There’s no formulaic approach to help retailers predict the whims of consumers. But there are some behavioral patterns every business must know if they want to cover all bases, and avoid missing out on a potential POS. AI cannot read someone’s mind, but it can be taught to learn what triggers purchases and why we shop the way we do today: irrational decisions sometimes rationalized by days of comparative research and sometimes the morning after an impulse check-out at 1am.

Turns out, our brain and heart both matter when it comes to retail decision-making. Experts say, “we buy on emotion then justify with logic.” This interesting fact raises a loaded question: How do retailers design their merchandising and marketing strategies to fit into this pattern and convert into sales. Achieving the balance between emotions and rationality can help companies achieve a boost in sales and loyalty.

Source: Bustle.com The 20 Stages of The 20 Emotional Stages of Holiday Shopping, Because Decking The Halls Can Be Seriously Traumatic

Physical places may trigger impulse purchases more than you would’ve thought. For that matter, any scenario-virtual or physical-that gives a sense of urgency while overwhelming the shoppers’ emotions (in a positive way) is a key trigger to fuel purchases.

While traveling, we often feel the pressure of time sensitivity and a sense of compulsion to buy from airports’ Duty-Free shops. A fear of missing out (FOMO) kicks in, combined with confined spaces and lack of time that seems to make us buy something, anything. There’s no scope for doing a two-hour session of price verification across all stores online as we would do at home.

The travelers’ propensity for boredom as they await their flight, makes the duty-free atmosphere appealing, which induces consumers to buy.[i] Research confirms time pressure at duty-free shops can increase impulse purchases, satisfaction, and repurchase intention.[ii]

Everyday FOMO exists, too. For instance, teens wanting to get the next cool thing are already shopping Snapchat & Instagram stories from sellers/brands they’ve never heard of, The ‘new and now, limited offer’ looms around every 5-second influencer fad.

If the makeover booths at beauty outlets are any proof, the appeal of magically transforming into a better version of themselves tugs at people’s emotions more than a $2 million billboard budget ever did.

Source: Flydulles.com Duty Free Shops are an enticing bargain for the bored passengers with time to kill.

Consumers make an effort to shop in store for personal service during the buying process and the immediacy of being able to take home their desired product. In one study, nearly 80% of respondents said instant gratification was the key benefit to buying in person; 75% appreciated human connection of shopping face-to-face, including social shopping with friends.

Consumers prefer to buy the less familiar products in store to see and feel, and reduce the risk of having to return it.[iii] What this implies is that in-store options are weighed for a lot of factors, vs. online where the thumbnail’s appeal and the price can overpower all other aspects of the product.

For relatively riskier purchases – new, unfamiliar or expensive products – generous, hassle-free returns policy can help. Easy returns when coupled with rave reviews can reassure shoppers and convince them to buy.[iv] Categories that consumers prefer to buy in-store include: automotive, major appliances, hardware, jewelry and electronics.[v] In short, high-value, risky purchases that need demos, product warranties, and an accommodating return policy. Does that mean perishable products like chocolates and fresh flowers are best sold online? What about check-out lane products like mints and single-serve snacks?

Of Britain’s 7 million online grocery shoppers, only 12 percent visit a confectionery-related webpage, and just half of those actually buy anything there, according to Kantar Media.

Not surprisingly, nonperishables enjoy the most online purchasing. Confectionary and biscuits were at less than 1 percent.

Is this where physical stores can tempt shoppers? Perhaps with the right sensory and emotional triggers, yes.

Pop-up shops & Flea markets can play into consumers’ desire for thrilling experiences and great deals. The pop-up industry has grown to approximately $10 billion in sales, thanks to unique and fun experiences, and localized assortments. Again, FOMO kicks in, as “Customers are attracted to exclusivity. They’re attracted to a ‘here today, gone tomorrow’ type of concept.”[vi]

Online shoppers crave the convenience of saving time and effort, as retailers cater to them by bringing the store to their front door. These shoppers prefer to buy familiar, branded items with qualities they can reasonably predict. Customers buy online because they expect abundant variety, transparency about inventory levels and the ability to research prices, customer reviews and promotional offers.[vii]

Categories that consumers prefer to buy online include: books, toys and games, and entertainment.[viii] In Q3 2017, online orders placed from a desktop device had an average value of $84 US. During the same period, online orders placed from a tablet had an average value of $102 US.[ix]

