By David Bright

The consumer-driven economy, fueled by historically high levels of manufacturing, is depleting the earth’s finite resources. Current levels of consumption are not expected to decrease, as three billion middle-class consumers will join the global economy by 2030.[1] As a result, the reserves of many raw materials are in danger of running out in just a few decades.[2] For instance, so called “rare earth metals,” which are vital components in smartphones, hybrid cars, computers and more, could run out in 12 to 17 years if mining stays at current rates. Platinum supplies could be depleted in 11 years and silver in 16 years.[3] These low levels of reserves have caused the price of metals for use in creating consumer goods to rise to unsustainable levels. Commodity price volatility is at an all-time high, making it harder for manufacturers to estimate what their costs will be.[4] Affected manufacturers are struggling to maintain profit margins. Some will not be able to overcome the higher costs and price volatility and will fail. The cause is a linear economy.

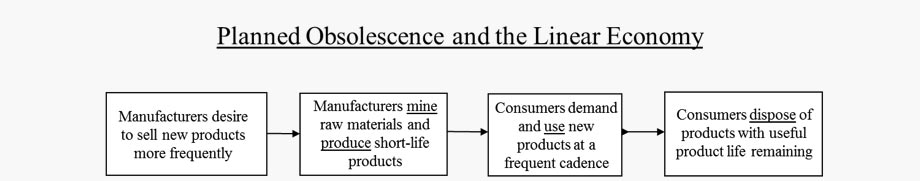

Planned Obsolescence and the Linear Economy. A linear economy is grounded in a manufacturing approach where products are “designed to fail” within a few years, or sooner. In addition, products are designed in a way that they cannot be repaired (think: component parts glued down) or cannot be repaired without considerable effort. This is called “planned obsolescence” and it started intentionally as a policy pursuit in the 1930s to spur the post-depression economy. Through these intentional methods, the linear economy and its dynamic of “mine-produce-use-dispose” has become the dominant paradigm.

Circular Economy and the Product-Service Approach. A circular economy is the policy and business response to a linear economy. Under circular economy principles, GDP growth is separated from and not reliant upon the mining and extracting of natural resources at current rates. Instead, through technology and new business models, limited resources are extended, shared by more people, reused and recycled.[5]

There are several different ways to adopt circular economy principles. They include (1) the use of circular supplies (like renewable energy sources); (2) creating products that are built to last longer; (3) establishing mechanisms for increased sharing of products, thereby increasing the utilization rate of each product; (4) recovering and reusing materials to create new products and (5) providing a product as a service in order to decouple the product from the service and make it more likely that the product can be recovered, reused and recycled.[6] A particular circular economy approach may (and often does) include more than one of these principles. The focus of this article is on the last two principles: a product-service approach that promotes the recovery, reuse and recycling of materials.

