Significant tax challenges and opportunities for manufacturing sector by One Big Beautiful Bill Act.

H.R. 1, formerly known as One Big Beautiful Bill Act (OBBBA), is generating interest across the industrial landscape, and for good reason. The legislation offers manufacturers tax reforms designed to increase competitiveness, reward U.S.-based innovation, and provide long-term planning stability.

While H.R. 1 offers significant opportunities, it also sunsets a range of clean energy incentives that many manufacturers have come to rely on.

For manufacturers considering large capital expenditures, the H.R. 1 offers one of the most generous incentives in recent memory: the return of 100% bonus depreciation for qualified property placed in service after January 19, 2025. In practice, that means businesses can deduct the full cost of new equipment, machinery, or certain facility improvements in the year the asset is put to use, accelerating cash flow and improving ROI. H.R. 1 has also created a new property category described as “qualified production property”, which is generally domestic nonresidential real property used in manufacturing tangible personal property, subject to certain other qualifying criteria. Qualified production property with a construction period beginning after January 19, 2025, and completed before January 1, 203, is now eligible for immediate 100% bonus depreciation, whereas this was previously only depreciable over 39 years.

In addition to bonus depreciation and qualified production property, annual Section 179 expensing thresholds have been raised to $2.5 million (with a $4 million in-service phase-out cap), offering smaller and mid-sized manufacturers more flexibility in their investment decisions. Both thresholds will be subject to inflationary adjustments.

Another standout provision of H.R. 1 is the restoration of immediate expensing for domestic research and experimental (R&E) costs, effective for tax years starting after 2024. This reverses the 2017 rule requiring R&E costs incurred in 2022 and later to be amortized over five years, which was a change that had stifled R&D investment for many businesses.

Importantly, businesses with average receipts under $31 million can apply the change retroactively to tax years beginning after 2021, unlocking new opportunities to recover past investments. Larger businesses will be able to accelerate deductions for previously capitalized and unamortized domestic R&D expenses over a one- or two-year period beginning in 2025.

For companies involved in semiconductor production or related supply chains, the Advanced Manufacturing Investment Credit jumps from 25% to 35% starting in 2026. This boost underscores the federal government’s continued focus on strengthening domestic chipmaking capabilities.

Perhaps one of the most valuable aspects of H.R. 1 is the permanence it provides. Several key provisions of the 2017 Tax Cuts and Jobs Act (TCJA) are now locked in for the long term, including the 20% Qualified Business Income (QBI) deduction and lower individual tax rates both of which are significantly impactful for owners/shareholders/ investors in entities structured as pass-throughs (tax partnerships and S-corporations).

This certainty empowers manufacturing executives to make long-term decisions about entity structure, compensation planning, and ownership transitions without the risk of expiring tax benefits.

While many provisions are designed to promote traditional and advanced manufacturing, HR1 significantly curtails clean energy tax incentives.

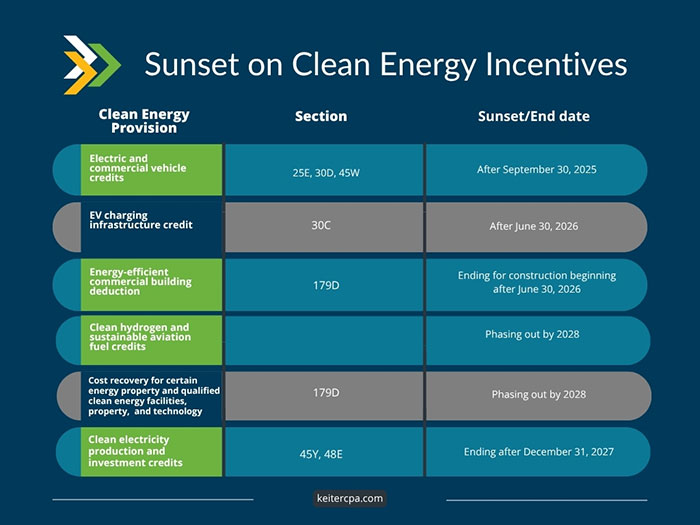

Several key programs will sunset in the coming months and years, including:

The expiration of these incentives presents a time-sensitive challenge for manufacturers with active sustainability initiative or suppliers to renewable sectors. Otherwise qualifying projects and expenditures delayed past these deadlines may no longer provide significant tax savings, potentially impacting return on investment.

H.R. 1 has created a lucrative window of opportunity for manufacturers to accelerate investment, refocus innovation efforts, and lock in long-term tax savings. But for companies with clean energy strategies, the window to act is closing quickly.

It’s important to also note that many procedural, implementation, and transition questions are surfacing in response to H.R. 1, which will need time to be addressed by Treasury and the IRS. State governments will also need to address conformity with changes to federal law.

About the Author:

Ryan Beethoven-Wilson, Keiter CPAs Tax Partner, works with manufacturing leaders to align tax planning with strategic goals, so they’re not only compliant but positioning themselves optimally for the future.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.