the mid-2030s. EVs will make up 23 percent of the market by 2030, with the auto market comprising 89 percent of the demand for batteries. At that time, the supply chain will struggle to meet demand, prompting a greater need for recycling, which is no simple task.

“This decade will see the supply chain further establish itself to be able to supply vast quantities of battery-grade chemicals and cathodes to cell manufacturers, whilst recyclers will struggle with the large mass and complexity of EV-packs,” Max Reid, the lead author of the WoodMac report, predicts.

Another way to mitigate the shortage of lithium materials is innovation in battery technology.

Longer-term, solid-state batteries (SSBs) may eventually replace lithium-ion batteries in EVs. These batteries are composed of “solid electrolytes, a carbon-free anode, and a cathode composite layer. Solid-state batteries employ a solid electrolyte consisting of glass, ceramics, solid polymers or sulfites, as opposed to the polymer gel or liquid electrolyte used in traditional lithium-ion batteries for electric vehicles (EVs),” explained Owais Ali.

These batteries charge more quickly and are more reliable. SSBs potentially last longer: an average of 10,000 cycles, compared to 3,000 cycles for lithium-ion batteries.

BMW, Ford, Toyota, Samsung, and QuantumScape supported by Volkswagen are already exploring this technology, but thus far, they only have developed laboratory versions. If SSBs are widely adopted, the need for rare-earth CAM per battery would decrease.

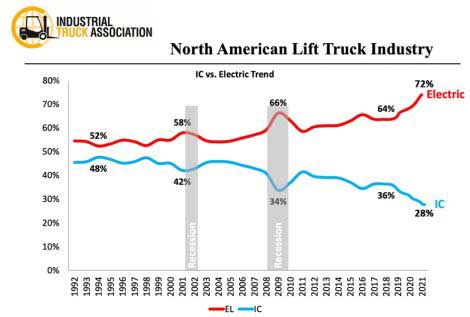

Though battery metal prices will continue to see some variability, these fluctuations are not influencing MHE electrification trends. In 2018, electric vehicles comprised 64 percent of the market, increasing over the subsequent years to reach 72 percent in 2021.

A key driver of this trend continues to be the demand for higher efficiency. As companies move away from lead-acid batteries to forklift Li-ion batteries, they see improved productivity and lower total ownership costs of their equipment.

What’s more, new regulations in individual US states continue to boost the adoption of EV vehicles. California’s bans on propane and diesel forklifts (starting in 2026) and the incentivization of zero-emission forklifts (starting in 2022) continue to drive the electrification of MHE. New York will also ban the use of ICE cars and light-duty trucks starting in 2035.

Key Takeaways:

Metal prices soared in 2022 due to increased demand for energy storage, EVs and other electric vehicles; COVID supply chain disruptions in China, the war against Ukraine, and Russian sanctions.

The continued demand for EVs continues to drive the battery-production market.

Investors seeking to profit from high prices in the raw materials market will spur a significant increase in the supply of battery metals by 2023 and 2024, pushing down the prices for these materials.

However, the resulting “super-cycle” in the battery mining industry may cause prices to shoot up again after 2024 before leveling off into 2026 and beyond.

China continues to dominate the battery metals production industry but longer-term developments in North America, like the Inflation Reduction Act, may reduce the country’s dominance.

LFP batteries are becoming more viable as rare-earth metals prices rise.

Ultimately, the EV and MHE electrification trend will not be deterred by the price of batteries. Globally, McKinsey & Company predicts the demand for electric vehicles will increase by 30 percent each year into 2030, even as the battery value chain tops a $410 billion annual valuation. Ninety percent of the worldwide demand for batteries will come from consumers interested in purchasing EVs.

“Overall, the growth has catalyzed an unprecedented level of investment that battery manufacturers must get right to stay competitive while other industries pursue the same scarce resources,” McKinsey says.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.