Effect exit via employee ownership.

By Zoe Schlag and Alexander Gordin, EQB

In a previous Exit@Maximum article, the Author outlined four strategies available to business owners when they choose to exit their companies:

The author is also committed to bringing in highly experienced specialists and reviewing the advantages and disadvantages of each strategy in greater detail. In this article, we examine one of the most effective, yet often underrated methods: selling the business to its employees. Employee ownership is a proven exit strategy that helps business owners leave on their own terms—both financially and culturally.

Every day, more business owners are asking an important question: What happens when I step away?

With the “silver tsunami” already underway, 37% of business owners are expected to seek a sale in the next few years1. Yet many are heading into that process without taking the time to understand their options and develop a clear succession plan:

Most owners hope for a clean exit and a lasting legacy, but the reality is often more complicated:

The stakes are high. A rushed or unstructured sale can lead to team disruption, lost local investment, and shrinking deposit bases for banks—especially in communities where small businesses anchor the local economy.

Many of these businesses are healthy and profitable but don’t fit the typical “buy box” of private equity firms and strategic acquirers. But that doesn’t mean they aren’t valuable; it just means they need a different kind of buyer.

That’s where employee ownership comes in.

Employee ownership offers a way for owners to sell their business while protecting what matters most: people, culture, and mission.

It’s an alternative succession strategy that enables owners to:

Employee-owned companies often outperform their peers—not just in productivity, but in long-term stability and employee wellbeing, too:

These benefits aren’t just felt inside the business; they ripple outward, helping stabilize communities, maintain jobs, and support local economies. Across industries—from tech to manufacturing to professional services—employee ownership is a resilient, values-aligned path forward.

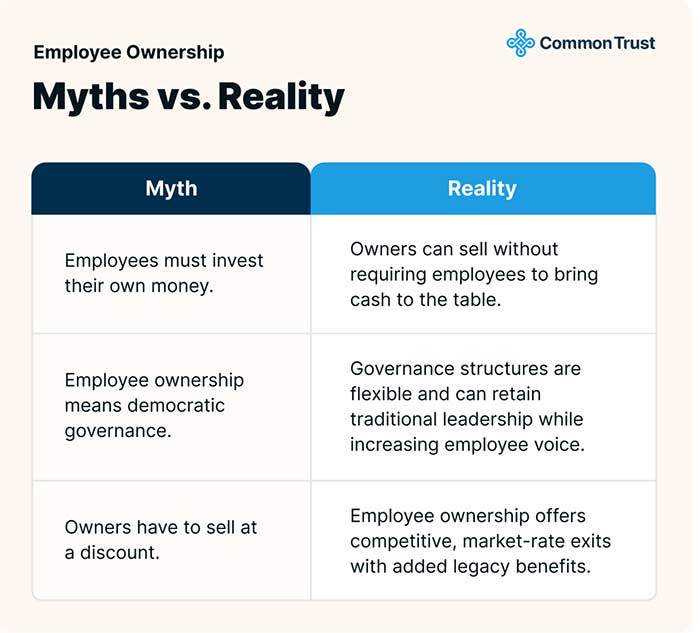

While employee ownership offers clear advantages, some misconceptions can make owners hesitant to explore it:

For owners ready to explore employee ownership, several established models provide flexible paths forward, each with its own structure and benefits:

