Complexity, scrutiny, and the level of risk in organizational spending decisions is at an all-time high. Buyers are under pressure as legislative changes impact the industry, there are increasing ethical and social concerns, and as a result, our decision-making processes have become interconnected and interdependent, necessitating collaborative decisions.

There’s no doubt the RFP is a tried and true purchasing vehicle. It is ideal for handling complex decisions in which a fair and transparent process is paramount and it provides structure for subjective decisions to take place.

This said, many organizations continue to work in silos, even though they are running similar processes, these processes happen behind closed doors. In this instance, it can be difficult to step back and see the big picture to get high level information that will help you put your process in context. It’s here that we need to ask ourselves: are we running our sourcing and supply chain workflow in most effective way possible? Are you getting the best value from the process? We set out to discover answers to these questions in a benchmarking study, and the results are in!

The 2018 State of the RFP reveals insights to help procurement teams understand how they stack up against their peers. The study leverage data from the Bonfire strategic sourcing solution and included $4.4 billion in combined spend, 200 organizations, and over 6,000 RFPs. What’s really exciting about this study is that it’s the largest of its kind in the procurement industry and is chalk full of rich data for today’s procurement professionals.

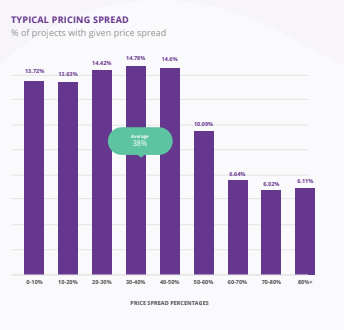

The study found that across 6,600 RFP projects conducted, the average project had a pricing spread of 38%. (Pricing spread is defined here as the difference between the highest and lowest priced vendors). On a $100,000 RFP, this equates to $38,000 or less between the highest and lowest priced vendors.

Previous research has shown that RFP outcomes are very sensitive to price weight; with only a 15% change in price weighting, one third of RFPs would be awarded to a different supplier. In light of this, it is crucial that buyers place serious thought on the price weighting of their decisions and how that will affect the outcome.

Furthermore, as products and services become more commoditized, teams must have a robust and defensible process for evaluating qualitative factors in their decision.

As for duration of the RFP process, the report discloses that the average duration of an RFP in the public sector (from proposal to awarded contract) remains open for less than two months. Additionally, we’re beginning to see that evaluators are starting to complete RFPs faster than previously, which in turn, will enable RFPs to be completed faster than teams ever thought possible. I’ll be diving into this key finding in more detail on my upcoming webinar.

Interestingly, there is an early indication of a trend towards more evaluation groups; in 2015, projects with 4 or more evaluation groups comprised of only 14% of total projects. By 2017, that number had risen to 19%. This trend may indicate that cloud-based tools are enabling increased collaboration among teams and improved communications. When it comes to pricing, the average price spread for public organizations in an RFP is 38%, although a trend of tighter spreads is emerging as the average price spread tightened slightly by 2% from 2015 to 2017.

Across thousands of RFP decisions, the least expensive proposal won in only 10% of all projects. Conversely, the most expensive proposal won 2.9% of time.

This finding shows that while price is important, it is rarely the be-all-and-end-all that it is often assumed to be. Furthermore, the vast majority of the time, the winning proposal is neither the highest nor the lowest priced. Besides putting to rest an old myth, this finding carries important implications for procurement teams.

Through the data outlined in the report, procurement professionals gain a unique window into the sourcing activities of other organizations, against which they can compare their own process. By doing so, procurement professionals can determine how they align with benchmarks, gain insight into areas where further optimization might improve their workflow, and equip themselves to better demonstrate the value that procurement delivers to their organizations.

The report is available today at www.gobonfire.com/2018-state-of-rfp. I encourage procurement professionals to take a read through – afterall it is free – and let’s get the conversation started.

About the Author:

Omar Salaymeh, Director of Client Success

Omar is responsible for customer experience at Bonfire, a company that provides cloud-based software to enable smart sourcing decisions, easily. Omar oversees a dynamic group comprised of client success managers, implementation specialists, support agents, and trainers. The team has consistently delivered industry-leading customer experience; achieving NPS scores of 70+, retention rates of 98%, and consistent net-negative churn rates. With his deep industry knowledge, Omar was part of the State of RFP committee, tasked with developing core questions in the study and unfolding key findings.

Contact:

W: www.gobonfire.com

E: hello@gobonfire.com

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.