Monitoring risk on a wide spectrum is key to navigating zero-Covid related disruptions.

By: Atul Vashistha, Founder and Chairman of Supply Wisdom

As the world’s second-largest economy and major manufacturing hub, China plays a significant role in the global supply chain. While most countries are quickly moving beyond pandemic-related restrictions, Government officials predict China’s ‘zero-COVID’ policy will last well into 2023, meaning more potential lockdowns in vital manufacturing hubs. In fact, as recently as November 2022, China’s COVID infections reached a new record that resulted in widespread nationwide localized lockdowns. In the face of further global supply chain impacts in 2023, businesses will need to be agile to move ahead of their competition. Today, agility requires radical supply chain visibility.

According to the 2021 Global Imports Report, 42% of all goods shipped to the U.S. come from China. Because of this, businesses and consumers alike feel the sting of product shortages and shipping delays when an industrial area in China goes into a lockdown on short notice.

Manufacturing and shipping hubs in China have recently attempted to implement “closed-loop” frameworks to limit virus transmissions. Although the goal is for workplaces to remain open with workers living and working on-site, the challenges of arranging food supply, accommodations, and healthcare have proven difficult. Adding to the challenges, the lack of outside contact and alleged poor conditions have resulted in worker dissatisfaction, evidenced by the recent exodus of employees and violent protests at Apple’s “iPhone city” in Zhengzhou. For some auto manufacturers, closed-loop systems have been made unattainable due to severe component shortages that have forced them to shut down. The closed-loop solution is not the panacea that China had hoped would keep workplaces open, factories running, and supply chains secure.

With China’s zero-COVID policies highlighting the risk of doing business in China, many enterprises are re-evaluating their offshoring strategies. Reports by Bloomberg show that the mention of onshoring, reshoring, or nearshoring in corporate earnings and presentation calls has increased more than 1000% in the last few months.

Re-sourcing out of China, however, often is not a simple or short-term solution. For some industries, this could be a 5, 10, or even 20-year plan. This especially holds true for hi-tech sectors, such as the semiconductor industry. While the recently passed Chips and Science Act aims to strengthen American manufacturing, it will be years before this impacts the available supply of “home-grown” chips. Construction of the necessary manufacturing infrastructure will take years, further prolonged by current workforce challenges, including a shortage of construction workers. Once the facilities are built, staffing them with qualified workers with highly specialized skills will be a challenge, especially as some skills no longer exist in the U.S. and will require education and training.

Although in the face of such disruptions, rethinking your sourcing location strategy is probably wise, one thing is certain: it’s not a quick fix. What enterprises need today to minimize disruptions is the foresight to act quickly. They need radical transparency deep into their supply chains, whether a supplier is nearshore or on the other side of the globe.

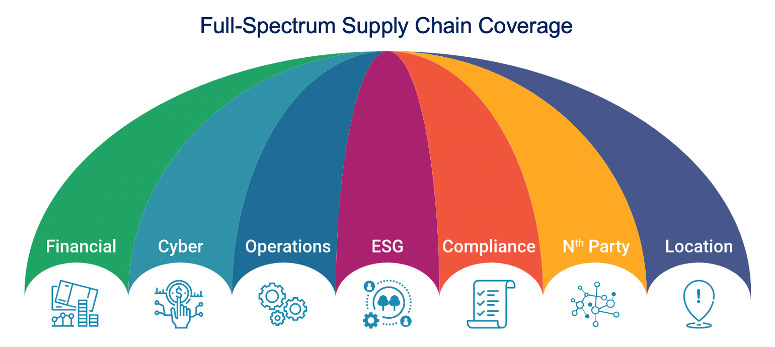

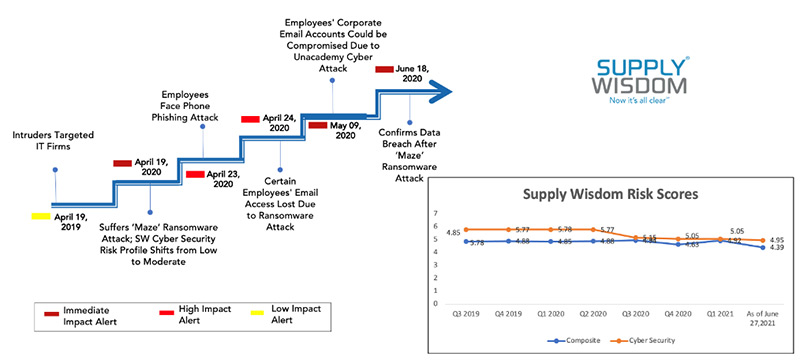

Enterprises today need to increase their investment in risk management solutions that give them greater visibility into their partners and the Nth parties in their supply chains. Beyond individual suppliers, they need visibility into the locations from where their suppliers are operating or sourcing components or raw materials. Enabling this radical supply chain transparency requires continuously monitoring a full spectrum of risk beyond the traditionally monitored financial and cyber risks, which are often lagging indicators of trouble. Today’s solutions leverage AI, machine learning, and data science to continuously monitor a full spectrum of risk and provide real-time risk intelligence. With early warning, enterprises can react quickly and with agility to pivot, if necessary, to alternate sources or suppliers ahead of their competitors. This is especially critical when supplies are limited.

Rethinking sourcing strategy will require current and deep location intelligence to evaluate the feasibility and appropriateness of “friendly” locations. But even once companies have re-shored to “friendly” nations, supply chain resiliency will require ongoing continuous monitoring of the locations that impact your supply chains. Extreme political candidates can change the equation. A once-friendly location can become unfriendly. Emerging regulations can change the desirability of a location.

Continuous monitoring is no longer a nice to have. It’s a competitive advantage that your business can’t afford to be without. Early warning enables you to act fast ahead of both disruptions and your competitors. Whether your enterprise is considering re-shoring or friend-shoring, the best thing you can do today to experience greater supply chain resiliency is to invest in a continuous monitoring capability than enables radical supply chain visibility across a full spectrum of risk.

About Atul Vashistha:

Atul Vashistha is the Founder and Chairman of Supply Wisdom. Founded in 2017 as an early warning service for business disruption risk, today, Supply Wisdom® is the market-leading patented continuous supply chain risk intelligence and actions solution.

Atul is recognized globally as a leading expert on supply chain risk and global business services. He has authored three best-selling books: The Offshore Nation, Globalization Wisdom, and Outsourcing Wisdom.

Atul serves on boards of the US Department of Defense Reserve Forces Policy Board, IAOP, and Shared Assessments. He has also recently served as Vice-Chair for the US Department of Defense Business Board.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.