Technology has a vital role to play in relieving pressure across supply chains during volatility cycles.

Order volumes across global supply chains have suffered the biggest quarterly fall since the first lockdowns in early 2020 according to new data from Tradeshift, the B2B digital network facilitating trade transactions between buyers and suppliers globally.

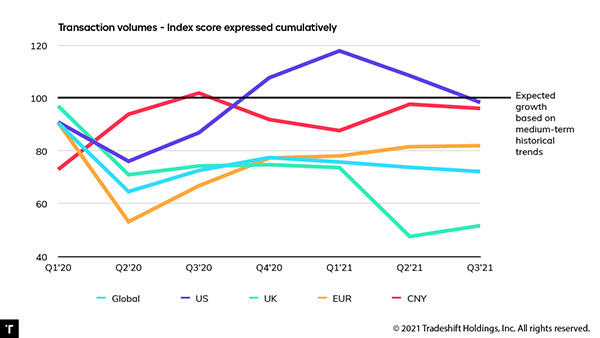

Tradeshift’s quarterly Index of Global Trade Health examines business-to-business transactions (purchase orders from buyers and invoices from suppliers) submitted through the Tradeshift platform. This quarter’s report sees the debut of an enhanced index model which tracks quarterly trade volumes against previous years. The Index uses a baseline score of 100; a reading above 100 indicates above-trend growth against medium-term, seasonal trends while below 100 indicates below-trend growth.

The Q3 Index data shows cumulative order volume growth fell by 24 points globally compared to the previous quarter. An index score of 85 in Q3 means order volumes are tracking 15 points below the level Tradeshift had forecast for the period before the pandemic.

Tradeshift’s data suggests that suppliers are struggling to fulfil a huge backlog of orders following a prolonged spike in demand as economies have reopened. Global invoice volumes, which indicate how quickly suppliers are able to fulfil orders, climbed by a slower than expected 5 points and remain 31 points below the pre-pandemic forecast range.

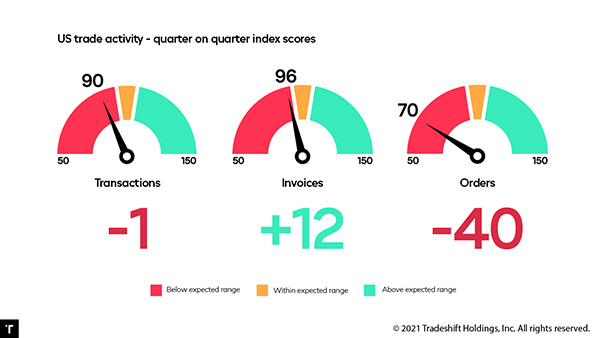

The Q3 Index data shows order volume growth fell by 40 points in the US compared to the previous quarter. An index score of 70 in Q3 means order volumes growth is tracking 30 points below the expected range for the period.

Invoice volumes jumped 12 points in Q3, but remain below the expected range. The relatively modest rise in invoice volumes in Q3 lends further weight to the theory that US suppliers are struggling to fulfil orders at sufficient pace to address the backlog.

“The delta we see between ordering activity and invoicing is indicative of massive fulfilment issues across global supply chains,” said Christian Lanng, co-founder and CEO of Tradeshift. “Buyers are starting to question the wisdom of putting fresh orders into a system that is buckling under an enormous backlog. The longer this situation continues, the more likely we’ll see a more prolonged reversal heading into 2022.”

Tradeshift’s data suggests the current imbalance is beginning to slow the recovery that has been booming across key supply chain hubs. U.S. transaction volume growth dipped to 98, compared to a score of 108.5 in Q2. In China, the transaction index score fell to 96, a drop of 2 points compared to Q2. Activity across Eurozone supply chains rose a modest 0.5 points in Q3, but an index score of 82 suggests there is some way to go before activity normalizes against the pre-pandemic range.

UK supply chains appeared to buck the global trend by moving 4 points closer to pre-pandemic levels in Q3. But this growth is coming from a very low base. An index score of 52 in Q3 leaves UK supply chains firmly at the bottom of the pack in terms of recovery.

“Resilience has become the number one conversation in board rooms, but we need to stop thinking about supply chains as individual fiefdoms and start looking at each supply chain as part of a richer ecosystem,” said Lanng. “Technology that connects buyers and suppliers more dynamically can help alleviate pressure that builds during volatility cycles. Areas where I see huge potential include digitized financing, which unlocks trapped working capital so that suppliers are incentivized to hold more inventory, and online marketplaces capable of intelligently pooling supply chain capacity and matching it to areas of high demand.”

To view the complete Q3 Index of Global Trade Health, visit https://hub.tradeshift.com/research-and-reports/the-tradeshift-index-of-global-trade-health-q3/.

About Tradeshift

Tradeshift is a market leader in e-invoicing and accounts payable automation and an innovator in B2B marketplaces and providing access to supplier financing. Its cloud-based platform helps buyers and suppliers digitize invoice processing, automate accounts payable workflows and scale quickly. Headquartered in San Francisco, Tradeshift’s vision is to connect every company in the world, creating economic opportunity for all. Today, the Tradeshift platform is home to a rapidly growing community of buyers and sellers operating in more than 190 countries. Find out more at: Tradeshift.com

Forward-looking statements

Any statements contained in this document that are not historical facts are forward-looking statements as defined in the U.S. Private Securities Litigation Reform Act of 1995. Tradeshift undertakes no obligation to publicly update or revise any forward-looking statements. All forward-looking statements are subject to various risks and uncertainties that could cause actual results to differ materially from expectations.

© 2021 Tradeshift Holdings Inc. All rights reserved.

Tradeshift products and services mentioned herein as well as their respective logos are trademarks or registered trademarks of Tradeshift Holdings Inc. in the US and other countries.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.