ESG priorities, stakeholder capitalism and supply chain vulnerabilities are driving companies to move manufacturing closer to home.

By Matt Elliott, Midwest Region Executive for Business Banking and President of Bank of America, Michigan

At the start of 2020, the process of re-shoring American manufacturing hubs was already underway. Many of the world’s largest corporations wanted to reduce dependence on China and address rising stakeholder pressure to minimize carbon footprints.

Then the COVID-19 pandemic hit, demonstrating in real-time just how quickly the intricate web of far-flung supply chains and delivery logistics could falter.

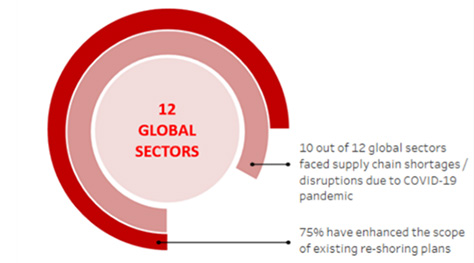

In a June 2020 survey of analysts covering 3,000 global companies, BofA Global Research found that companies in more than 80% of global sectors suffered supply chain disruptions during the pandemic. As a result, three-quarters of those companies are now accelerating and widening the scope of their re-shoring plans.

As the pandemic continues to have major ripple effects on supply chains, decision-makers are coming to the same conclusion: at least some portion of supply chains should relocate to closer, more resilient locations. Below are four key considerations for manufacturers who are either evaluating or in the process of re-shoring their operations.

Companies need to account for the logistical planning and costs of reshoring – which are often underestimated – and conduct cost-benefit analyses to weigh those investments against opportunities for job creation and future growth. This is particularly important for companies experiencing financial strain from the pandemic. Offsets such as automation, tax breaks, low-cost loans and other subsidies can help ease the short-term financial burden, as can spreading out costs over multiple years.

Another catalyst driving re-shoring is the shift to stakeholder capitalism, where corporations focus not only on shareholder interests but those of consumers, employees and communities. In fact, BofA Global Research found that 75% of companies in North America and Asia Pacific, and 67% of companies in Europe, are expecting to face additional scrutiny around their supply chains from governments, corporate boards and shareholders. Beyond economic factors, operating in regions with a strong track record on fair labor practices and human rights will be increasingly critical to meeting rising stakeholder demands.

Cost is not the only factor at play: corporate boards, shareholders and consumers are increasingly influenced by ESG (Environmental, Social and Governance) considerations. Manufacturers in Europe and North America already have some under-appreciated advantages, such as a higher use of non-fossil fuel power and proximity to consumers, resulting in lower carbon footprints. This supports the growing case for re-shoring from China to within U.S. or European borders, or other countries with shared values.

Some of those shared values include Diversity, Equity & Inclusion (DE&I), another critical dimension of ESG that delivers significant business benefit. In fact, research finds that companies that focus heavily on supplier diversity generate a 133% greater return on procurement investments compared to firms who rely solely on traditional suppliers. As manufacturers face growing pressure to deliver on DE&I and ESG goals, not just internally but across their entire supply chain, they need to identify partners who share their commitments and are taking real action to achieve them.

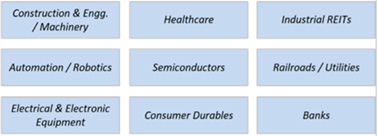

A sustained recovery in manufacturing has multiplier effects on the broader economy. According to BofA Global Research, an estimated seven indirect jobs are created for every new job in durable goods manufacturing. Other multiplier effects include higher wages, greater R&D spend, more tax revenues and the creation of industrial clusters. Investors may like to position portfolios towards sectors that stand to benefit from this dynamic – construction engineering and machinery, factory automation and robotics, electrical and electronic equipment manufacturing, application software etc., to name a few. Whether these enhancements are direct or indirect, manufacturers play a crucial role in continued economic growth and development well beyond the supply chain.

Re-shoring is fast becoming a new economic, geo-political and environmental reality. If manufacturers assess the considerations above against their own circumstances and goals – while making stakeholder capitalism, ESG and DE&I central to their strategy – they have an opportunity to move forward more fairly and efficiently.

Matt Elliott, Michigan Market President | Midwest Region Executive, Business Banking

Matt Elliott serves in a dual role as Michigan Market President and Business Banking Midwest Region Executive at Bank of America. In his role as state president, Matt serves as the bank’s enterprise leader in Michigan, working with company leaders across the state to help deliver Bank of America’s full range of global financial services. As a Region Executive for Business Banking, Matt oversees teams of commercial bankers who leverage the product breadth, industry expertise, and global presence of the bank to deliver integrated financial solutions to companies and institutions. Matt has more than 25 years of commercial lending, capital markets and corporate finance experience. Matt graduated with high honors from Michigan State University and earned his MBA with honors from the University of Chicago’s Booth School of Business. He is a FINRA Registered Representative and holds Series 7, 63, 79 and 24 securities licenses.

© 2021 Bank of America Corporation

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.