Changes to net operating losses (NOLs) may provide cash-strapped manufacturers with the financial boost necessary to quickly recover.

By Ryan Sheehan, Sr. Product Manager Bloomberg Tax & Accounting

With the country almost fully open, manufacturers are looking to swiftly get back to business as usual. To help manufacturers achieve this goal, stimulus-related tax breaks offered through the CARES Act of 2020, the Bipartisan-Bicameral Omnibus COVID Relief Deal and the American Rescue Plan Act of 2021 are available. In particular, changes to net operating losses (NOLs) may provide cash-strapped manufacturers with the financial boost necessary to quickly recover.

Before jumping into COVID-specific NOL tax changes, it is important to have a working knowledge of pre-COVID rules. Generally, for a tax year beginning in 2018 or later, a net operating loss (NOL) deduction for any tax year equals the lesser of:

As manufacturers devise upcoming or even retroactive tax strategies, understanding how NOLs are calculated is equally important. A corporation’s net operating loss is equal to deductions less gross income, but with some modifications as follows:

Prior to the CARES Act, NOLs arising in years after 2017 were not allowed to carry back, had an unlimited carryforward period, and were limited to 80% of taxable income. Under the CARES Act, NOLs arising in years beginning 2018 through 2020 may be carried back five years and the 80% NOL deduction limit is temporarily lifted for NOL carryforwards to years beginning before January 1, 2021. A few other CARES Act guidelines to keep in mind:

Understanding how to utilize these temporary NOL changes can result in significant tax cash. Consider this simple scenario.

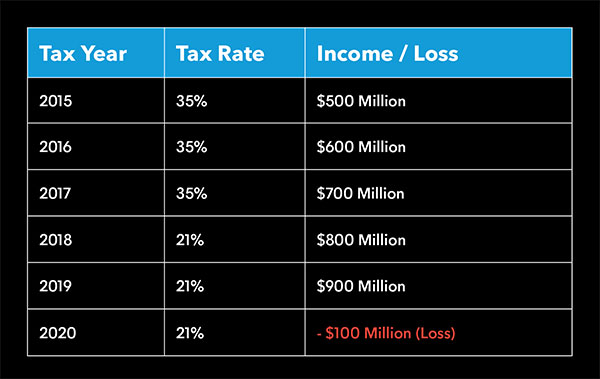

Following five straight years of profitability, due to Covid, Manufacturer ABC reported a $100 million loss in 2020. The tax rate in 2015, 2016 and 2017 was 35%; and 2018, 2019 and 2020 the current flat 21% rate.

Under the 2020 CARES Act, Manufacturer ABC can elect to apply its 2020 $100 million loss to 2015 (remember NOLs are first carried back to the earliest tax year of the 5-year carryback period), when the corporate tax rate was 35 percent (compared to the 21 percent tax rate applicable to tax years to which NOLs otherwise would have been carried forward). This would result tax refund of $35 million.

Federal Tax Due for 2015 prior to CARES Act

$500,000,000 X 35% = $175,000,000 tax due

Federal Tax Due for 2015 after CARES Act

$500,000,000 – $100,000,000 (2020 NOL) x 35% = $140,000,000 tax due

Tax Refund Owed

$175,000,000 – $140,000,000 = $35,000,000 tax refund

Under a long-standing provision, IRC §172(b)(3), a corporation can elect to waive this five-year carryback. A corporation making an election under section 172(b)(3) can still take advantage of the temporary changes to the 80% limitation rules and offset 100% of taxable income with NOL carryforwards that would otherwise be subject to the limitation.

There are complicated interactions with other rules, particularly for multinational corporations. Those corporations that repatriated income under IRC §965 between 2016 and 2019 may not offset inclusion income under a deemed election under IRC §965(n). However, CARES provides for an election to skip IRC §965 years while still applying the NOL carryback to other years.

Whichever tax strategies your company is considering, it is important to view potential scenarios holistically as deductions and elections can impact other tax attributes. For example, general business credits (GBCs) and foreign tax credits (FTCs) may be freed up by the NOL carryback and may now carry back or forward to other years. The alternative minimum tax (AMT) may also come into play, not only with a minimum tax but with the limitation for general business credits as well. The separate return year rules come back into play with consolidated return groups. NOLs may need to be allocated to a departing consolidated return member.

The road to recovery may be long and arduous, but for manufacturers that take advantage of stimulus-related tax breaks, the process can be a made a little easier. Modeling various tax scenarios, especially when it comes to new NOL guidelines, may result in a large infusion of tax cash to jump start recovery efforts.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.