February 6, 2018

By Chris Otto

EKS&H, in conjunction with Leading Edge Alliance, recently published the 2018 National Manufacturing Outlook and Insights report, which illuminates what manufacturers across the U.S. were thinking as they approached the new year. Results from the survey that generated the report point to optimism about the economy, sales growth potential, and manufacturers’ own sectors. More than half of respondents in each sector indicated they expected growth within it, and the percentage of respondents that anticipated an increase in revenue grew by 11% over 2017.

Respondents also indicated that their top priorities for 2018 were (1) growing sales, (2) cutting costs, (3) addressing the workforce shortage, and (4) seeking new markets. In addition to addressing these priorities in more customary ways, the industry and business climate in general are shifting and new/different thinking may be necessary. Manufacturers should therefore take the temperature of their own unique business and sector and reevaluate tactics that might have made sense as recently as a year ago. Below are suggestions for a new look at some common strategies.

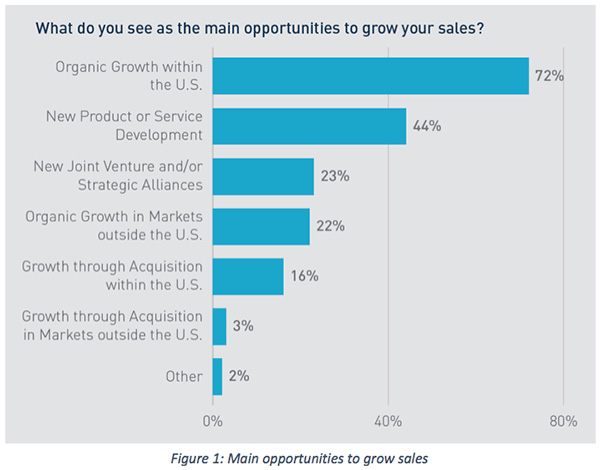

Manufacturers selected organic growth within the U.S. as their primary opportunity to grow sales (72%), followed by new product or service development (44%) (see Figure 1). Both of these strategies are excellent options, but company leaders might want to explore some less traditional ideas, including strategic alliances with supply chain partners or customers. Global opportunities and acquisitions could also be good options for manufacturers who have saturated their U.S. markets. Manufacturers should always aim to have clear data on product and customer profitability — often requiring a deep dive into cost allocation and accounting.

Technology has the potential to improve manufacturing operations in innumerable ways. For the top drivers impacting their technology strategy, survey respondents selected increasing productivity (66%), improving customer service and response time (45%), gaining access to more relevant data (34%), and improving product quality (34%), all of which could lead to decreased costs.

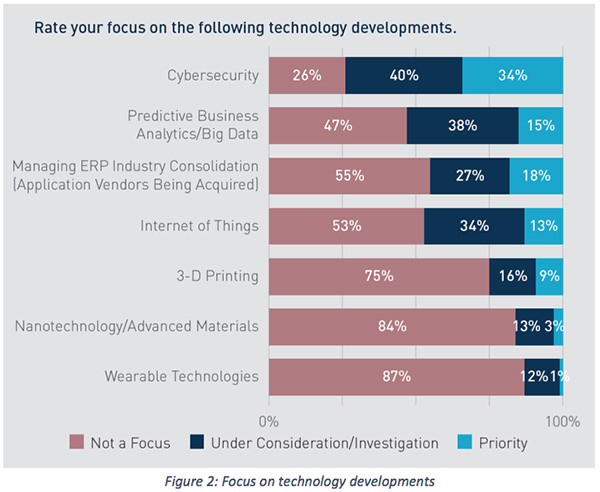

The technologies respondents planned to focus on included cybersecurity first (74%) and predictive business analytics/big data second (53%) (see Figure 2). While company leaders should certainly be looking at cybersecurity and using data to compete, utilizing some other technologies could be beneficial as well. For example, the Internet of Things (IoT) is likely to present opportunities for less costly ways of interacting with customers. Similarly, 3-D printing, advanced materials, and wearable technologies are all technological developments worth considering.

When asked about their greatest expected barriers to growth, survey respondents ranked labor/talent as their primary concern, at 55%. Additionally, 54% of respondents said they expected to increase their hiring. Neither of these findings is surprising, considering that the talent gap has been an industry issue for many years. Expected business growth in 2018 will require additional labor, which will increase the competition for talent.

