As black swan events increase in frequency, global supply chains are being redefined and a “Made in USA” renaissance is underway.

COVID-19 has triggered a re-evaluation of supply chain risk for all manufacturing companies globally. Manufacturers in the United States, who had been leveraging long global supply chains, have had their entire businesses put at risk due to an inability to get parts and components from their long-term, trusted suppliers outside of the country. Companies that sell products in the United States have also experienced severe disruptions in their ability to source the products they sell and are looking for regional sourcing solutions moving forward. Many are asking “how did we get here?”

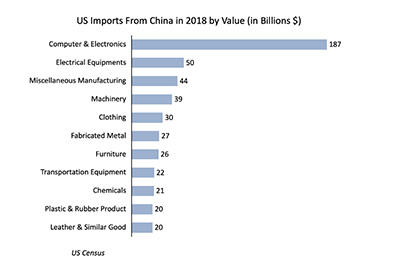

For the past several decades, companies have embraced the idea of globalization to reduce their costs. Automotive, textile, consumer electronic and many other OEMs gave up control to the supply base by developing system suppliers, to shift capital investments to build up production globally. Manufacturing companies have been generously rewarded by the efficiency and initial labor arbitrage savings brought by a global supply chain. However, with the lower pricing came less intimacy to the supply chain. Recent tariffs, trade talks, COVID-19, black swan events, and the Executive Order on American Supply Chains from the Biden administration all signal a turn in the strategy. The previous mindset that held globalization as a safe strategy may be collapsing. Business decision makers need to understand the new paradigm and adjust their business to succeed. Successful supply chain design of a multinational corporation is a true balancing act between optimism and reality, as well as short term cost savings and risk. In this article, we will discuss the opportunities and propelling factors for the reshoring of manufacturing businesses and the challenges for having a renaissance of “Made in the USA.”

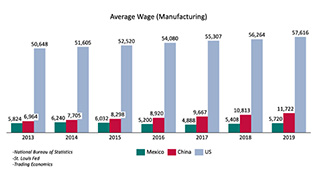

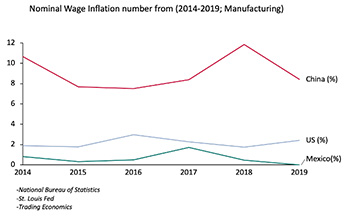

Profit is the natural pursuit of all trades. For decades, the primary incentive for offshoring manufacturing, besides expanding to new markets, was the low-cost labor. China is the most well-known destination of offshoring. However, in the past ten years, the nominal manufacturing wage cost in China has increased on average of 9.3% per year (productivity adjusted wage inflation is around 3% per year), steadily eroding its cost advantages. Meanwhile, the average income for the US manufacturing employees starts much higher at $58,000 but has increased at a much lower rate of 2% per year. Media has reported the fading cost advantages, but there remains a large wage advantage comparing China to the US.

If labor were the only cost driver this would be an easy calculation and Mexico would be getting even more business in the North American region, but businesses need to make manufacturing and supply chain decisions based on total cost, which consists of labor, logistics, land, taxation, tariffs, raw materials, energy, warranty, and other industry specific factors. According to a study made in 2018, total cost of manufacturing in the US (southern states) is only 6 % higher than manufacturing in China, and Mexico manufacturing costs were often lower. The United States played to its advantages with shale oil and gas technology breakthroughs that reduced American energy costs to levels significantly lower than other global markets.

Different businesses can have dramatically different total cost profiles from one another. Reshoring decisions require careful analysis of costs, risk complexity, and the ability of the organization to execute a more cost-effective and lean capital strategy. Few organizations have a dedicated “move” team that can transfer tribal knowledge and production equipment, as well as manage the complexities of supply continuity while consistently delivering high quality parts. Outside help is often required and there are few teams with the skill and experience to move lines around the world while minimizing capital outlays. Even companies unconstrained by capital expenditures struggle to execute these moves on their own.

Auto glass manufacturer Fuyao, a Chinese supplier to Ford and Honda for windows, is an example of lower landed cost decision-making where an internal team executed a decision to build a manufacturing facility in the United States. Fuyao’s Dayton, Ohio factory is highlighted in a documentary called American Factory. In one interview, the owner of Fuyao, Cao Dewang, mentioned that the lower cost is driven by less expensive land, electricity (glass manufacturing is energy-extensive), natural gas, and a total manufacturing tax that is 35% lower than in China. As a result, by manufacturing in the United States his business can earn double-digit greater profit, even though labor costs in the US are five times higher than those in China. Cao admits the cultural challenges associated with the start-up of the plant were not easy. Fuyao had to learn to deal with many challenges along that way, and these could have been mitigated by engaging external transfer experts.

As cost dynamics and risk quantification evolve, businesses moving to or located in the United States will increasingly benefit from the improving cost structure in energy, transportation, and quantified risk costs.

