Monthly Leasing and Finance Index new business volume was up 6% Y/Y and 15% M/M in June.

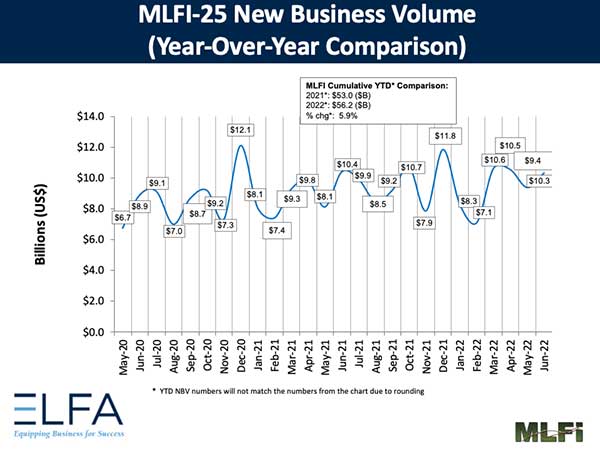

Washington, DC—The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $1 trillion equipment finance sector, showed their overall new business volume for June was $10.9 billion, up 6 percent year-over-year from new business volume in June 2022. Volume was up 15 percent from $9.5 billion in May. Year-to-date, cumulative new business volume was up 1.9 percent compared to 2022.

Receivables over 30 days were 1.8 percent, down from 2.0 percent the previous month and up from 1.5 percent in the same period in 2022. Charge-offs were 0.37 percent, up from 0.33 percent the previous month and up from 0.15 percent in the year-earlier period.

Credit approvals totaled 76.1 percent, down from 76.4 percent in May. Total headcount for equipment finance companies was down 1.5 percent year-over-year.

Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index (MCI-EFI) in July is 46.4, an increase from the June index of 44.1.

ELFA President and CEO Ralph Petta said, “The second quarter concludes on an optimistic note, as MLFI respondents reported strong business performance coupled with a positive outlook for the short-term future of the industry. As inflation continues to decelerate and the Fed appears to be on the verge of achieving an economic soft landing, the equipment finance market enters the second half of the year in fine shape.”

“The equipment finance industry has remained resilient through one of the most turbulent periods in recent economic history,” said Anthony Sasso, Head of TD Equipment Finance. “Despite economic headwinds, like high interest rates, the equipment finance sector continues to see opportunities for growth and innovation. In fact, the year-over-year increase on overall new business volume reflected in the ELFA data is consistent with our experience here at TDEF, as customers across many sectors continue to look for financing solutions to help them acquire equipment in order to keep up with demand.”

About ELFA’s MLFI-25

The MLFI-25 is the only near-real-time index that reflects capex, or the volume of commercial equipment financed in the U.S. The MLFI-25 is released globally at 8 a.m. Eastern time from Washington, D.C., each month on the day before the U.S. Department of Commerce releases the durable goods report. The MLFI-25 is a financial indicator that complements the durable goods report and other economic indexes, including the Institute for Supply Management Index, which reports economic activity in the manufacturing sector. Together with the MLFI-25 these reports provide a complete view of the status of productive assets in the U.S. economy: equipment produced, acquired and financed.

The MLFI-25 is a time series that reflects two years of business activity for the 25 companies currently participating in the survey. The latest MLFI-25, including methodology and participants, is available at www.elfaonline.org/knowledge-hub/mlfi-25-monthly-leasing-and-finance-index.

The MLFI-25 is part of the Knowledge Hub, the source for business intelligence in the equipment finance industry. Visit the hub at www.elfaonline.org/KnowledgeHub.

MLFI-25 Methodology

ELFA produces the MLFI-25 survey to help member organizations achieve competitive advantage by providing them with leading-edge research and benchmarking information to support strategic business decision making.

The MLFI-25 is a barometer of the trends in U.S. capital equipment investment. Five components are included in the survey: new business volume (originations), aging of receivables, charge-offs, credit approval ratios, (approved vs. submitted) and headcount for the equipment finance business.

The MLFI-25 measures monthly commercial equipment lease and loan activity as reported by participating ELFA member equipment finance companies representing a cross section of the equipment finance sector, including small ticket, middle-market, large ticket, bank, captive and independent leasing and finance companies. Based on hard survey data, the responses mirror the economic activity of the broader equipment finance sector and current business conditions nationally.

About ELFA

The Equipment Leasing and Finance Association (ELFA) is the trade association that represents companies in the $1 trillion equipment finance sector, which includes financial services companies and manufacturers engaged in financing capital goods. ELFA members are the driving force behind the growth in the commercial equipment finance market and contribute to capital formation in the U.S. and abroad. Its 580 members include independent and captive leasing and finance companies, banks, financial services corporations, broker/packagers and investment banks, as well as manufacturers and service providers. ELFA has been equipping business for success for more than 60 years. For more information, please visit www.elfaonline.org.

Follow ELFA:

Twitter: @ELFAonline

LinkedIn: https://www.linkedin.com/groups/89692/

ELFA is the premier source for statistics and analyses concerning the equipment finance sector. Please visit www.elfaonline.org/knowledge-hub/knowledge-hub-home for additional information.

Media/Press Contact: Amy Vogt, Vice President, Communications and Marketing, ELFA, 202-238-3438 or avogt@elfaonline.org

A warm welcome to our guest Didi Caldwell, CEO of Global Location Strategies (GLS) and one of the world’s top site selection experts. With over $44 billion in projects across 30+countries, Didi is reshaping how companies choose where to grow. Here she shares insights on reshoring, data-driven strategy, and navigating global industry shifts.