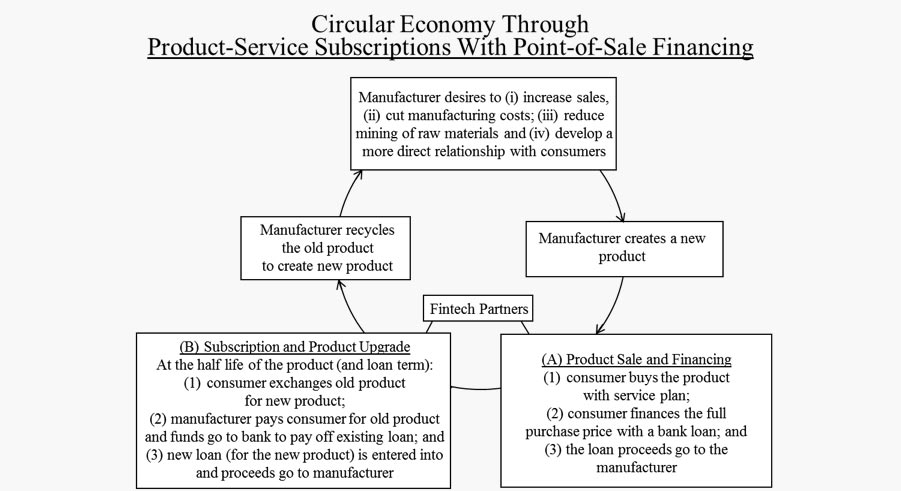

A Particular Circular Economy Solution: Product-Service Subscriptions Coupled with Point-of-Sale Financing. The product-service subscription program described in this article involves a manufacturer partnering with a bank in order to create a differentiated product-service experience for their customers. The objective of the manufacturer is to find a solution that addresses certain “pain points” in its business model, including (1) stagnant or decreasing sales volumes; (2) higher manufacturing costs caused by higher costs of raw materials (as well as price volatility); (3) the unsustainability of its business due to raw materials waste and low reserves and (4) concerns that it does not a have a closer relationship with its customers, largely caused by market disruptors. To address these issues, the manufacturer seeks a solution to increase sales, cut its manufacturing costs, reduce its impact on the mining of raw materials and develop a more direct relationship with its customers. A product-service subscription program that includes point-of-sale financing offers such a solution.

The diagram below provides the details of how a product-service subscription program powered by point-of-sale financing could be structured.

Benefits to Manufacturers. The benefits to manufacturers partnering with banks to create a product-service program are considerable. Most published approaches to a product-service model diverge from the model described in this article and include the manufacturer retaining ownership of the product. This approach does not allow manufacturers to book a sale, forcing them to keep assets on their books. In addition, they have to shift from receiving 100 percent of their expected sales proceeds from completed goods and instead accept an income stream over time, effectively financing the leasing of their products. This is a material diversion from current payment, business and accounting approaches – and it is not necessary, as the product-service strategy described in this article allows the manufacturer to receive all of its sales proceeds at the time of the sale, while the lender takes on all credit risk. Another benefit to the manufacturer is that it serves as the face of the transaction throughout its lifecycle. By guiding its customers through a product sale, loan financing and then a product exchange after a set period of time, it develops a close, continuous relationship with them. Finally, as a result of the financing, the manufacturer’s customers can “buy now and pay later,” thereby expanding the pool of viable customers and increasing sales volumes.

Benefits to Consumers – and the Circular Economy. Under the subscription product-service approach, consumers only pay for the portion of the product that they use. This is achieved by structuring the model such that they only make payments during the peak performance period of a product. This is similar to, for example, the annual subscription programs offered by wireless service providers and Apple under its iPhone Upgrade Program. Microsoft and many other manufacturers also offer a subscription program.[7] Under these programs, instead of paying the full purchase price upfront, consumers pay a monthly amount (as a loan payment under the related loan) and have the option of swapping the product for a newer model on an annual or semiannual basis depending on the program. In this way, consumers only pay for the peak performance period of the product instead of the entire life of the product.[8]

Typical renewal rates under a product-service subscription program range from 80 to 90 percent.[9] With average renewal rates this high, there is considerable promise that a product-service subscription model can help a manufacturer achieve its business objectives, while serving as a key component to the realization of a vibrant circular economy.

David Bright is an attorney at Holland & Knight. He has considerable experience providing counsel on a broad range of finance matters, including consumer and small business point-of-sale loan offerings for some of the largest worldwide manufacturers and retailers.

David Bright is an attorney at Holland & Knight. He has considerable experience providing counsel on a broad range of finance matters, including consumer and small business point-of-sale loan offerings for some of the largest worldwide manufacturers and retailers.

The opinions expressed are those of the author and do not necessarily reflect the views of the firm, its clients, or Industry Today, or any of its or their respective affiliates. This article is for general information purposes and is not intended to be and should not be taken as legal advice.

[1] Ella Jamsin, “Circular Economy-System Perspectives for a New Enlightenment,” TedxLiege 3 July 2014

[2] Rachel Nuwer, “What is the World’s Scarcest Material?,” future 18 March 2014

[3] Rachel Nuwer, “What is the World’s Scarcest Material?,” future 18 March 2014

[4] Ella Jamsin, “Circular Economy-System Perspectives for a New Enlightenment,” TedxLiege 3 July 2014

[5] “Circular Advantage: Innovative Business Models And Technologies That Create Value,” Accenture 2014

[6] “Circular Advantage: Innovative Business Models And Technologies That Create Value,” Accenture 2014

[7] Microsoft offers a subscription under its Surface Plus for Business program.

[8] Although consumers make continual payments under this model, they have shown a willingness to make these payments in exchange for an enhanced product experience, as evidenced by the proliferation of many successful subscription programs, including Netflix and Spotify.

[9] “What’s in a Renewal Rate?”, Virgo Capital 2017

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.