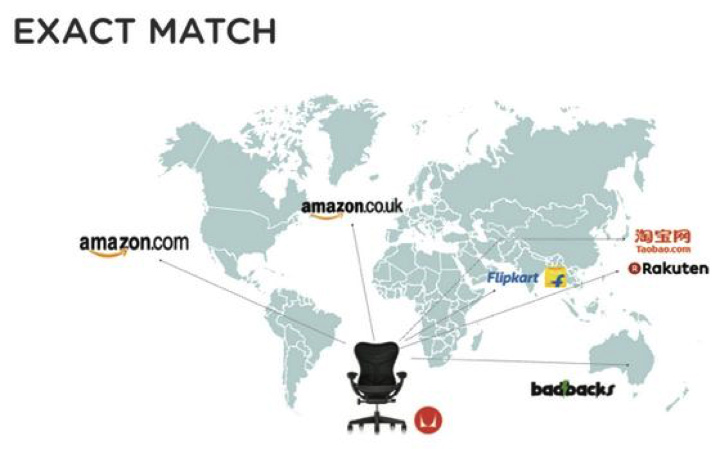

Competitive considerations: Retailers must know their rivals. For instance, retailers selling a Herman Miller chair must know which e-commerce rivals offer exact and similar matches – and at what prices.

Competitive considerations: Retailers must know their rivals. For instance, retailers selling a Herman Miller chair must know which e-commerce rivals offer exact and similar matches – and at what prices.

To appeal to consumers’ logical side, Amazon uses a rather rational, information-driven approach. The company sells nearly 500 million products spanning multiple categories, at various prices. Retail companies of all sizes can appeal to consumer’s logic. For instance, they can list product benefits, like efficiency, and add reviews to convince consumers of a product’s reliability.[x]

For instance, consumers want to know: Is the company legitimate, reputable and likely to deliver on time? Is the product well-reviewed, good quality and able to satisfy their needs? How consumer-friendly is the return policy?

Of course, consumers also care about the price of product and whether there’s free delivery. The total basket value is very important, including taxes, shipping, and handling.

In one study, 93% of respondents said free shipping encouraged them to buy more online. That’s because they felt secure and successful at getting a great deal.

Need for speed (and savings): Logistics processes and costs matter, as consumers say they are more willing to buy products online when they receive free, fast shipping. xi

Savvy consumers take the pricing challenge even further, scouring the web to score the best deal. They search for online coupon codes on such sites as Groupon, SlickDeals to minimize the price of their desired product.

While every customer has some degree of price sensitivity, the most price-sensitive consumers are exceptional comparison shoppers. Their rational behavior includes researching multiple websites to discover the lowest possible price before they buy.

There’s also a link between customer satisfaction and price sensitivity. To convince a price-sensitive customer to pay slightly more, retailers must add value with superior customer service. This can include online support, fast delivery, and convenient return and exchange policies.[xi]

In summary, retailers must appeal to consumers’ heads, hearts and wallets. By offering rational reasons for consumers to buy a product, such as quality, efficiency, and reputation you can lure the most rational of comparison shoppers. By appealing to untapped emotions at a POS, such as a sense of urgency, a feeling of exclusivity, and sheer excitement you can make the same shoppers find a justifiable reason to buy anything.

[i] Rossi, Serena and Cristina Tasca. Consumer Behavior and Marketing Strategies in the Duty Free Market: An Explorative Study on Offer, Customer Service and Atmosphere. Uppsala University. August 15, 2012.

[ii] Lee, Kang-Yeol, Yu-Jin Choi and Jin-Woo Park. A Study on Effects of Time Pressure Perceived by Users of Airport Duty-free Shop on Impulsive Purchasing Behavior and Repurchase Intention. Canadian Center of Science and Education. December 1, 2017.

[iii] Gramigna, Kristen. Retail or E-tail? Buying Online Vs. Buying in Person. Business.com. February 22, 2017.

[iv] Serpa, Rachel. 10 Quick Tips to Increase Basket Size. Gigya. April 28, 2017.

[v] Online vs. in-store shopping preferences of consumers in the United States as of February 2017, by product category. Statista. 2018.

[vi] Pop-Up Stores Become More Than Just A Trend. Retail Touchpoints. 2017.

[vii] Gramigna, Kristen. Retail or E-tail? Buying Online Vs. Buying in Person. Business.com. February 22, 2017.

[viii] Online vs. in-store shopping preferences of consumers in the United States as of February 2017, by product category. Statista. 2018.

[ix] Average value of online shopping orders in the United States as of 3rd quarter 2017, by device (in U.S. dollars). Statista. 2018.

[x] Mann, Shuki. Rational Vs. Emotional Triggers in Online Marketing – Which Approach is Better? Conversioner. October 19, 2016.

[xi] Alton, Larry. 5 marketing tips to help you reach the price-sensitive customer. CIO. February 2, 2017.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.