Mitigating a higher labor cost can be accomplished in part through increased automation. Industrial robots cost between $20,000 and $100,000 per machine. These need to be maintained by highly skilled and increasingly scarce technicians, but over time robots pay for themselves when doing consistent repetitive tasks. Tesla can build cars in California because it leverages significantly advanced technology, but still uses workers for more complex or inconsistent tasks. Human hands still have irreplaceable flexibilities and precision which makes humans superior to robots in many applications. Human labor tends to be limited to select stations on the final assembly line at Tesla’s Fremont factory.

Another surprising example is Tianyuan garments, a Chinese textile supplier for well-known brands like Adidas and Reebok, which is setting up manufacturing sites in both New York and Arkansas. The textile industry, once a typical labor-intensive trade, was among the first group of business offshored for lower labor cost in the 1970s. However, with automated production processes and textile manufacturing’s high need for energy and water, the United States, particularly the South, offers a compelling new alternative for the foreseeable future – if a textile manufacturer’s end market is North America.

Over the course of numerous moves, we have learned that minimizing changes at the facility where the lines are being sent (Receiving Site) is critical. Companies that optimize and stabilize the process in the existing manufacturing plant (Sending Site) prior to any move see far better results and a faster road to recovering eventual move costs.

To re-shore businesses with high labor content requirement, companies need to invest in building a base of skilled workers to fill in the gap created by the last thirty years of offshoring. The hiring and training process is increasingly challenging because manufacturing jobs are not a popular choice for young people today, however the rising wages we are seeing to combat the COVID stimulus payments are attracting more workers to the sector. There are some outstanding manufacturing training programs that have been developed. The MAT2 apprenticeships programs in Michigan, created with the help of former Governor Rick Snyder, provides the possibility of co-investing between employees and employers, and ensures that people learn the technical skills to earn a living wage whilst providing a sustainable labor supply to local manufacturers. States in the Southeast have also developed strong training and apprenticeship programs.

Globalization benefited some businesses in the short term, but the short-term gains are now dwarfed by the costs of supply chain failures.

Therefore, no matter whether internal polarization of politics, trade disputes with China, or the COVID-19 pandemics in the past three years, all indicate to the policy makers in the US that a resurgent of localized manufacturing is necessary. Democrats and Republicans are aligned. The most recent policy is outlined in the Executive Order (please see our one pager made previously on Biden’s plan) signed by President Biden on strengthening the supply chain in the US. As President Biden described referring to the executive orders, the policy was welcomed by officials of both sides “just like the old times.”

The United States appears to be headed towards a loosely defined “national manufacturing strategy,” which will be driven by government incentives to support domestic production and encourage reshoring. Tariffs enacted by the previous administration may increase as covenants put in place to minimize the effects have been violated due to COVID-19. The emergent strategy we are seeing minimizes the efficiency and cost saving achieved through the global supply chain and focuses on resilience, diversity, and security of a domestic United States supply chain. Businesses and manufacturing facilities are already facing incentives for:

We expect to see the United States begin to follow the Japanese government precedent of paying for the relocation cost of many Japanese manufacturers out of China. Larry Kudlow, former economic counselor of the Trump administration, once proposed ‘paying the moving costs’ of American companies out of China, and while this proposal was unpopular with the Democrats at the time, more people seem to be understanding the importance of a robust and stable manufacturing base in the United States.

Based on studies that were kicked off by President Biden’s Executive Order we see significant pressure for the following industries to build a strong manufacturing footprint in the United States. The industries include:

The fundamental strategy supply chain assumptions that drove business decisions over the past decades have changed significantly. There are three things that you can do today to help prepare your organization for the future. Each of these areas can benefit from fresh eyes driving the processes, either from the broader business or through engaging an external expert who has experience in these areas.

In the end, the black swan events in 2020 have changed and challenged the convenience and efficiency that we all took for granted. It expedited certain change (e.g., digitalization) and makes us brood on how we can better embrace the future. For example, the automotive industry is going through a major revolution to switch to EV and this revolution is creating a lot of the instabilities; for semiconductors, its manufacturing is currently planning to switch from a highly globally integrated value chain (e.g., ultraviolet machine from Netherland, memory disks from South Korea, semiconductor-specific chemical products from Japan and finally manufacturing in Taiwan) to a more end-to-end system in every country. The resilience and efficiency of the business will be at test. Despite all the uncertainties, it is certain that we are looking at a future that is full of uncertainties and opportunities.

About the Authors:

Ambrose Conroy is the Founder of Seraph. Ambrose has more than 20 years of management consulting and industrial experience. He has led multiple projects in NAFTA and China. His focus is on operational strategy including footprint optimization and restructuring projects.

Louise Lu is a consulting analyst at Seraph. Louise majored in Economics and specializes in providing research and economic analysis of the industry trends.

Contact Information:

https://www.seraph.com/

ac@seraph.com

Related Links:

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.