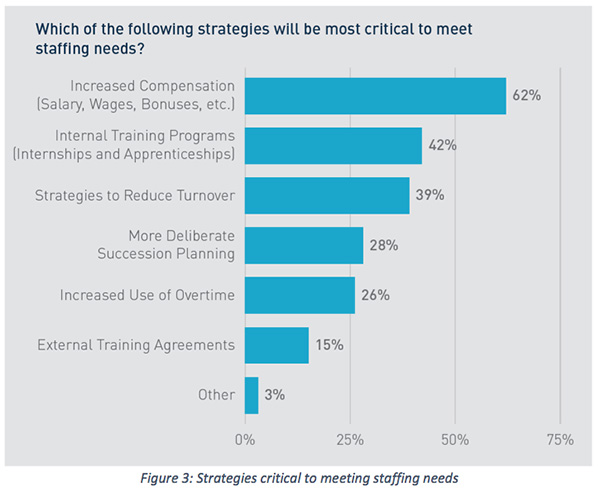

Manufacturers responding to the survey planned to use a number of strategies to meet staffing needs (see Figure 3), including increasing compensation (62%). They are also considering some of the more creative strategies, including developing internal training programs (42%) and external training agreements (15%) with industry or educational institutions. Tactics to reduce turnover, selected by less than half of respondents (39%), and more deliberate succession planning (28%) could also decrease the costly need to attract (and train) new talent.

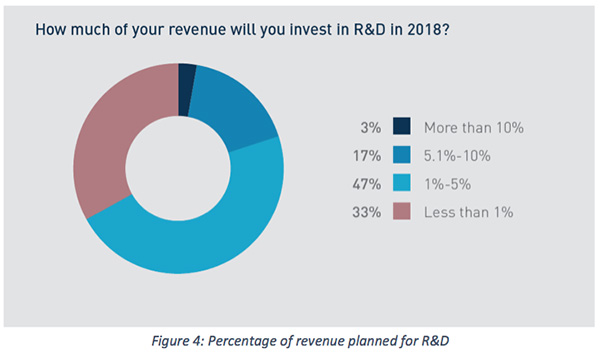

When asked how much of their revenue they plan to invest in research and development (R&D) in 2018, 20% of manufacturers responding to the survey indicated they would spend more than 5%, and 67% noted they would spend at least 1% (see Figure 4). R&D to develop new products and services was also the second most likely strategy to be deployed to grow sales. Unfortunately, leveraging the benefits of this strategy (and tax credit) is underutilized because many manufacturers believe the R&D tax credit applies only to large corporations or high-tech companies.

The R&D credit remains unchanged with the new federal tax law and can be used even by companies in the pre-revenue stage; these companies can elect to apply their R&D credits against federal payroll taxes reported on Form 941. The election is a powerful tool for developing new products and services, reducing payroll tax liability, and freeing up cash to reinvest in operations.

Based on the survey results, U.S. manufacturers are looking forward to a robust 2018. However, to maintain momentum and achieve the results they expect, company leaders may need to rethink some strategies (even those that have proven successful in the past). For example, a company that doesn’t think it needs to worry about succession planning might consider what could come from such an initiative. Could leadership coaching or mentoring help the business in other ways? Each company will be different in which tactics it prioritizes, but, for all manufacturers, exploring less-expected strategies could lead to less-expected — and often more profitable — results.

About the Author

About the Author

With more than 20 years of public accounting experience, Chris Otto leads the manufacturing client practice for EKS&H, a top 50 U.S. public accounting and consulting firm based in Denver, CO. He has extensive expertise advising closely-held businesses, conducting financial audits and reviews, internal controls analysis, and assisting with a wide range of strategic planning for manufacturers.

For more information about the 2018 National Manufacturing Outlook and Insights Survey, or to learn about how EKS&H helps hundreds of manufacturing companies across the U.S., please contact Chris Otto at cotto@eksh.com or call us today at 303-740-9400.

In this episode, I sat down with Beejan Giga, Director | Partner and Caleb Emerson, Senior Results Manager at Carpedia International. We discussed the insights behind their recent Industry Today article, “Thinking Three Moves Ahead” and together we explored how manufacturers can plan more strategically, align with their suppliers, and build the operational discipline needed to support intentional, sustainable growth. It was a conversation packed with practical perspectives on navigating a fast-changing industry landscape.