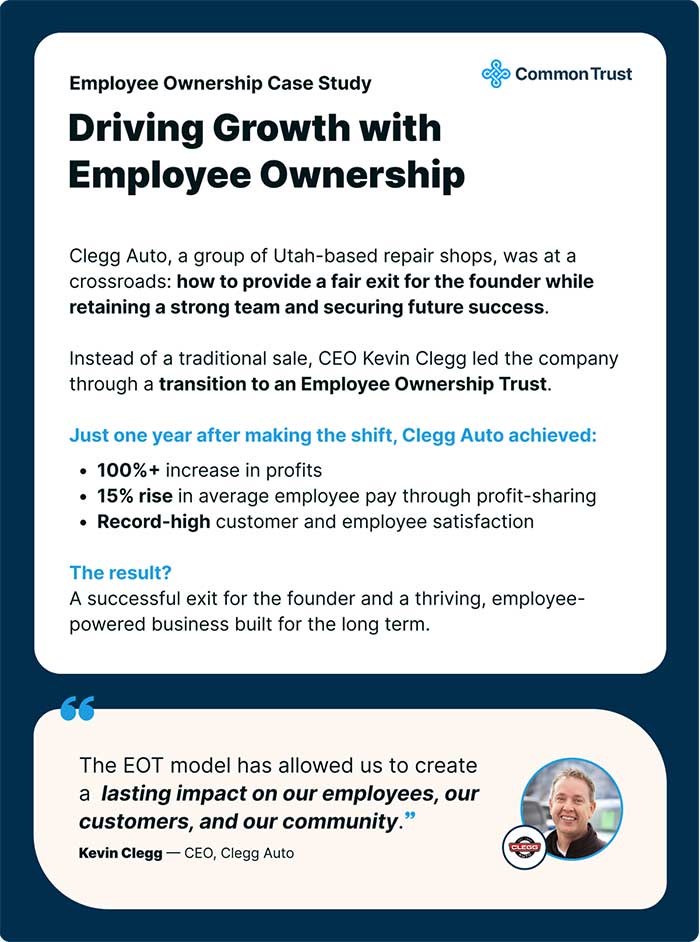

1. Employee Ownership Trust (EOT)

A trust holds shares on behalf of employees, allowing owners to sell all or part of the business without requiring employee buy-in. EOTs are highly customizable, often lower cost, and easier to administer than other models—and they can maintain traditional leadership while creating shared ownership.

2. Employee Stock Ownership Plan (ESOP)

A retirement benefit plan where employees gain ownership gradually. ESOPs are most common in larger companies that can manage the upfront setup, ongoing administration costs, and long-term share repurchase obligations.

3. Management Buyout (MBO)

Ownership transfers directly to key managers already involved in running the business. MBOs often preserve continuity and are a good fit when there’s a strong internal leadership team in place.

So, what happens when a company puts its employees in the driver’s seat?

About the Authors:

Zoe Schlag has built her career as an operator and investor, partnering with hundreds of founders to support their growth and sustainable success.

As CEO of Common Trust, she leads businesses nationwide through the Employee Ownership Trust (EOT) process and helps owners structure capital aligned with their values to support ownership transitions.

With more than a decade of experience in impact investing—including roles with TechStars and Schmidt Futures—Zoe brings deep expertise in scaling mission-driven companies and designing innovative capital solutions. She sees employee ownership as a strategic operating model, a long-term transition, or an exit strategy that preserves culture, empowers employees, and builds resilient businesses.

Zoe is deeply committed to Common Trust’s mission of advancing equitable and sustainable economic models that provide owners with liquidity while preserving the culture and values they have cultivated.

To learn more, visit www.common-trust.com.

Alexander Gordin, EQB is an International Merchant Banking and Risk Management professional with over 30 years of experience providing services in the areas of business advisory and business exit planning, project finance and investment, risk mitigation, capital markets transaction development. Clients have ranged from US-based and foreign SMEs, foreign governments, state-owned enterprises, to select Fortune 500 cos.

Transaction and negotiations experience in over 30 countries. Participated as Principal and advised on multiple exits, financing, M & A and restructuring transactions ranging from $1.1 million to $444 million.

Author of the critically acclaimed “Fluent in Foreign Business” book. Co-creator of the proprietary suite of business development, business exit and financing tools including the Exit Quarterback™ and Grey2White®.

Published, or featured in multiple publications and on nationally syndicated TV programs. Featured speaker at numerous conferences.

MBA from the Wharton School at the University of Pennsylvania. B.S. in Management Information Systems from the NYU Tandon School of Engineering. For more information, please call 1 844 4 EXITQB.

Citations:

[1] Baker, J. (2025a, June 5). Crisis averted: Small business survival in the wake of the silver tsunami. Teamshares Blog. https://www.teamshares.com/resources/silver-tsunami/.

[2] Dodd, T., ButcherJoseph, Beaulieu, B., & ITR Economics. (n.d.). The “Silver Tsunami” and Its Effect on the M&A Landscape. https://butcherjoseph.com/wp-content/uploads/2022/05/Silver_Tsunami_White_Paper.pdf

[3] State of Owner Readiness – Exit Planning Institute. (n.d.). https://exit-planning-institute.org/state-of-owner-readiness

[4] Meehan, M. (2025, April 18). Council Post: Why you should think about selling your business before you have to. Forbes. https://www.forbes.com/councils/forbesfinancecouncil/2025/04/18/why-you-should-think-about-selling-your-business-before-you-have-to/

[5] Ratanjee, V., & Khoury, G. (2019, October 18). How to Stop losing talent when you merge and Acquire. Gallup.com. https://www.gallup.com/workplace/267494/stop-losing-talent-merge-acquire.aspx

[6] Ayash, B., & Rastad, M. (2019). Leveraged buyouts and financial distress. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3423290

[7] Kruse, D., Rutgers University, & IZA. (2022). Does employee ownership improve performance? In IZA World of Labor (p. 311v2) [Journal-article]. https://doi.org/10.15185/izawol.311.v2

[8] National Center for Employee Ownership. (2017). Employee Ownership & Economic Well-Being. https://www.ownershipeconomy.org/wp-content/uploads/2017/05/employee_ownership_and_economic_wellbeing_2017.pdf

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.